The Reasoning Behind Gold’s Breakout

Gold’s dramatic move above $1400 has caught the investment establishment by surprise. Physical gold ETFs, as a proxy for direct portfolio investment, amount to only 0.05% of the estimated $250 trillion of global investment values. As well as being badly wrongfooted, investment managers have little understanding of the role of gold as money, believing it to have no role in the monetary system. They will have to undergo a rapid re-education. This article addresses their common misconceptions.

Introduction

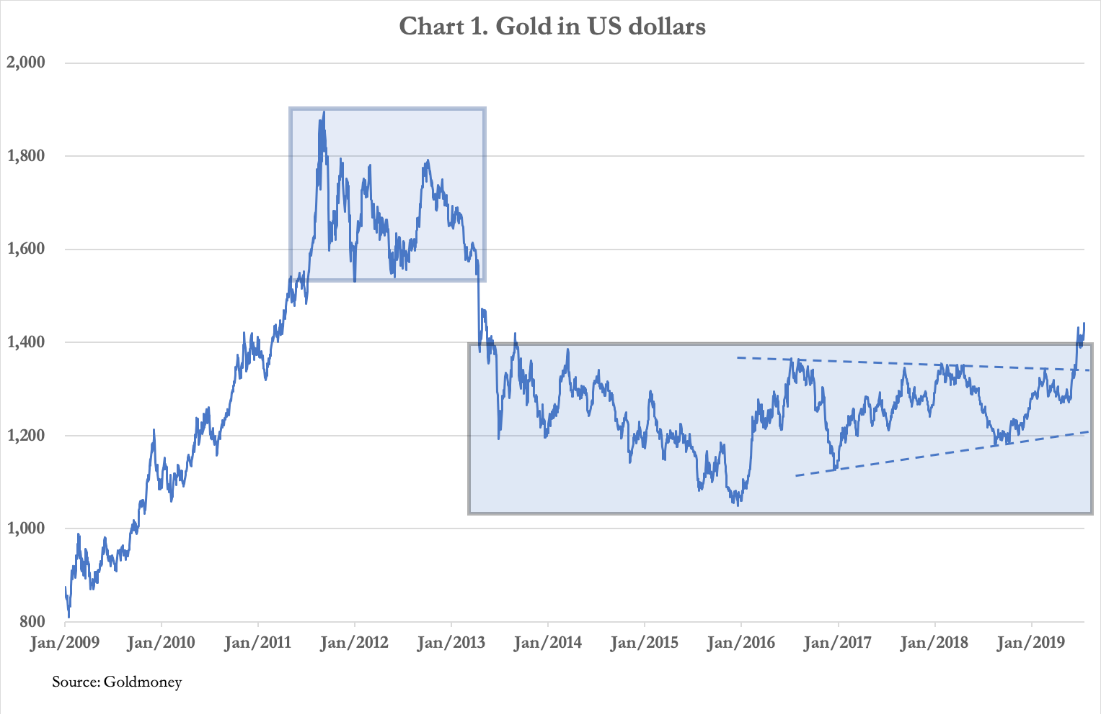

One month ago, gold made a dramatic move above a three-year consolidation (delineated by the pecked lines in Chart 1), confirming for technical analysts that a bull market in gold dating from the December 2015 low at $1,050 is alive and well. Chart 1 shows that a basing process has actually been in train for over six years, highlighted by the lower rectangular box.

Technically, the post-Lehman crisis bull market, when gold more than doubled, was ripe for a set-back. After peaking at $1920 intraday in September 2011, the Cyprus banking crisis in 2012 failed to collapse the Eurosystem and the gold price fell heavily. The topping-out process is highlighted by the upper smaller box in the chart. But that is now irrelevant. What is relevant is gold appears to be breaking out of a multiyear base, solid enough to offer the prospect of a potentially strong bull market in the dollar price of gold.

