Negative Interest Rates Boost Gold Demand Overseas

Strengths

- The best performing precious metal for the week was silver, up 2.87 percent. Investors own the most silver in exchange-traded products in seven months, boosting holdings from a three-year low, according to ZeroHedge. This rebound comes as hedge funds and other money managers hold a near-record bet on further price gains.

- Physical gold ETF holdings have increased by over 270 tonnes since reaching their cycle-low in early January, reports TD Securities, coinciding with an 18 percent rally in the gold price. In contrast, only three tons of gold have been collected so far in India’s newly announced deposit plan. Macquarie raised its 2016 gold forecast for the precious metal by 4.8 percent, while Morgan Stanley announced its gold price outlook for the year up 8 percent to $1,173 per ounce.

- Calico Resources Corp. and Paramount Gold Nevada Corp. announced this week that Paramount has agreed to acquire all of the issued and outstanding common shares of Calico. Particulars of the transaction show that holders of Calico Shares will be entitled to 0.07 of a share of common stock of Paramount, in exchange for each Calico Share held. This represents an implied offer premium of 49.2 percent per share.

Weaknesses

- The worst performing precious metal for the week was gold, still up 0.34 percent. Gold consolidation is underway says UBS, adding that this should be healthy for the market. In its Global Precious Metals Comment this week, the group points out that pullbacks in gold so far this year have been relatively shallow and short-lived, not really offering investors many opportunities to enter at better levels.

- While the Indian jewelry trade continues its stir for withdrawal of the 1 percent excise duty announced in the Union Budget, the finance ministry does not indicate a compromise, reports the Business Standard. The strike entered its seventeenth day on Thursday. One ministry official said, “There is no question of a rollback.”

- B2Gold Corp. announced this week its approval for Gold Prepaid Sales Financing Arrangement, or prepaid sales, of up to $120 million. As stated in the company’s release, the prepaid sales (in the form of metal sales forward contracts) allow B2Gold to deliver pre-determined volumes of gold on agreed future delivery dates in exchange for upfront cash pre-payment. These financing arrangements will help fully fund the Fekola Mine Construction.

Opportunities

- CLSA’s Christopher Wood believes that the European Central Bank’s meeting last week reinforces the fact that central banks globally are addicted to unconventional monetary policies, reports Barron’s. Prior to the Bank of Japan meeting this week, Wood said that pension funds should have 70 percent exposure to the precious metal. Wood’s logic says that as we adjust for rising income, gold could peak again at $4,212 an ounce in an ultimate bull market.

- Bloomberg reports that in Japan, negative interest rates are boosting gold demand (according to the nation’s biggest bullion retailer). The same is true in Germany, where reinsurer Munich Re has boosted its gold and cash reserves in the face of the negative interest rates imposed by the ECB, reports Reuters. Last week the ECB cut its main interest rate to zero and dropped the rate on its deposit facility to -0.4 percent from -0.3 percent.

- Roxgold Inc. announced results from its latest drilling project this week from the QV1 structure at the Bagassi South regional exploration target, 1.8 kilometers to the south of the 55 zone. “Results from this program further confirm the potential at QV1,” stated John Dorward, President and CEO of Roxgold. These results make a stronger case for owning Roxgold and likely increased the prospect of Roxgold as a significant take out candidate.

Threats

- The CSFB “Fear Indicator” (specifically designed to measure investor sentiment, and represented by the index prices zero-premium collars that expire in three months) has never been higher, writes ZeroHedge. This could indicate that institutional investors are not believers in the equity rally and that there is more demand for put protection, continues the article, a sign of fear in the marketplace.

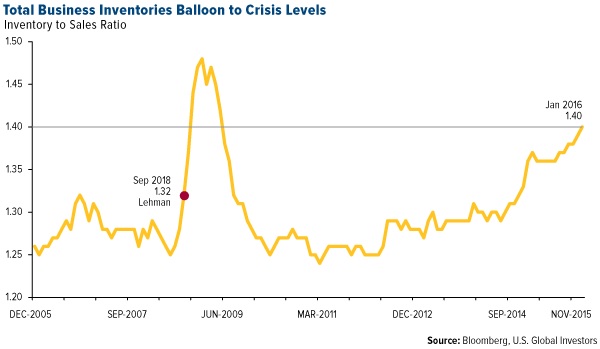

- Total business inventories have ballooned to crisis levels, according to a report from Macro Strategy Partnership. This can be seen in the chart below which shows the inventory-to-sales ratio. Inventories are up another 1.8 percent year-over-year to $1.81 trillion, and are up 18.5 percent from the prior peak in August 2008 while sales are only up 5.8 percent over the period.

Barclays thinks that the rally in commodities is overdone, and although economic data has improved, it is not enough to support current prices. With a fragile global economy still in place, the group believes that a turning point for commodities is still some way away.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of