Recycling: a Largely Forgotten Part of the Precious Metal Supply

When talking about the gold supply, the focus is usually on mine production. Unsurprisingly, this has not yet responded to the sharp rally in gold prices. Apart from the decline caused by the COVID-19 measures, mine production has been plateauing since 2018. New gold production is also expected to reach this level in 2025. In the first half of the year, the same amount of new gold was mined as in previous first halves of the year. This rigidity is due to the fact that mine production cannot be expanded without significant lead times, not to mention the development of a new mine. Even record-high profit margins do not change this.

This focus on mine production is comprehensible. However, it overlooks an important pillar of gold supply, one that responded much more quickly to the gold price rally: recycling.

The global volume of recycled gold has grown steadily in recent decades. In the 1990s, annual recycling volumes typically ranged between 800 and 900 tons. In the 2000s, recycled gold rose to 1,000 tons and beyond. The all-time high was reached in 2009 with 1,728 tons. After that, the annual amount of recycled gold fell back to around 1,000 tons. In recent years, the supply of recycled gold has risen again.

In 2024, 1,370 tons of gold were recycled, 10.9% more than in the previous year, after an increase of 8.6% had already been recorded in 2023. In both of these years, the price of gold in US dollars recorded double-digit percentage increases, namely 27.2% in 2024 and 13.1% in 2023. In the first half of 2025, the amount of recycled gold continued to increase slightly by just under 2% to almost 700 tons.

This suggests that the prolonged slump in the relative share of recycling in the total supply of gold has now been overcome. In 2009, recycled gold accounted for 42% of the total gold supply. Despite initially rising gold prices, the amount of recycled gold declined. The sharp decline in the gold price in 2012/2013 was reflected in a noticeable decline in the share of recycling in total supply. Like the gold price, the recycling rate remained at a low level.

It was not until 2023 that an increase was recorded again, which was initially tentative but became more pronounced as the gold price rally gained momentum. The increase from 23.8% in 2022 to 27.6% in 2024 corresponds to a rise of 16%. In the first half of 2025, the share of recycled gold in total supply continued to rise to 28.7%. On a half-year basis, this was a 12-year high. The continuation of the gold price rally is reflected in this increase.

Urban Mining

Urban mining refers to reclaiming valuable materials, such as gold and silver, from urban waste streams, including electronic waste (e-waste), old jewelry, and other discarded items. It represents a sustainable approach to recovering resources that would otherwise be lost or disposed of, while also reducing the environmental impact of traditional mining. The World Gold Council employs a strict definition of recycled gold “as that sold for cash by consumers or other supply-chain players, such as jewelry manufacturers that sell old stock”. This definition, however, excludes gold involved in gold exchanges at jewelry stores, as well as manufacturing residue or new scrap.

Gold recycling from jewelry

Jewelry recycling represents the most traditional form of gold recycling, accounting for approximately 90% of all gold recycled globally. This percentage varies regionally, with higher rates in countries with a strong gold jewelry tradition like India, and lower rates in Western countries, where gold jewelry plays a smaller cultural role and other segments like electronic scrap are relatively more significant.

Recycled has become a prominent trend within the global jewelry industry. Brands including Chopard, Prada, Tiffany, and Pandora have committed to sourcing materials responsibly, particularly through the use of recycled gold. Additionally, numerous emerging jewelry startups exclusively utilize recycled precious metals, further driving demand for recycled gold.

Gold recycling from e-waste

E-waste has emerged as an increasingly important source of recycled gold. Global e-waste generation currently exceeds 60 million tons annually, and is projected to more than double to 137 million tons by 2050, representing a significant value. A substantial percentage of this e-waste contains precious metals, including gold. For context, studies have shown that a typical mobile phone contains approximately 7 to 34 mg of gold. Higher-end electronic devices, such as high-end desktop computers and server-grade motherboards, may contain as much as 1 g of gold.

