Stocks Forecast For 2014

No one knows with absolute certainty, but IMHO it is ludicrous to be long Wall Street stocks in this volatile environment. There are three compelling factors that force this analyst to be adamant in warning investors today of the looming danger of a sharp correction in U.S. stocks this year. These irrefutable bearish factors are:

No one knows with absolute certainty, but IMHO it is ludicrous to be long Wall Street stocks in this volatile environment. There are three compelling factors that force this analyst to be adamant in warning investors today of the looming danger of a sharp correction in U.S. stocks this year. These irrefutable bearish factors are:

- Technical Analysis demonstrates stocks are grossly over-extended (ie over-valued)

- NYSE Margin Debt is at an all-time record high

- Ukraine/Russian tension can only worsen from here

Technical Analysis demonstrates stocks are grossly over-extended

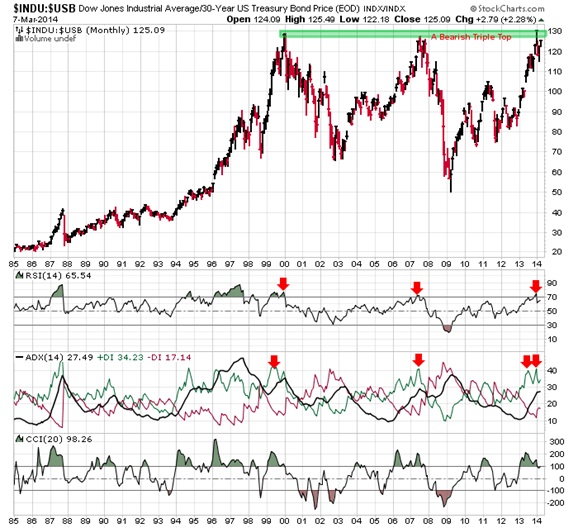

An ominous bearish Triple Top has formed in Dow/T-Bond ratio. In early 2000 the Dow/T-Bond ratio peaked, triggering the beginning of a bear market in Wall Street stocks...that last more than two years.

Again in mid-2007 the Dow/T-Bond ratio peaked, which was open door rampage of a devastating bear market in stocks where the Dow lost about -54%. This bear market lasted 20 months.

FAST FORWARD early February 2014: Yet again the Dow/T-Bond ratio has peaked.

Moreover, all the TA indicators are RED NEGATIVE -- as they were in 2000 and in 2007.

This begs the question: WHEN are the big bad bears going to storm out of their lairs?

No one knows with absolute certainty, but IMHO it is ludicrous to be long Wall Street stocks in this environment.

FURTHERMORE, today’s Dow Index brandishes a Bearish Rising Wedge

he writing is on the Wall (Street): A STOCK CRASH LOOMS

NYSE Margin Debt is at an all-time record high

To be sure there are numerous ominous signs and bear fundamental factors that forecast an imminent stock market crash in Wall Street. However, the most compelling STOCKS’ SELL SIGNAL is the all-time high level of NYSE Margin Debt. These graphs clear show this:

https://www.gold-eagle.com/editorials_12/images/droke051013-1.jpg

https://www.gold-eagle.com/sites/default/files/vronsky123013-10.jpg

https://www.gold-eagle.com/sites/default/files/vronsky112513-2.jpg

https://www.gold-eagle.com/sites/default/files/vronsky112513-3.jpg

https://www.gold-eagle.com/sites/default/files/lombardi120313-1.jpg

https://www.gold-eagle.com/sites/default/files/miller030414-2.jpg

Ukraine/Russian tension can only worsen from here

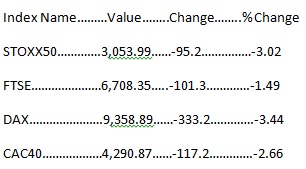

A valid indication of what might occur in the future is what happened on March 3rd at the height of the recent Crimea Crisis. Here’s how European stocks closed on March 3, 2014:

On the same day Russia's Stock Index (MICEX) tumbled -11%.

Gold spikes as investors seek safe haven when Russian military is on the prowl. Geo-political unrest in Europe caused gold to spiral upward $24 to $1344 in the same day…as Russian troops poured into the Crimea of Ukraine.