For trend-chasing investors who form a large majority by sheer weight of managed money, this is the primary consideration. They will have ignored the debate about the weaknesses of fiat currencies, geopolitical tensions with the Asian superpowers and America’s acts of trade immolation. That was always going to be the case until such time as gold broke convincingly through the $1350 technical price ceiling. With the price now establishing itself at over $1400, an appraisal of the reasoning behind gold’s breakout is timely for these investors.

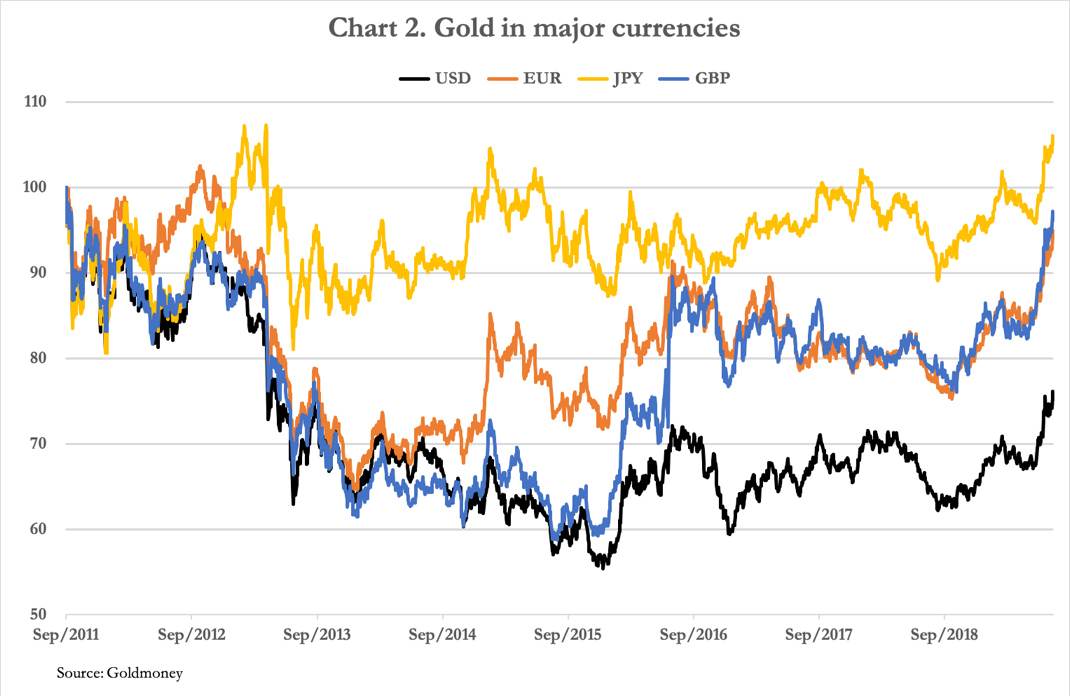

The dollar price is no more than a headline indicator for investors whose portfolio performance is not measured in dollars. Gold’s performance measured in other currencies has been far better. Since the price peak in September 2011, by mid-December 2015 the dollar price of gold had lost 45% of its value and has recovered to a net loss of only 24%. The gold price measured in the other major three currencies has performed significantly better, with the price in Japanese yen even higher now than it was at the time of the dollar’s 2011 all-time high. This is shown in Chart 2.

Furthermore, while the dollar price has only just caught the attention of mainstream dollar investors, residents of Euroland and Britain have seen gold in euros and sterling recover to within six and four per cent of the 2011 high respectively. Nearly three months ago, it was said that the gold price in 72 currencies stood at all-time highs. Given that emerging market and developing economy currencies tend to be weaker than the majors it is probably true.

Those who watch dollar headlines before jumping on a trend are late arrivals to a party already in full swing. Since the dollar price of gold bottomed in late-2015, the sterling price aided by the Brexit debacle has risen 63%, proving to be an excellent hedge against a falling pound. Gold priced in euros is up 45% from its lowest point, proving the wisdom of ordinary Germans who are the largest group of gold buyers in the Eurozone.