Historically, e-waste recycling yielded relatively low recovery rates for precious metals. However, improvements in refining and separation techniques have significantly improved these rates, with modern e-waste recycling plants now capable of recovering over 90% of the gold contained in discarded electronics. Currently, however, e-waste generation is growing five times faster than e-waste recycling.

According to a recent study by The Gold Bullion Company, the US leads the way in gold recovery from discarded electronics, followed by China and Germany. In 2022, the US generated 4.1bn kg of officially documented electronic waste, from which an estimated 13,767 kg of gold was recovered. Although it generates only half as much electronic waste, China ranks second with an estimated 6,630 kg of recycled gold.

On a national level, the United States leads in gold recovery from discarded electronics, followed by China and Germany, according to a recent study by The Gold Bullion Company. Based on 2022 data, the US generated 4.1bn kg of formally documented electronic waste, from which an estimated 13,767 kg of gold could be recovered. Despite generating only half as much e-waste, China follows in second place with an estimated 6,630 kg of recycled gold.

Sustainability benefits of recycling

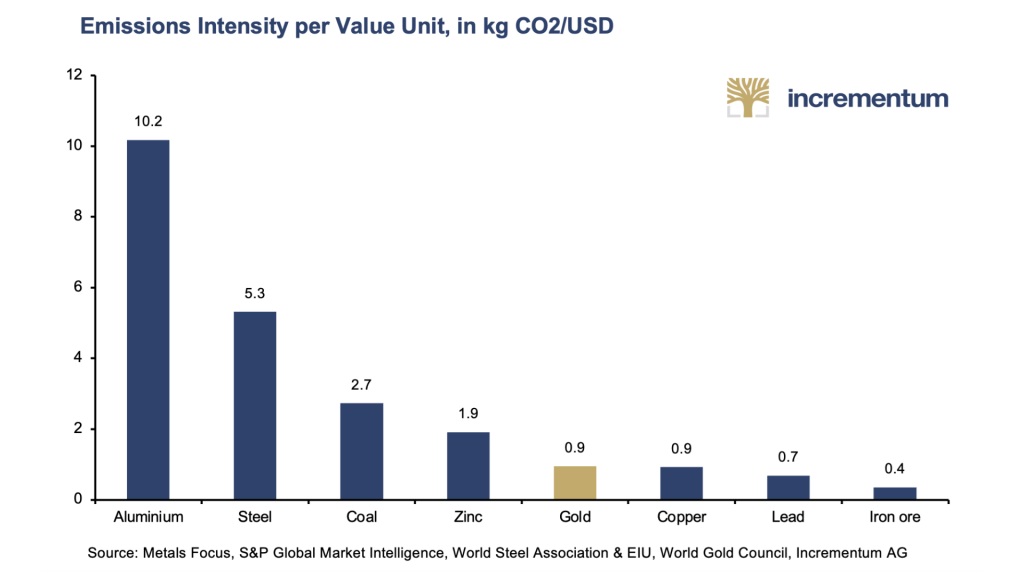

This analysis would be incomplete without acknowledging the positive contribution of recycling to sustainability. Recycling reduces the demand for newly mined metals, reducing the CO2 footprint associated with production. Since gold can be used indefinitely and CO2 emissions are mainly generated during the initial extraction process, gold has a very small CO2 footprint. Therefore, each recycling saves about 90% of the CO2 emissions generated during extraction. Extracting one ounce of gold through traditional mining emits an average of about one ton of CO2.

As a result of geopolitical tensions, recycling is now also taking on strategic significance. After all, recycling reduces the demand for newly mined metals, some of which have to be sourced from countries with which the importing country has a critical relationship. For example, the EU meets 100% of its demand for heavy rare earths from China, 98% of its demand for boron from Türkiye, and 71% of its demand for platinum from South Africa. Thus, there is a need for at least 25% of the annual consumption of the 34 minerals listed as critical raw materials in the EU to be obtained through recycling by 2030. This would also contribute to developing the circular economy desired by the EU.

