Our Year End Positions in the Gold Sector

Unlike other analysts, I do not provide predictions or forecasts in January every year. We stay true to our trading models, and this is our current position as 2006 ended and 2007 just begun.

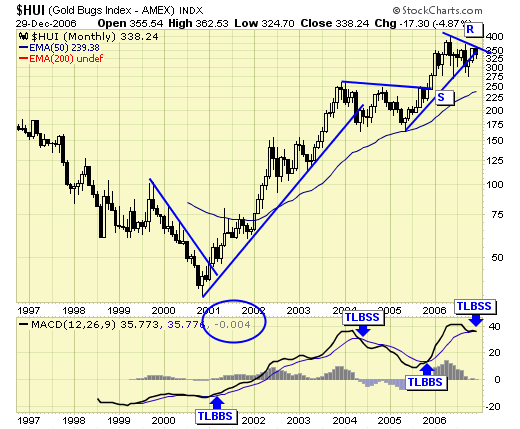

We have a long term sell signal on the $HUI, therefore, no core positions should be held until a buy signal again.

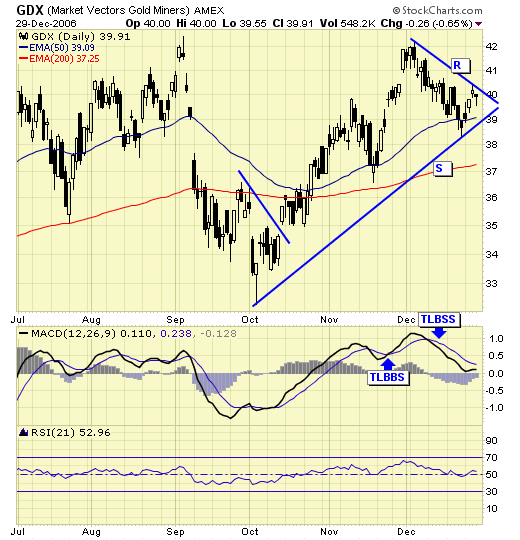

GDX is on a sell signal, US traders should be short or in cash.

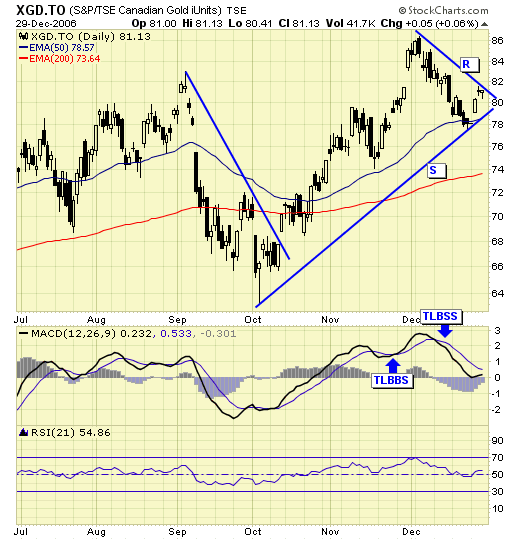

XGD.TO is on a sell signal, Canadian traders should be short or in cash.

Summary

Despite a weak second half, we had another great year in 2006 as our ROI (return on investment) exceeded our annual average of the past five years. This is due mainly to a strict money and risk management as we were wrong as many times as we were correct in 2006. Markets are dynamic and subject to constant change. The best we can do is to manage risk and exit when we are proven wrong. Capital preservation is priority #1.

Thank you for your support in 2006 and look forward to another productive year in 2007.

********

Disclaimer: I am not a certified investment advisor, and I have no affiliations with any of the mentioned investment funds. Investing has risks and you should seek professional advice before buying or selling anything.