Powell And Yellen Sound Upbeat. Don’t They Like Gold?

Both Powell and Yellen testified before Congress. They sounded upbeat on the U.S. economy, but gold’s reaction was weak.

What a combo! Both Fed Chair Jerome Powell and the U.S. Treasury Secretary Janet Yellen testified before Congress this week. They spoke about the economic response to the economic crisis caused by the Covid-19 pandemic and the Great Lockdown.

In his prepared remarks, Powell sounded rather hawkish, as he noted that “the recovery has progressed more quickly than generally expected and looks to be strengthening.” As well, during the Q&A session, the Fed Chair seemed to be very confident about the economy and the central bank’s monetary policy. In particular, Powell told senators that 2021 was “going to be a very, very strong year in the most likely case.”

He also downplayed worries about higher inflation expressed by some lawmakers, arguing that the environment of low inflation we have observed for years before the epidemic won’t change anytime soon:

We think the inflation dynamics that we’ve seen around the world for a quarter-century are essentially intact — we’ve got a world that’s short of demand, with very low inflation. We think those dynamics haven’t gone away overnight, and won’t.

And Powell dismissed concerns about the supply disruptions as well, saying that “a bottleneck, by definition, is temporary”.

In a sense, Powell is right. A lot of supply disruptions are short-lived. But there are more inflationary factors operating right now, to name just a surge in the broad money supply. So, I’m afraid that he might be too conceited and understated the risk of higher inflation. You know, a lot of economic trends last – until they don’t. I’m referring here to the fact that the macroeconomic conditions change not gradually but rather abruptly. Inflation may remain low as long as inflation expectations are well-anchored, but if they become unanchored, inflation may rise quickly.

Importantly, Powell was also unmoved by the recent rally in the bond yields :

Rates have responded to news about vaccination, and ultimately, about growth (…) In effect there’s been an underlying sense of an improved economic outlook (…) That has been an orderly process. I would be concerned if it were not an orderly process, or if conditions were to tighten to a point where they might threaten our recovery.

Yellen also sounded rather hawkish in her prepared remarks, as she wrote that “we may see a return to full employment next year.” Yellen also admitted that asset valuations are high, but that she wasn’t worried about financial stability, nevertheless: “I’d say that while asset valuations are elevated by historical metrics, there’s also belief that with vaccinations proceeding at a rapid pace, that the economy will be able to get back on track”. However, she argued that economy needed more help to recover fully.

Importantly, Yellen admitted that higher taxes would be likely needed to raise revenues for increased government spending: “But longer run, we do have to raise revenue to support permanent spending”. Tax hikes could be negative for Wall Street and the economy, and thus, supportive for the price of gold.

Implications for Gold

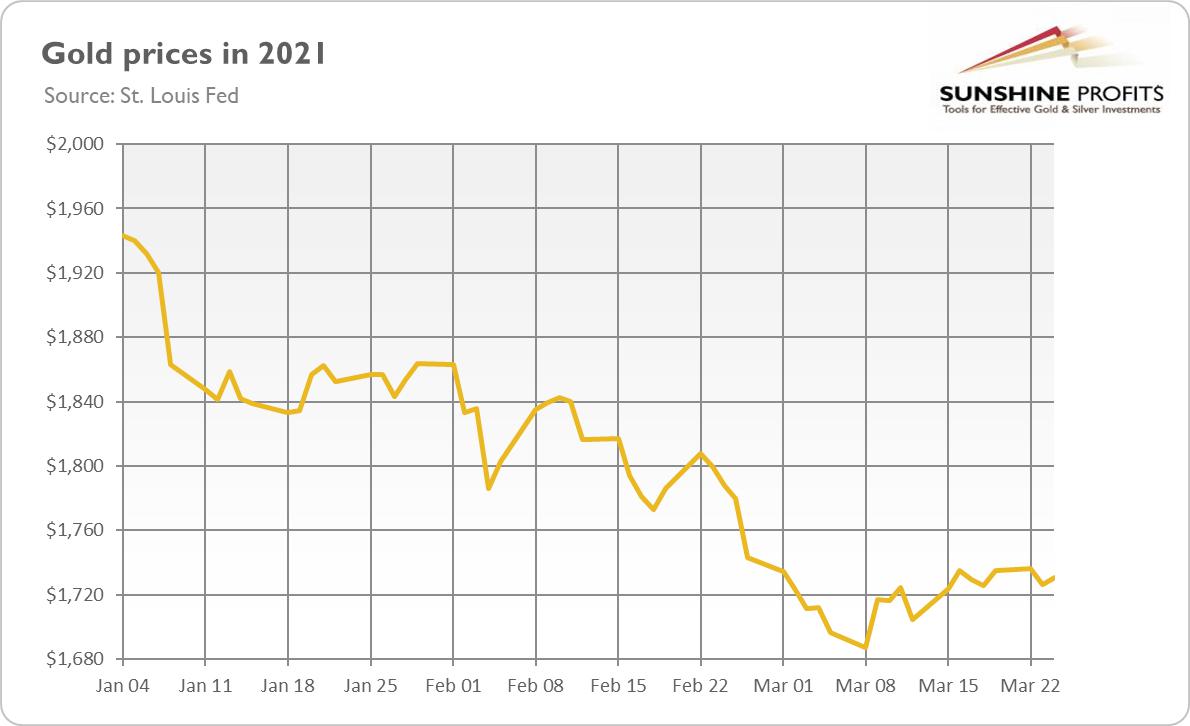

What do Powell and Yellen’s testimonies imply for the gold prices? Well, the two most important economic figures in the U.S. didn’t surprise the markets, so the yellow metal reacted little to their statements, as the chart below shows.

However, as both Powell and Yellen sounded rather optimistic about economic growth this year, their remarks might prove negative for the yellow metal. What can be particularly bad for gold is Powell’s calm stance regarding the rising bond yields. Of course, he could just put a good face on higher interest rates, but gold would prefer a more dovish stance. However, gold’s lack of a larger bearish reaction to rather upbeat testimonies from Powell and Yellen can actually be taken as an optimistic symptom. Anyway, a more accommodative stance of the Fed would be very helpful for the yellow metal.

If you enjoyed today’s free gold report , we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care

********