At a time of zero and negative interest rates and bond yields, these returns are doubly impressive. But there are remarkably few bulls on board with reasonable portfolio exposure. According to the World Gold Council, at end-June gold ETFs held 2,548 tonnes of bullion worth $115bn at current prices. While there are other gold-related regulated investments and derivatives, this feedstock of the raw stuff is tiny compared with the total value of global portfolio assets, which is probably in excess of $250 trillion. Given that nowhere is physical bullion a regulated investment, direct holdings of vaulted investment bullion are unlikely to be significant in this context. Putting physical gold being held as an unrecorded asset to one side, to find physical gold in investment portfolios you have to dig very deep. On these figures, ETF bullion represents only 0.046% of estimated global portfolio values.

Estimates of physical exposure in portfolios should not be taken too literally, but from these estimates we can see that for all practical purposes gold’s breakout has left the trend-chasing establishment with almost nothing. For this reason, there is now likely to be a scramble to understand why gold has broken out. Portfolio managers will be keenly aware they are likely to come under pressure from clients to participate and will want to have answers.

This article is addressed to the portfolio managers and investors who are in the unfortunate position of not yet owning any gold or find themselves underweight in gold-related investments and are considering what to do about it. But first we must dispel some of the common myths about the role of gold, so we can approach the subject with clarity.

Myths about gold as an investment medium

On Monday, Tom Stevenson, an investment director at Fidelity International, in his regular column in The Daily Telegraph wrote an article headed “Gold’s lustre may help hedge your bets if markets head south.” For a senior portfolio manager to recommend some portfolio exposure to gold supports this article’s contention that investment managers have noted the trend, but it appeared to present Stevenson with some difficulties arising from some common fallacies.

As a starting point, his article provides us with material to work with. His bias is clearly anti-gold. But his concern the gold price is telling him something important is evident from his headline, and he then enters into a mea culpa as to why gold should not be considered a normal investment. Stevenson trots out the usual anti-gold-bug stuff, claiming gold being only of interest to the kind of people who stockpile tinned goods and Kalashnikovs. But he also lists some of the alleged disadvantages of gold, commonly believed in the investment management industry.

Stevenson states it pays no income, is expensive to store and insure, it has no intrinsic value, no real use beyond looking pretty, it’s extremely volatile, it’s a greater-fool investment requiring another buyer to believe it’s going higher, and it’s value was higher forty years ago in real inflation-adjusted terms. We shall address all his points.

Before doing so, we must set one thing straight. What he didn’t mention is the common belief in investment management circles that gold is no longer money. We shall start with this issue, given its overriding importance, before addressing Stevenson’s other presumptions.

Myth 1. Gold is no longer money

The first step towards understanding the role of gold is to recognise it is money. It still competes with today’s fiat currencies as money and predates them by many millennia. Over the millennia there have been many other forms of money tried, and apart from silver, they have always failed. The gradual emergence of unbacked fiat currencies, particularly from the 1920s onwards, is the only monetary challenge to gold’s long history as money that has yet to fail.

With today’s state-issued currencies unbacked by anything other than public credibility in their issuers’ standing, the US dollar has loosely replaced gold as the principal currency against which all the other currencies are measured. This was by design: since 1971 the US Treasury has embarked on a campaign to deny gold’s role as money, promoting the dollar as the reserve currency instead.

In the past, when a state-issued currency was freely convertible into gold, its currency circulated as a gold substitute. Today, no currency is convertible into gold, so gold does not circulate as money even indirectly. By insisting its state-issued currency is used for tax payments, and therefore is the basis for everyone’s accounting, a government ensures it is the circulating medium. But another important function of money is as a store of value, preserving it for the lapse of time between it being earned and finally spent, and in this function state-issued currency fails.

The continual loss of purchasing power in fiat currencies since gold backing was removed has rendered them unsuitable as a savings medium. Only gold retains sound-money attributes and is still valued as such in a number of populous nations. In fact, the naysayers who claim gold is no longer money are only a very small proportion of the world’s population, given the general public as a whole in the advanced nations have no definite view on the matter. It is a common error to assume neo-Keynesian economists speak for entire populations.

For ordinary people, gold will become an increasingly important refuge, given the prospect of an acceleration in monetary inflation as the world tips into recession. With government spending already out of control, governments are relaxing budget discipline even further while promising greater spending. Consequently, the monetary quality which will become more valued is the ability to preserve value and it is upon this quality that gold markets are beginning to place a premium.

That is why gold is being valued as a more stable form of money, despite the fact it is not commonly found in general circulation. However, in the growing certainty that fiat currencies will die, gold can and will rapidly return to circulate as money.

We can now address Stevenson’s unfounded presumptions.

Myth 2. Gold doesn’t pay interest

Only hoarded gold, like physical currency cash, does not pay interest. Gold is loaned and borrowed for interest, just like fiat currencies. When markets are acting freely without state interventions and distortions, gold should have a lower originary interest rate than a fiat currency for the same loan term, because it is no one’s liability, unlike a fiat currency. The originary rate is shorn of all loan risks other than a pure time-preference value.

Today’s bullion market sets gold’s interest rate in the context of dollar interest rates. In London’s forward market, gold’s interest rate is termed its lease rate, which is derived from the gold forward rate (GOFO) and the London dollar interbank offered rate. GOFO is the rate at which a bullion bank is prepared to lend gold to another bullion bank on a swap basis against US dollars. The notional formula is the gold lease rate equals LIBOR minus GOFO.

In the days of the gold standard, when currencies were accepted as gold substitutes, the originary interest rate was that of gold. While it was impossible to quantify, because actual loan rates depended on borrower risk, the originary rate, as described above, was set by time preference. Expressed as an annualised interest rate, gold’s originary rate was normally in the order of two or three per cent.

Compared with today’s unbacked currencies, gold’s interest rate was very stable, but it was not immune to changes in its purchasing power. There were some fluctuations in supply, such as those caused by the Californian and South African mining booms. The rate of technological progress, to the extent productivity was advanced, lowering the general level of prices over time was also an important factor, which meant that a saver would experience the purchasing power of savings increase. For this reason, savers were prepared over time to accept a lower rate of interest on gold than would otherwise be the case.

The modern mantra that gold does not pay interest is simply untrue.

Myth 3. Gold is expensive to store and insure

This is untrue. At Goldmoney, fully insured annual storage fees for gold in LBMA approved vaults range between 0.01% and 0.018%. ETFs and mutual funds charge far higher rates for management, administration and custody. There is ample margin for Fidelity to pay Goldmoney’s vaulting and insurance fees, and for Fidelity to enjoy a substantial mark-up within its existing fee structure. We won’t hold our breath.

Myth 4. Gold has no intrinsic value

From Wikipedia, the definition of intrinsic value is as follows:

“In finance, intrinsic value refers to the value of a company, stock, currency or product determined through fundamental analysis without reference to its market value. It is also frequently called fundamental value.”

It is clear from this definition that the financial concept of intrinsic value depends on the income stream generated by an asset. In the case of a currency, this can only relate to the interest it earns for a lender. Like a currency, gold pays interest on being loaned out, so it must have an intrinsic value.

The concept of intrinsic value applied to money is little more than a red herring. But if we are to pursue it, we should observe that the suppression of interest rates reduces the intrinsic value of a currency, that zero interest rates remove it altogether, and negative rates give rise to negative intrinsic values.

On this basis, gold will always have an intrinsic value, while unbacked currencies in the current financial climate often do not. Gold clearly wins over today’s currencies on this basis.

Myth 5. Gold has no real use beyond looking pretty

We can all agree gold looks pretty. But it is also incredibly durable. Gold’s physical qualities and its rarity have made it the money of choice for diverse people and their cultures throughout the long history of mankind’s economic cooperation.

For Stevenson to imply that gold is only ornamental infers that the marginal price of gold is set by its supply and demand for that function. This is not the case. Gold is demanded in Asia for its property as a readily realisable store of value. It is a mistake to think diverse Asian communities, including the poorest in society, waste significant sums of their governments’ currencies on the frivolous function of making their women look pretty.

