Not Giving Up Short-Term Bullish Case For Silver Price & Gold Price

First published Sat May 2 for members: Last weekend, I was looking for a bottom in the metals, to be followed by an imminent strong rally. Well, the market did not disappoint us in that expectation. However, it did surprise me with the depth of the pullback we experienced at the end of the week. And, it does make me a bit more cautious, but I am still going to maintain my original perspective for an impending rally to take hold.

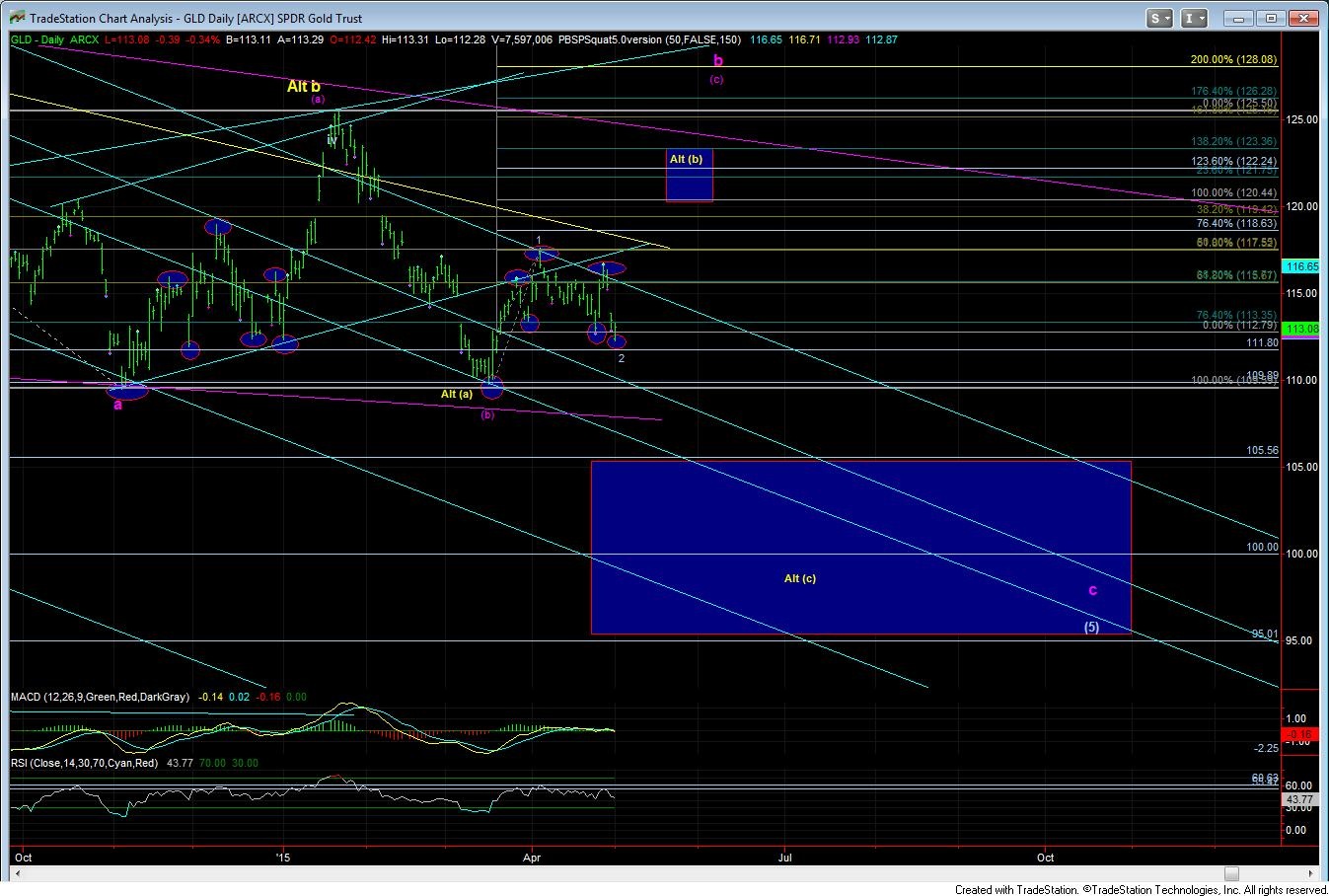

The first thing I want to present this week is a fractal comparison with the rally which began in November of 2014. I want to highlight the 6 blue ellipses in the November fractal, which almost exactly relate to the 6 in our current market action. Furthermore, the secondary, slightly lower low struck on January 2, 2015 (1st market day of 2015) held just at the .764 retracement of the initial rally off the low. Currently, the slightly lower low we struck on May 1, 2015 (1st market day of the Fibonacci 5th month of 2015) also held just at the .764 retracement of the initial rally off the recent low. If this fractal were to play out currently, then we should be seeing a strong rally take hold in the upcoming week. And, if the fractal plays out similarly, it may only take us two to three weeks to reach the top of the next rally. What would make me reconsider this potential is if the GLD should break down below the 111.50 level, which may make consider a more immediate bearish perspective.

The next thing I want to point out is the supposed “heads and shoulder’s pattern” to which every person who writes about this market has pointed. There is not a single person out there who has not noted this pattern. But, the problem is that when a pattern is so recognizable that the entire market is focused upon it as the “clear” market direction expectation, it rarely works out in that manner. In fact, it was a very similar market fractal in the US Dollar which pointed me to looking for a strong rally in the dollar back in May of 2014, while everyone else was focused on a similar type of “clear” heads and shoulders pattern. Truthfully, this feels quite similar from a sentiment standpoint as well.

But, the one chart I will be watching closely is the silver chart. As I write this, silver has only provided us with a 3 wave drop off the recent high. That still leaves us with an appropriate i-ii upside set up, as long as it does not break 15.64. However, should silver complete 5 waves down, and then only rally correctively from that point, I will likely be turning a bit more defensive sooner than I had expected, and will notify you of this change in perspective via a mid-week Market Update. What will turn me immediately bearish is if silver completes 5 waves down, rallies correctively, then breaks the low of the initial 5 waves down.

So, for now, I will be maintaining the shorter term bullish perspective, even though this past week’s action was not an ideal development. But, I will be watching the silver chart very carefully for signs that my short term bullish perspective is wrong.

And, as I have often said in my daily live videos, for the last several years, there are very few analysts that have been able to maintain on the correct side of this market on a very consistent basis. Along those lines, I believe we have been among the few that have done quite well in the metals arena, calling almost every twist and turn for the last several years, after calling the top to the market in 2011. And, as we come towards the end of this 3+year correction, I often wonder if it is our turn to be scathed by this market. But, there is one thing that is certain: as soon as I recognize that I am wrong in my expectations, I will alert you to that immediately in a Market Update, so that you are able to reposition appropriately. But, ultimately, please keep in mind we are attempting to trade the metals for a counter-trend rally. So, I still suggest you size your positions appropriately, with tight risk management parameters, taking that into consideration. Remember, we are still likely going to see lower lows, and that should be what you are most focused upon.

See Avi’s charts illustrating the wave counts on the metals below:

********

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of