In light of the current Ukraine turmoil, it is apropos to review history:

Growing Geo-Political Tensions in Europe (Russian vs Ukraine) have NOT ended. This will continue on through the summer months when military operations are more plausible due to better weather conditions for invasion.

History is testament that Russian Aggression will foster extreme volatility in all markets.

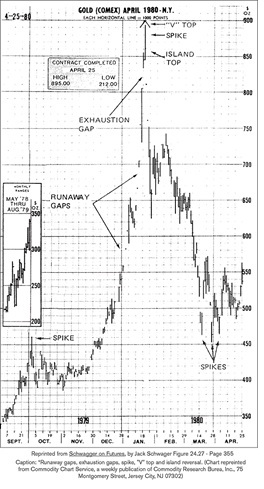

A siimilar situation occurred in the late 1970s when Russian troops invaded Afghanistan, gold went ballistic. In December 1979, in the midst of the Cold War, the Soviet 40th Army invaded Afghanistan in order to prop up the communist government of the People's Democratic Party of Afghanistan (PDPA) against a growing insurgency. Consequently, the price of gold went ballistic, soaring +98% in just 7 weeks ($430 to $850 intra-day – London). Correspondingly, the price of silver went viral up +163% in the same time period ($19 to $50 intra-day). During the same brief crucial geo-political period, the Dow Stock Index plummeted -15% from 898 to 763. And if that weren’t enough damage, US T-Bonds were hammered down -20%, the price in free-fall from 82 to 66…as the then President Jimmy Carter was wringing his hands in his feeble foreign policy confusion and desperation in the White House. The reaction to Geo-Political turmoil in the future way cause gold to go viral to levels unimaginable by most reasonable analysts.

A siimilar situation occurred in the late 1970s when Russian troops invaded Afghanistan, gold went ballistic. In December 1979, in the midst of the Cold War, the Soviet 40th Army invaded Afghanistan in order to prop up the communist government of the People's Democratic Party of Afghanistan (PDPA) against a growing insurgency. Consequently, the price of gold went ballistic, soaring +98% in just 7 weeks ($430 to $850 intra-day – London). Correspondingly, the price of silver went viral up +163% in the same time period ($19 to $50 intra-day). During the same brief crucial geo-political period, the Dow Stock Index plummeted -15% from 898 to 763. And if that weren’t enough damage, US T-Bonds were hammered down -20%, the price in free-fall from 82 to 66…as the then President Jimmy Carter was wringing his hands in his feeble foreign policy confusion and desperation in the White House. The reaction to Geo-Political turmoil in the future way cause gold to go viral to levels unimaginable by most reasonable analysts.

The same could possibly happen again in 2014 vis-à-vis Russian tenacity in war and penchant for domination…as it is steeped in the soviet culture since the Stalin era. Not surprisingly, Washington’s myopic view on the subject is “interesting” at best.

IN SUMMARY

The 2000 Sell Signal saw the DOW Index fall -39% during the succeeding 34 months. And the 2007 Sell Signal witnessed the DOW Index fall -54% during the next 16 months. Today we again see a Sell Signal (USB/INDU). And if we assume the DOW Index is indeed peaking, and that the subsequent stocks bear market might replicate the average decline of the last two bear markets in magnitude and time duration, then the DOW Index could conceivably drop to 9000 in the not too distant future.

The upshot is that the Raging Stocks Bull during the past five years has turned into an Aging Stocks Bull, which will eventually birth a Stocks Bear Market. Stock Cycles are immutable, only duration and magnitude vary.

Related Bear Market Articles:

2014…Déjà vu 1987

https://www.gold-eagle.com/article/2014%E2%80%A6d%C3%A9j%C3%A0-vu-1987

2014…Déjà vu 2000 & 2008 ?

https://www.gold-eagle.com/article/2014%E2%80%A6d%C3%A9j%C3%A0-vu-2000-2008

Ides Of March 2014

https://www.gold-eagle.com/article/ides-march-2014

Stocks Are Hell Bent To Suffer A Sharp Correction In 2014

https://www.gold-eagle.com/article/stocks-are-hell-bent-suffer-sharp-corr...