Stock Market And Gold ETF Tactics

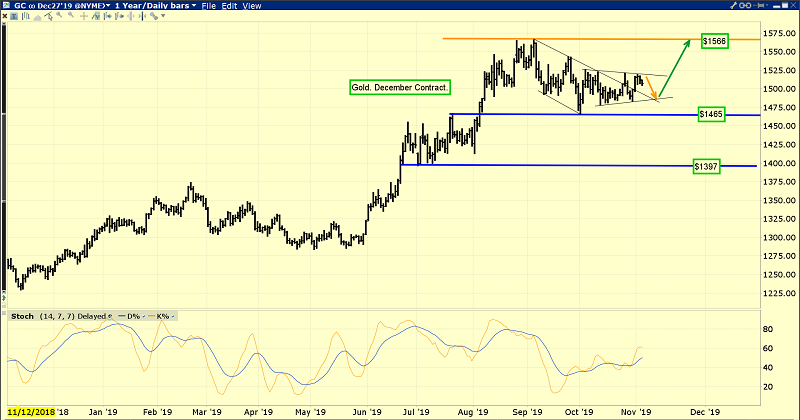

Gold continues to consolidate with sideways price action after reaching the $1500-$1550 resistance zone.

Investor patience is required when the price arrives at a major support or resistance zone like $1500-$1550.

The good news is that for the current gold market reaction, this patience can be measured in terms of months rather than years.

The massive bull patterns on this weekly chart suggest gold will be the world’s top performing asset for the next several decades.

In the medium term, the $1465 and $1397 support zones should be the main areas of focus for investor buying.

I’ve suggested that a close over $1525 should produce a fast surge to the $1566 resistance zone.

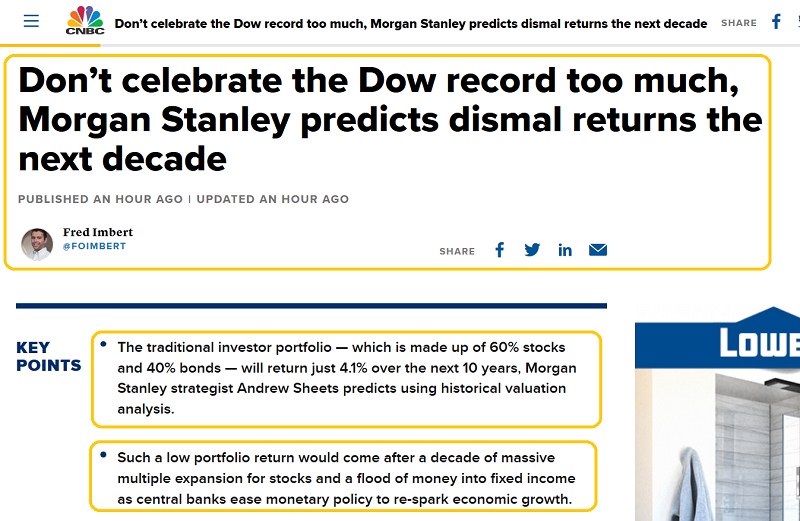

Excessive optimism by stock market investors is common at all market highs, especially late in the business cycle.

This time is no different. Trump is pro-business, but America lacks the demographics to produce the 1950s or 1880s type of economy that nostalgic investors want to see.

For the next decade, Morgan Stanley predicts about 4% annual gains for a typical stock and bond portfolio.

From a performance standpoint, that prediction is in sync with my suggestion that America is at a time somewhat like 1966; inflation begins to appear, growth stagnates, and gold stocks rally solidly higher for the next 10 to 15 years.

In the 1970s, an oil price shock added to inflation in a big way.

In the current market, oil is unlikely to spike higher because of a supply shortage. A glut of oil and a stagnant price related to failing global demand is my preferred oil market scenario.

This time, the coming inflation is likely to be caused by global government debt.

Ominously, QE has reached the endpoint of its ability to stimulate the real economy. It’s only function now is to keep the stock market and government bond market from collapsing. As a tool, QE is becoming more inflationary than deflationary. This transition is slow but relentless.

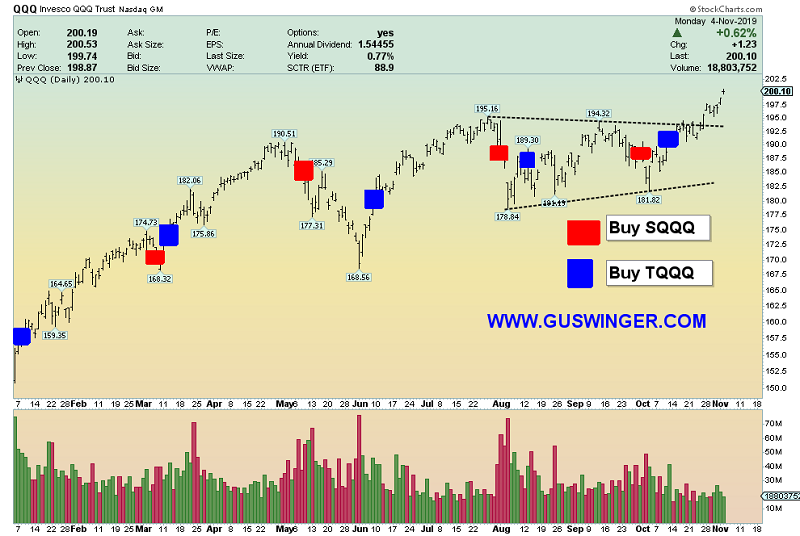

The Nasdaq index ETF chart.

Whether the US stock market goes higher, lower or sideways, my www.guswinger.com swing trades provide a simple approach to make large potential profits with limited drawdowns.

The current buy signal has been a gravy train for traders. I added money to my Nasdaq trading account on Friday, based on the profitable action!

The stock market tends to trend well in the November-December period, and this year the trend appears to be to the upside.

Regardless, the miners are where most investors should have their focus.

Frank Holmes’ GOAU ETF has performed solidly during this gold price consolidation. Volume has surged on rallies and subsided on declines.

That’s the sign of a very healthy market!

I outlined the $15.50 area as a key buy zone, with an optional stoploss just under $15. This trade is looking quite good already, and a close above $16.50 targets the $18 highs.

A move over $18 targets the $21 zone. The GOAU ETF, and most of its component stocks, should perform incredibly well over the next 10 to 15 years.

I recommend owning both GDX and GOAU. That’s because GDX tends to have less drawdowns on gold price reactions, and GOAU is the clear outperformer on the big rallies!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Juniors With The Juice!” report. I highlight buy and sell points for six junior miners that are blasting higher while the rest of the sector consolidates.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: