The Next Rally In Gold Price

Last week, we discussed the likelihood of another Large Spec washout in COMEX gold and the impact this would have on price in the short term.

Today, let's look at this in greater detail.

If you missed last week's column, you should be sure to read it. It can be found here: https://www.sprottmoney.com/Blog/gold-going-on-sal...

Ultimately, this is an issue of dollar strength.

The past four weeks have seen a relentless rally in the U.S. dollar as the Dollar Index has soared by nearly 4%. This has led the computers that trade COMEX gold and silver to dump their positions, causing lower prices for both. If the dollar can soon reverse from this greatly overbought position (RSI nearing 80!), the selling pressure on the COMEX digital metals will decrease.

But what if the dollar doesn't reverse soon and instead continues higher? If the selling pressure in COMEX gold worsens, how much farther might price fall?

The answer can be found by combining price with the CoT data.

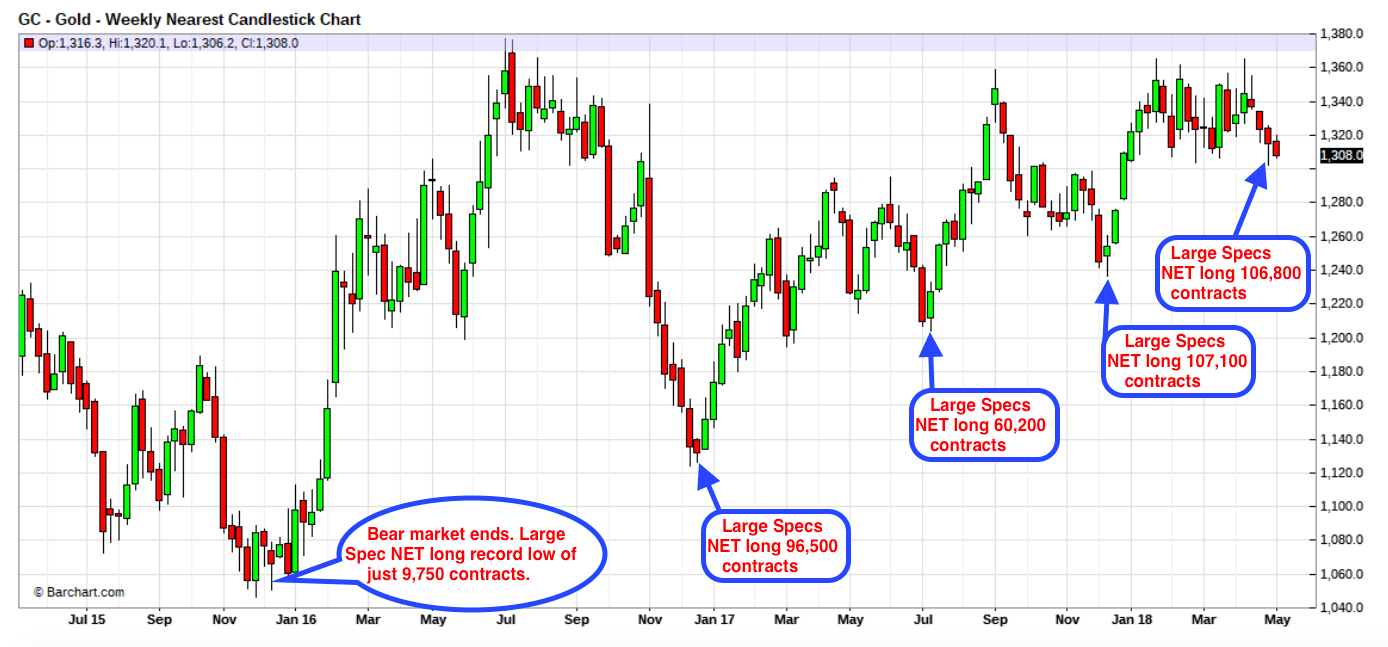

As we noted last week, there were three occasions in 2017 where the price of COMEX gold fell below its 200-day moving average. On all three occasions, massive Large Speculator selling followed and price dropped by an average of $30-40. An updated chart is below.

On it you can see the 200-day breaks of July and December of last year. Both breaks drove price about $30 below the continuous front-month 200-day moving average. A similar break now would take price to near $1,275.

However, as you consider this, be sure to take into account the fact that the Large Speculators in COMEX gold had already trimmed their NET long position to just 106,800 contracts as of last Tuesday, May 1. For perspective, the chart below shows the Large Spec NET positions at recent major lows.

What's the point of this?

If the U.S. dollar continues to rally, the price of COMEX gold is likely to fall even farther as speculators dump their remaining long positions. However, history suggests that further damage will be limited, and a price drop much below $1,275 is unlikely. At that point, the speculator positions will be "washed out", and the stage will be set for the next rally. Thus, any investors and traders waiting for a profitable entry point may soon get their opportunity.

|

|

Our Ask The Expert interviewer Craig Hemke began his career in financial services in 1990 but retired in 2008 to focus on family and entrepreneurial opportunities. Since 2010, he has been the editor and publisher of the TF Metals Report found at TFMetalsReport.com, an online community for precious metal investors. |

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.

********