To have one’s accumulated wealth held beyond the control of government has proved to be a wise decision for the middle and lower classes in populous countries such as India, as well as all the other nations between Turkey and Indonesia inclusively. An Indian has seen the price of gold increase from under 200 rupees when Bretton Woods failed to nearly 100,000 rupees today. It is not so much a rise in the price of gold; rather it is a measure of the loss of purchasing power of the rupee. In Asia, where half the world’s savers reside, gold is the basis of a wise man’s family pension fund. Lack of gold ownership could be his western equivalent’s folly.

Clearly, gold is much more than a bauble upon which rupees and rupiah are continually wasted by ignorant natives. And if it is only pretty, why is it that central banks are adding to their gold reserves at a record pace?

Myth 6. Gold is volatile

This observation is in the same category as that which states the sun rises in the morning and sets in the evening. It appears to be true, but it is the result of the earth’s own rotation, not the sun rotating round the earth. Those that say gold is volatile subscribe to a flat-earth fallacy that ignores the volatility that arises from currencies.

Measured in dollars, in 1971 the price of a barrel of oil was $3.60. At that time, the official gold price, before gold backing for the dollar was suspended in August that year, was $42.22, which meant oil was priced at 0.085 ounces of gold. Today, the oil price is $57, an increase in the dollar price of nearly fifteen times. Measured in gold, the price is 0.04 ounces, roughly half the price in 1971.

Energy, typically measured by the price of oil, is the most important of all commodities to human life. The price in gold-ounces is demonstrably more stable than the price in dollars. Clearly, the volatility is in the currency and all the other currencies that defer to it, not gold.

Myth 7. It’s a greater-fool investment

That gold is a greater-fool investment, requiring another buyer to believe it is going higher, is surely the most preposterous statement for any investment manager to make. The whole basis of equity investment and dealing in derivative markets is just that. With this statement, Stevenson has defined his own company’s stock in trade. Every investment, putting aside bonds held to maturity, requires an exit strategy. If Stevenson and his colleagues apportion equities into their clients’ portfolios without one, they would have good cause to remove their funds and seek a manager who at least looks before he leaps.

With respect to gold, nothing is further from the truth, which is why it is so important to understand that at its most fundamental level gold is money and not an investment to be traded. You can trade it of course, but the ultimate purpose of owning gold is to spend it.

Myth 8. Gold’s value was higher 40 years ago in real terms

Besides being highly selective with his timing to make his point, Stevenson’s statement that gold has failed to keep pace with inflation over the last forty years is presumably made to emphasise gold is a disappointing investment. As an investment, it therefore must be under-priced, given gold is widely recognised to be a hedge against paper currencies losing purchasing power.

