Should We Prepare For the Worst And Buy Some Gold?

As the COVID-19 pandemic has shown, it is worth being better prepared for a possible crisis. Does that mean it pays to have some gold up your sleeve?

I have to confess something. I always laughed at preppers (aka survivalists) – people who spend their entire lives stockpiling beans and ammo in preparation for the highly unlikely doomsday scenarios. C’mon, who would take these freaks seriously? Well, as the pandemic and supply crisis showed us, we all should.

When most people scrambled for masks and hand sanitizers, preppers laughed. When most people fought epic battles for toilet paper and something to eat to survive the Great Lockdown, preppers laughed. When most people were confronted with surging inflation and supply shortages of different products, preppers laughed. When most people panicked upon hearing about energy blackouts, preppers laughed. It seems that mocked preppers got the last laugh, after all.

Hence, the COVID-19 epidemic made it clear that the world is not a paradise flowing with milk and honey and that bad things do really happen, so we should be more prepared for possible calamities, even if they look like remote possibilities. For example, experts now point out the threat of cyberattacks, and just last month, Kazakhstan’s government turned off the internet nationwide, depriving its citizens of access to their bank accounts.

The problem is, of course, that crises always seem highly unlikely until they occur. Meanwhile, historical cases are too distant and abstract for us, and we tend to think that “this time is different”, or that “we’ll make it through somehow.” Perhaps you will, but it’s much easier when you are prepared. When other people panic, you don’t, because you have made your preparation and have a clear plan of action.

You see, the issue is not if the crisis hits, but when. It’s just a matter of time, even the government suggests storing at least a several-day supply of non-perishable food. However, the problem is that when things are going well, people don’t think about preparing. Why should we worry and spoil the fun? Let’s drink like tomorrow never comes! Maybe the problem will somehow disappear by itself, and if it doesn’t, we’ll deal with it later.

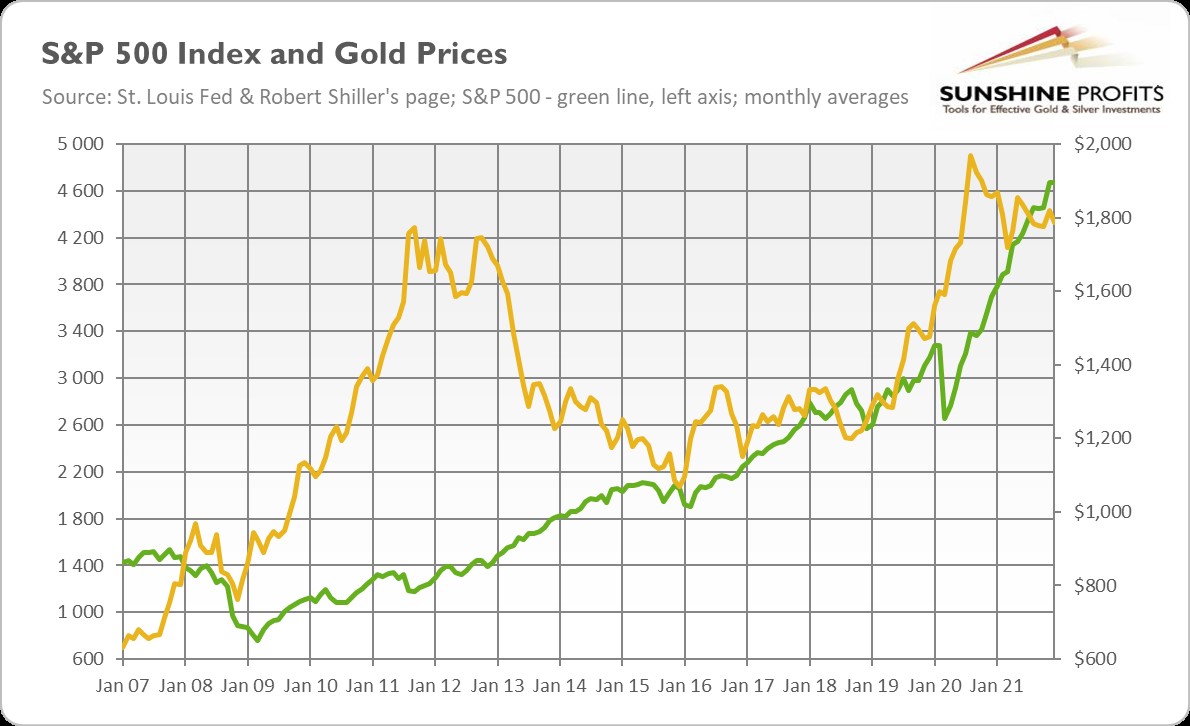

I got it, but how does it all relate to gold? Well, quite simply. Owning gold is a part of preparing for the worst. This is because gold is the store of value that appreciates when confidence in fiat money declines. It’s also a safe-haven asset, which shines during financial crises when asset prices generally decline. The best example may be the Great Recession or 2020 economic crisis when gold performed much better than the S&P 500 Index, as the chart below shows.

You can also think of gold as a portfolio insurance policy or a hedge against tail risks. A house fire is not very likely, but it’s generally smart to have insurance, you know, just in case. Similarly, the collapse of the financial markets and the great plunge of asset prices are not of great probability (although the Great Depression, late 2008, and early 2020 show that they are clearly possible), but it’s nice to have a portfolio diversifier that is not afraid of black swans.

In a sense, the whole issue boils down to individual responsibility. Do you take responsibility for your life and for being prepared for different scenarios, or do you count on other people, the government, or simply luck, magically thinking that everything always goes well? To be clear, being prepared doesn’t equal being pessimistic – it’s rather about being realistic and hoping for the best, but planning for the worst.

However, there are two important caveats to consider before exchanging all of your paper currency for gold coins. First, you shouldn’t conflate holding gold as insurance with gold as an investment asset. When you want protection, you’re not interested in price trends. There might be a bear market, but gold would still fulfill its hedging role. This is also why you shouldn’t own more than about 5-10% of your whole portfolio in precious metals (as insurance, you can invest more in gold as an investment or as a part of your trading strategy).

Second, don’t treat gold as a panacea for all possible disasters. It all depends on what you are preparing for. If you expect power outages, buy batteries, power banks, and think about alternate sources of energy. Precious metals won’t power your home. If you fear a zombie apocalypse (who doesn’t?), flamethrowers and rifles seem to be better weapons than gold bars (although large ones can serve quite well). If you can’t wait for a nuclear explosion (who can?), you will need a proper shelter with uncontaminated food rather than shiny metal (pun intended). It’s possible that in such a post-apocalyptic world, people would initially return to a commodity-based standard rather than the gold standard. It all depends on the particular conditions and how deeply the civilization would devolve.

Hence, don’t be scared by dodgy people and false advertising into buying gold because of imminent hyperinflation, the total collapse of the financial system, nuclear greetings from Kim Jong-Un, or another calamity. The role of gold is not to rescue you from all kinds of troubles, but to be insurance that pays off during economic crises.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

*********