Should We Worry About The Yield Curve?

One of the hottest issues among economists and financial analysts is the yield curve. Investors worry that it is likely to invert soon, bringing the current expansion to an end. And even the FOMC member discussed “what a flattening of the yield curve might signal about economic activity going forward” in their meeting in June. Are these fears – or gold bulls’ hopes – justified?

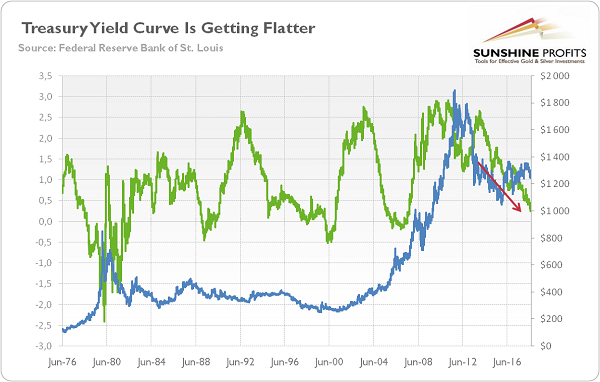

We have covered this topic many times (see this and this article), but as our Readers are interested in the matter, we are returning to it to provide some fresh thoughts. Let’s analyze the chart below. It shows the yield curve, calculated as the spread between 10-Year and 2-Year Treasury yields. As one can see, the yield curve has steadily narrowed since 2014. It has already declined below 0.3 percent, the narrowest level since summer 2007.

Chart 1: Yield curve (green line, left axis, spread between 10-year and 2-year Treasury yields) and the price of gold (blue line, right axis, in $) from June 1976 to July 2018.

Why is that? Well, when the yield curve gets flatter, it means that the difference between long-term and short-term rates narrows. It can be a signal of possible economic weakness, as the long end of the curve should be significantly higher than the short end. You see, in theory, the interest rate on the long-term bond should be the average of the short-term interest rates that people expect to occur over the bond maturity. So if the long-term rates are low, it means that people expect low short-term rates in the future, implying possibly the anticipation of the economic slowdown. And higher short-term interest rates do not help the business. When the Fed hikes the short-term rates, it does it to prevent inflation and overheating. The economy slows down. Actually, most of the Fed hike cycles put the economy into a recession.

Indeed, this theory works exceptionally well in practice. We mean here the fact that the inverted yield curve – and we are just about 25-30 basis point from the inversion – often preceded recessions in the past.

However, the precedence does not mean causality. Inverted curve is rather a coincident indicator than a causal factor. Historically speaking, the inversion did signal recession, but not always and with a couple of false alarms. It’s just another correlation without a clear story of causation. Investors should also be aware that there have only been five recessions since 1976, when data series about the yield curve starts, so it is rather difficult to draw certain conclusions from such few observations.

But the most important point is that the current tightening cycle may be very different, given the unprecedented central bank’s actions since the Great Recession. Why is it so important? Well, because of the quantitative easing and other nonstandard measures, the yield curve is much flatter than it normally would be at this stage of the business cycle (most estimates suggest the order of about 50 basis points). Hence, because of the Fed’s unconventional monetary policy, the yield curve is a much less powerful signal that it has been in the past.

Moreover, although the Fed is raising rates, is not yet tightening. The monetary policy is still accommodative, while the financial conditions remain easy. And real economy indicators, such as business capital spending, remain healthy. Hence, it’s too early to call the end of the business cycle. We exceptionally agree with several FOMC participants that “yield curve movements should be interpreted within the broader context of financial conditions and the outlook”. Precious metals investors should remember about that.

What does it all mean for the gold market? Well, as the US economy is in the late stage of the business cycle, investors are nervous and they look for signs of recession. This is why the yield curve, and its possible inversion, attracts so much attention. It’s certainly possible that it could signal the upcoming economic problems, but we do not see the confirmation of troubles in other pieces of data. And it wouldn’t say anything about the timing of recession.

Hence, gold investors should not base their investment decisions based on the yield curve. Its predictive power has weakened due to the central banks’ intervention in the economy. And there is no clear relationship between the Treasury yield curve and the price of gold (see the chart above). Actually, the steepening of the yield curve could be much more problematic, as the long-term would have to be much higher – at levels the economy couldn’t handle because of its excessive indebtedness. Therefore, many gold investors are currently looking in the wrong direction.

Arkadiusz Sieron

Sunshine Profits - Free Gold Analysis

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.