Patient Approach Remains Appropriate For Fed. How Will Gold Price React?

The Fed released the minutes from its last meeting. What are the Fed’s views on the economy, global risks and inflation? What do the learnings imply for the US monetary policy and in turn, the gold market?

Minutes Show That FOMC Members Are Still Patient

The minutes from the May FOMC meeting show that the Fed is still patient. The downside risks for the global economy diminished and the financial conditions improved. As a result, the US central bank decided to keep its patient approach to the monetary policy in place:

In light of global economic and financial developments as well as muted inflation pressures, participants generally agreed that a patient approach to determining future adjustments to the target range for the federal funds rate remained appropriate. Participants noted that even if global economic and financial conditions continued to improve, a patient approach would likely remain warranted, especially in an environment of continued moderate economic growth and muted inflation pressures.

Perhaps this is why the gold market saw little reaction to the minutes, as the chart below shows. After all, they did not contain any significant surprises. The fact that the Fed is in no hurry to adjust monetary policy one way or the other was widely expected and already factored into the gold prices.

Chart 1: Gold prices from May 21 to May 23, 2019.

But does it mean that the publication is irrelevant? Not necessarily! We learned many interesting things about the FOMC members’ views. First, the policymakers are more upbeat regarding the balance of risks for the global economy. Although they agreed that downside risks to the outlook for growth remain, some participants “viewed risks to the downside for real GDP growth as having decreased, partly because prospects for a sharp slowdown in global economic growth, particularly in China and Europe, had diminished”.

Moreover, a number of participants noted that “financial market conditions had improved following the period of stress observed over the fourth quarter of last year and that the volatility in prices and financial conditions had subsided.” What is important here is that the improvement in financial conditions was regarded by many participants as providing support for the outlook for economic growth and employment. The more optimistic outlook should translate into more hawkish Fed in the future – and exert downward pressure on gold prices. There’ s one caveat here, however. The renewed trade wars may prevent the US central bank from abandoning its patient approach.

Second, the Committee members agreed that the recent dip in inflation was likely to be transitory. As long as inflation stays near or below the 2-percent target, the Fed sees no reason to change the federal funds rate in one way or another. However, if the subdued inflationary pressure is transitory, it can reemerge in the future. And then, the US central bank would need to tighten its monetary stance:

Many participants viewed the recent dip in PCE inflation as likely to be transitory, and participants generally anticipated that a patient approach to policy adjustments was likely to be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective (…) However, a few participants noted that if the economy evolved as they expected, the Committee would likely need to firm the stance of monetary policy to sustain the economic expansion and keep inflation at levels consistent with the Committee's objective, or that the Committee would need to be attentive to the possibility that inflation pressures could build quickly in an environment of tight resource utilization.

This is really important. The Fed believes that the recent softness in inflation have been caused by such distinctive (idiosyncratic) factors as unusually sharp declines in the prices of apparel and of portfolio management services:

At least part of the recent softness in inflation could be attributed to idiosyncratic factors that seemed likely to have only transitory effects on inflation (…) Some research suggests that idiosyncratic factors that largely affected acylical sectors in the economy had accounted for a substantial portion of the fluctuations in inflation over the past couple of years.

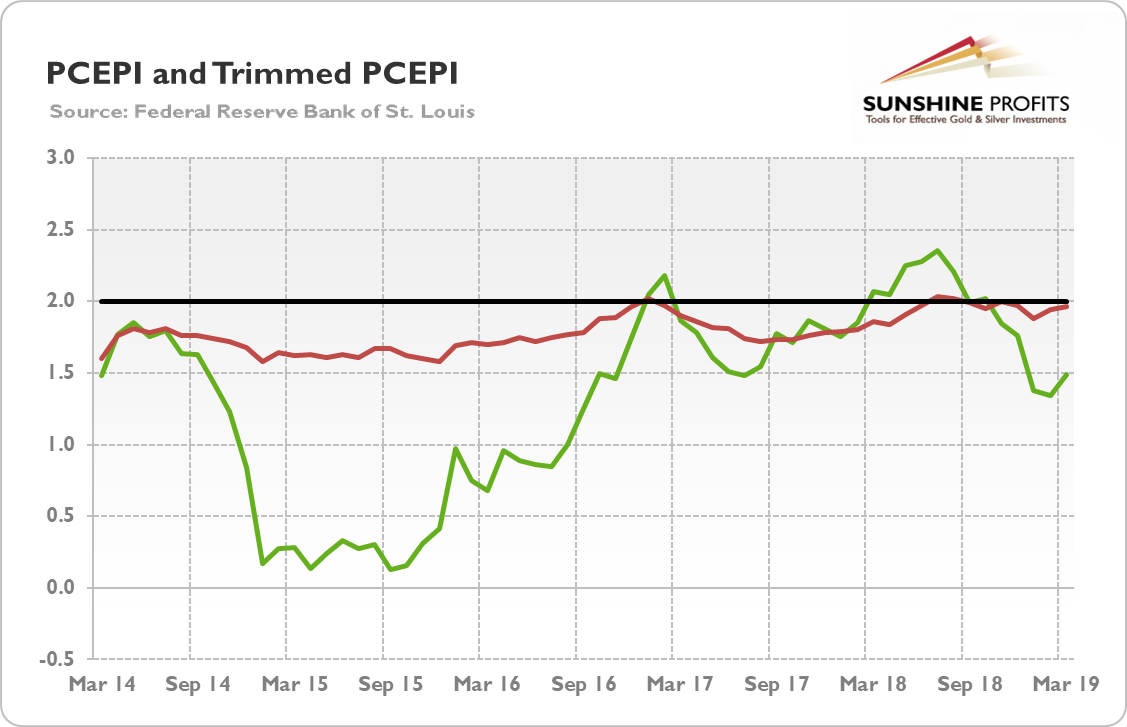

Indeed, the trimmed mean measure of PCE price index, which removes the influence of unusually large changes in the prices of individual items in either direction, had been stable at or close to 2 percent over recent months, as one can see in the chart below.

Chart 2: PCE Price Index (green line, % change from year ago) and trimmed mean PCE Price Index (red line, % change from year ago) from March 2014 to March 2019.

If true, we should see a rebound in inflation in the future. It means that the Fed may turn more hawkish in the future, or at least that the cut in interest rates is less likely that the markets expect. This is not good news for the gold bulls.

Implications for Gold

What does it all imply for the gold market? Well, the latest FOMC minutes confirm that the US central bank will remain patient for a while. The pause in tightening should support the gold prices. However, the market expectations of the interest rate cut later this year might be inappropriate. The minutes show that the Committee members are more optimistic about the balance of risks and the behavior of inflation in the medium term. The recent softness is believed to be caused by transitory factors to a large extent. This is what the trimmed PCE Price Index also suggests. Hence, inflation should go up later in the future. If the Fed lags behind the curve, gold would benefit. But if higher inflation prompts the FOMC members to tighten its monetary policy stance, and if the expected interest rate path shift higher, the yellow metal may struggle, then.

*********

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.