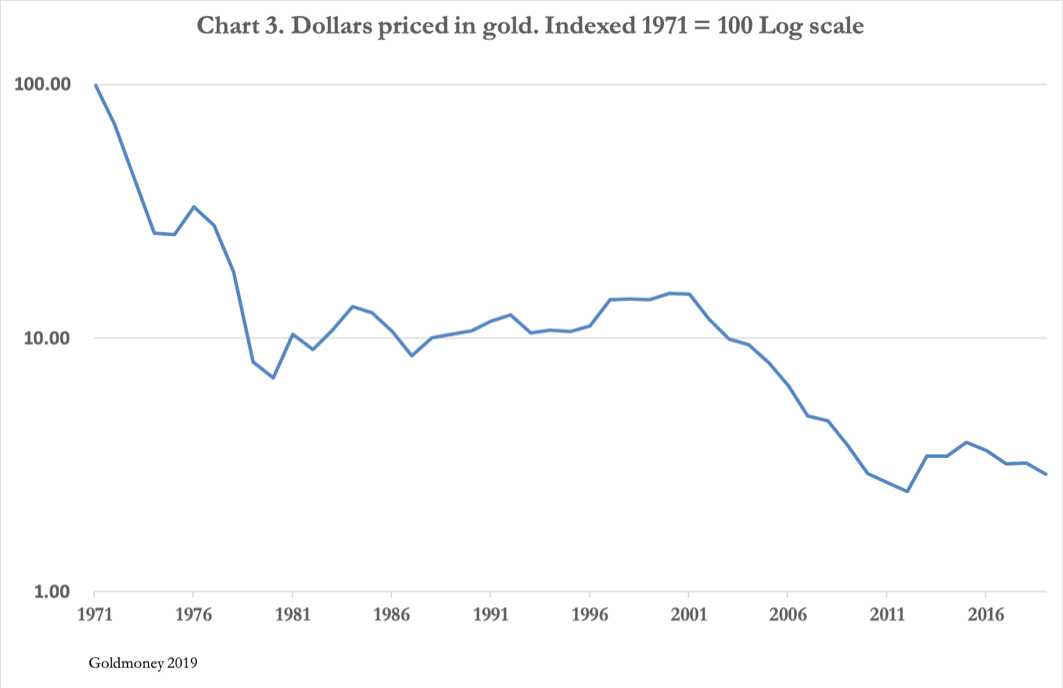

Stevenson’s approach is to only wrongly view gold as an investment, when in fact it is money. It is in the same category as uninvested cash, though with its own special sound-money characteristics. It is intended to be spent, not to be compared with financial assets. But as cash, it has retained purchasing power, which is more than can be said for the dollar. Since the Bretton Woods Agreement was terminated in August 1971 by President Nixon, the dollar has lost 97% of its purchasing power measured against gold.

If gold has produced a bad return for a dollar portfolio, one wonders what Stevenson thinks is a good one. To be fair, the performance of the S&P 500 Index gets close.

At the end of the same month the Bretton Woods Agreement was suspended, the S&P 500 Index stood at 97.24. Today it stands at 3,000. Therefore, the S&P500 has risen 30 times, while over the same period gold has risen nearly 33 times. Ignoring dividends, dealing costs to constantly rebalance the S&P index and the interest earned on gold, the performance is remarkably similar. But that is before considering the increased risk factors facing equities today, factors which are enormously positive for gold.

There is growing evidence of a developing global recession and a US slowdown. On the eve of these enhanced investment risks, the upside for the S&P500 seems limited at best, while there is a growing likelihood of an equity bear market developing. At the same time, the loosening of the Fed’s monetary policy clearly boosts prospects for the gold price.

The consequences of an accelerating money supply

An investor observing gold’s breakout and wondering if it leads to higher gold prices will be aware of the growing certainty that monetary inflation will accelerate. These events are connected.

Monetary inflation has been a longstanding problem. Most investors are wholly unaware that since 1971, measured in gold, the dollar has lost 97% of its value, reflecting the expansion of money and bank credit. This is illustrated in Chart 3, which is to a logarithmic scale.

Some of the loss of the dollar’s purchasing power is likely to be due to an increase in the purchasing power of gold, as the price of oil quoted above illustrates. But there are now reasons to believe the dollar and most other state-issued currencies are due for another significant loss of purchasing power.

In President Trump we observe a leader who in chronological order has attempted to restrict imports, bully the Fed into lowering interest rates, and is now pushing for a “competitive” dollar. The consequence of his administration’s trade policies has been to disrupt international trade to the extent that the evidence is it is contracting. The impact on all major economies has been to threaten them with recessions which could turn out to be significantly worse than the temporary slowdowns we have seen from time to time since the Lehman crisis.

Central banks are now concerned they have run out of road, confirmed by the Bank for International Settlements in its Annual Economic Report 2019, dated 30 June. In calling for “a better balance between monetary policy, structural reforms, fiscal policy and macroprudential measures”, the BIS, which represents all central banks is saying there is little more central banks can do to stabilise the global economy. That is not the way politicians, hooked on easy money will see it. Despite monetary policy makers’ misgivings, they have no policy alternative to more easing of interest rates and more expansion of their money supplies.

At the same time, governments are contemplating how they might provide spending or fiscal stimulus. Like China, some are contemplating infrastructure spending, and others, such as America and Britain under Boris Johnson are pursuing tax cuts. No government is prepared to reduce spending. It all adds up to one thing, and that is another round of massive monetary inflation.