Where is gold recycled?

The recycling market for gold can generally be divided into two categories: recycling for high-grade and low-grade gold. Depending on the category, different factors influence the recycling location.

High-grade scrap

The US occupies a central position in the precious metals recycling ecosystem. In 2023, it contributed 100 t of recycled gold to the global supply. Major US-based refineries specializing in gold recycling include Asahi Refining (which acquired Johnson Matthey in 2015), The Refining Company, and Palladium Refining. China and India also account for a substantial share of the global recycled gold supply. Leading refineries for gold recycling are the China National Gold Group and the Shenzhen Zhongjin Lingnan Nonferrous Metal Company.

In Europe, Italy has developed a well-established jewelry industry, particularly in cities like Florence and Vicenza. The country’s focus on high-quality gold jewelry and luxury goods has created a robust market for recycled gold, especially in gold scrap from old jewelry. The Italian gold recycling market also benefits considerably from the EU’s open borders, importing large volumes of gold scrap from neighbouring countries.

Dubai plays a similar central role for the Middle East. Its outstanding importance for the gold trade was recognized in an entire chapter of the In Gold We Trust Report 2024. While the city is renowned as the region’s gold trading center – with 20–30% of all gold traded globally each year passing through the city –, it unsurprisingly also handles large volumes of gold recycling for neighbouring countries that lack gold refinery facilities. Today, some of the world’s largest refineries operate in Dubai, including MTM Gold Refinery DMCC, Emirates Gold, and SAM Precious Metals.

Switzerland, the world’s dominant gold refining country, is also a major player in gold recycling. Home to five of the world’s largest and most essential refineries – MKS PAMP, Argor-Heraeus, Metalor, Valcambi, and Cendres Métaux – Switzerland processes and mints approximately 70% of all globally mined gold. Valcambi is the largest refinery worldwide, processing more than 2,000 t of gold, silver, platinum, and palladium per year.

Low-grade scrap

Lower-grade scrap material contains a very low precious metal content of around 1% or less, found in sources such as burnt electronic scrap or non-auto catalysts. Compared to high-grade scrap, low-grade precious metal scrap has a lower monetary value per unit, consequently presenting less financial risk to transport. As a result, there is worldwide competition for these materials, although fewer specialized refineries can process them efficiently. Japan has developed expertise in this sector, becoming well known for importing and recycling this category.

Worldwide, countless gold and silver refineries operate; however, the most important ones have received accreditation by the LBMA (London Bullion Market Association) for adhering to the stringent standards of Good Delivery or by the Responsible Jewelry Council (RJC) Chain of Custody standard (COC). On a global scale, the top refineries are: Agosi (Pforzheim, DEU); Argor-Heraeus (Mendrisio, CH); Cendres + Métaux (Biel, CH); Emirates-Gold (Dubai, ARE); Engelhard (Newark, USA); Heimerle+Meule (Pforzheim, DEU); Heraeus (Hanau, DEU; Johnson Matthey (London, GBR); Metalor (Neuchâtel, CH); PAMP (Castel San Pietro, CH); Perth Mint (Perth, AUS); Rand Refinery (Germiston, ZAF); Tanaka-Kikinzoku (Tokyo, JAP); Umicore (Brussels, BEL); Valcambi (Balerna, CH).

Conclusion

Despite the growing popularity of gold, the recycling of precious metals has received little attention to date. Recycled gold even accounts for more than a quarter of the total gold supply. The rest of the supply for both metals is covered by traditional mining. Surprisingly, the ratio between recycling and new production is within a relatively narrow range, even though the absolute amount of recycled gold is subject to noticeable fluctuations.

*******

Ronni is the managing partner of incrementum AG in Lichtenstein. He studied business administration and finance in the USA and Austria.

Ronni is the managing partner of incrementum AG in Lichtenstein. He studied business administration and finance in the USA and Austria.