Nine Straight Months Of Inflows Into Gold-Backed ETFs

Strengths

-

The best performing precious metal for the week was platinum, up 2.91 percent. The price of gold saw a small uptick on Thursday after the producer price index (PPI) increased 0.3 percent in August and the Labor Department said 884,000 Americans filed for first-time jobless claims in the most recent week. The metal notched a small weekly gain of 0.57 percent. Reuters reports that Thailand’s central bank will allow gold trading in U.S. dollars soon as it tries to curb the impact of growing gold demand on the baht currency.

-

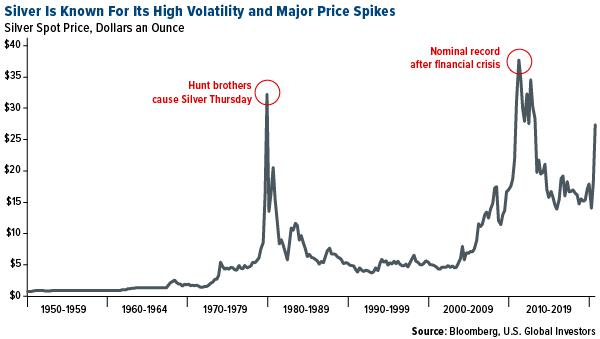

Silver, known for its massive and rare price spikes, could be on its way to another boom. The white metal’s gains are nearly double that of gold for 2020. Retail investors have added more than 8,800 tons of the metal to ETFs so far this year. Bloomberg notes than Robinhood buyers of the largest silver ETF have more than doubled in the month leading to August 13.

-

The Turkish Treasury and the Istanbul Gold Refinery will allow selected jewelers to collect gold from citizens and deposit it at state banks in a new effort to coax gold into its financial system. It is estimated that “under-the-mattress” stashed gold is valued around 40 percent of Turkey’s GDP. According to Esen, an estimated 5,000 tons of gold are stored outside of the financial system. Gold is popular in the country as a protection against inflation and traditional gift for holidays and celebration – especially as the lira as gone through wild price swings.

Weaknesses

-

The worst performing precious metal for the week was silver, down 0.48 percent.

-

The 120-day rolling correlation between gold and the Bloomberg Barclays gauge of emerging-market dollar bonds fell below zero for the first time since July 2016 this week – signaling that the two assets have stopped responding in the same way to the dollar’s moves. While the gold rally is looking “tired and ripe for a correction,” emerging-market bonds are extending gains to a sixth month, reports Bloomberg.

-

As demand for physical gold as a haven asset has jumped, so too has the cost and logistics of insuring it. Bloomberg Businessweek notes that as the price of gold rises, the number of insurable ounces at each storage site decreases, since insurers place a cap on how much financial exposure they’ll assume for each vault. Ludwig Karl of Swiss Gold Safe, which manages vaults in the Alps, said “you could put all the gold in the world in a large storage space, but you would never be able to get the insurance for it.” Although positive that demand is rising, is it a small weakness that insurance and storage difficulties could detract new buyers.

Opportunities

-

Gold-backed ETFs saw a ninth-straight month of inflows in August, driven by growing appetite in Asia. Collectively, 39 tons of bullion, equivalent to $2.1 billion, were added to ETFs in August with 7 tons coming from Asia.

-

A diamond the size of an egg is being put up for auction next month and is expected to fetch $12 million to $30 million. Kitco News reports that Sotheby’s is selling a 102.39-carat diamond – the second largest oval diamond of its kind to be offered at auction. The largest ever, a 118.28-carat stone set a record $30.8 million price in 2013.

-

Talley Leger, investment strategist at Invesco, said in a commentary that the end to gold’s bull run looks increasingly unlikely, reports Kitco News. Leger says for the gold market to lose steam, the U.S. economy would have to overheat enough to force the Fed to drastically raise interest rates, which would boost the dollar. “In our view, the Fed seems determined to protect this budding upturn by keeping interest rates low for the foreseeable future.” Lower rates boost gold’s appeal since it is a non-interest-bearing asset.

Threat

-

A flurry of new investors to the gold mining space has Newmont Corp. warning against dodgy deals. The SEC warns investors of “mini-tender” offers: “Some bidders make mini-tender offers at below-market prices, hoping they will catch investors off guard if the investors do not compare the offer price to the current market price.” Newmont explains that these are offers to acquire less than five percent of a company’s outstanding shares and avoid many of the investor protections afforded for larger tender offers.

-

James Steel, chief precious metals analyst at HSBC, said a rise in international trade could create an unfavorable market for gold. Steel points out that an increase in trade is a positive sign for global economic growth and geopolitical stability, which decreases the appeal of gold. “The outlook for trade is better than it was, but is still contracting that is good for gold,” Steel said on an LBMA webinar this week.

-

LVMH (Moet Hennessy Louis Vuitton) said it will walk away from its planned $16 billion takeover of Tiffany – a hit to the jewelry and luxury goods industry. LVMH said that its board received a letter from the French foreign ministry asking it to delay the acquisition to beyond January 2021 due to the threat of additional U.S. tariffs. At the same time, LVMH said Tiffany asked to extend the deadline to December 31 from the original date of November 24. Now Tiffany is suing to force the deal through – which was set to be the largest transaction ever in the luxury sector.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of