What has not yet been appreciated are the consequences, and that is what the breakout in gold’s price, illustrated in Chart 1, is all about.

Chart 3 is about the bigger picture, taken from when there was a run on the US Treasury’s gold, and it could no longer swap dollars for gold at the then devalued rate of $42.22 per ounce. Today, we are on the verge of another run against currencies. Just imagine for a moment the combination of looming recession, negative interest rates still imposed in the EU, Switzerland, Denmark, Sweden and Japan, and now the prospect of competitive devaluations. And then ask yourself, what are the prospects for the gold price measured in these devaluing currencies?

Conclusion

Not only do global bond markets offer minimal or even negative returns, but there are growing signs the corporate sector is coming under pressure from a gathering recession. The strains in the fiat-money financial system are growing, with unsustainable corporate and consumer debt becoming an urgent consideration. This puts the investment management industry in a difficult, even impossible position.

From this viewpoint, the only investment opportunities that are now emerging, beyond increasing fiat cash balances, are unregulated. These are a dash into cash in the form of gold, and speculation in cryptocurrencies. Unregulated investments are anathema to compliance officers and therefore investment managers. Even when wrapped up in ETFs, which are regulated, the investment management industry has been slow to accept them. For the purpose of this article, we have put cryptocurrencies to one side. This is about physical gold.

Having invested intellectually in fiat money concepts for at least since the demise of Bretton Woods, investment managers have reduced portfolio exposure to gold and related investments to probably as low as it can get. Now that its dollar price has broken out of a multi-year torpor, gold offers the prospect of enhancing portfolio returns, which is why it is catching the attention of the investment management industry.

For most investment managers, the process of unlearning the theory of state money will be a painful one. Tom Stevenson is not alone, and his article in the Daily Telegraph exposes a worrying degree of ignorance among so-called investment experts about monetary affairs in general, but particularly about the role of gold as money.

With governments everywhere itching to increase spending without raising taxes and as the global economy sinks into a trade and credit-cycle induced recession, budget deficits will fuel monetary inflation at a faster pace than seen before. Re-learning that gold is sound money is now the most urgent priority for all those charged with responsibility for other peoples’ investments.

Alasdair Macleod

HEAD OF RESEARCH• GOLDMONEY

Twitter: @MacleodFinance

MOBILE: +44 7790 419403

Goldmoney

The Most Trusted Name in Precious Metals tm

NEW YORK | ST. HELIER | TORONTO

Publicly Traded Symbols: CA: XAU | US: XAUMF

© 2017 GOLDMONEY INC. ALL RIGHTS RESERVED. THIS MESSAGE MAY CONTAIN CONFIDENTIAL OR PRIVILEGED INFORMATION. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE ADVISE US IMMEDIATELY. THIS MESSAGE IS FOR GENERAL INFORMATION ONLY AND SHOULD NOT BE CONSTRUED AS AN OFFER OR SOLICITATION OF AN OFFER TO BUY SECURITIES OR ANY OTHER FINANCIAL INSTRUMENTS. WE DO NOT PROVIDE TAX, ACCOUNTING, OR LEGAL ADVICE, AND RECOMMEND THAT YOU SEEK INDEPENDENT PROFESSIONAL ADVICE IF NECESSARY. WE CONSIDER INFORMATION IN THIS MESSAGE RELIABLE BUT WE DO NOT REPRESENT THAT IT IS ACCURATE, COMPLETE, AND/OR UP TO DATE AND IT SHOULD NOT BE RELIED ON AS SUCH. OPINIONS EXPRESSED ARE OUR CURRENT OPINIONS AS OF THE DATE APPEARING ON THIS MESSAGE ONLY AND ONLY REPRESENT THE VIEWS OF THE AUTHOR AND NOT THOSE OF GOLDMONEY INC OR ITS SUBSIDIARIES UNLESS OTHERWISE EXPRESSLY NOTED.

Notice: This email may contain confidential or privileged information. If you received this email in error or believe you are not the intended recipient, please notify the sender immediately and delete this email without forwarding or opening any attachments. Thank you for your cooperation and attention.

********