Suspicious Strength In The Miners: More Signs Emerging

Just like it was the case on Monday, gold and silver haven’t done much yesterday either, but we saw some interesting action in the miners – they formed a bullish reversal after testing the rising support line. The performance of the USD Index provides us with clues as well. It declined and this should have triggered a move higher in the metals and miners. It didn’t. What really happened?

Let’s start with the miners.

Gold Miners’ Short-term Reversal

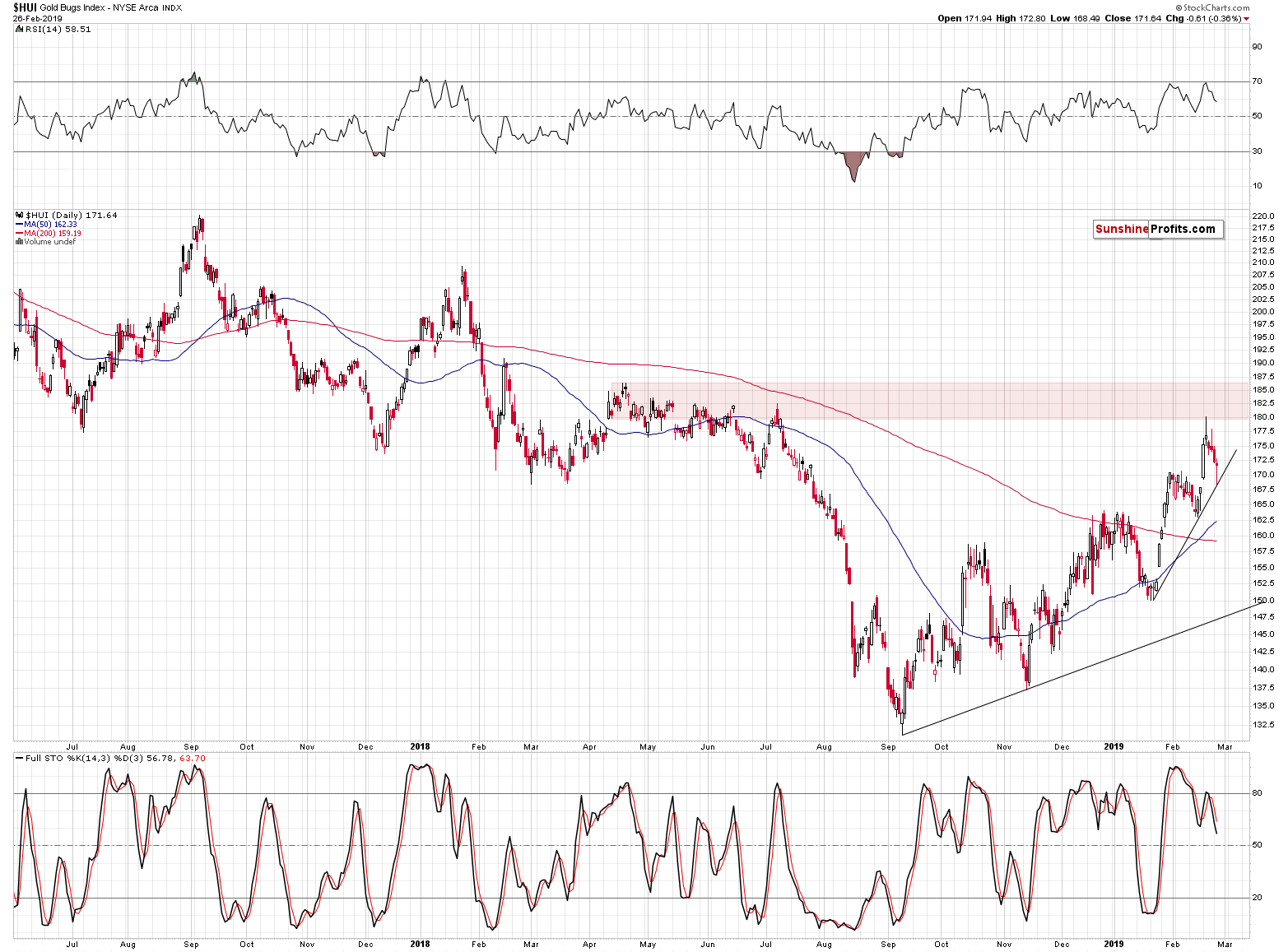

Just when it started to appear like the mining stocks are going to break below their January high and below the rising support line, they reversed their course. In mid-February, when gold stocks moved to their previous (early January) high and then moved back up, it was the local bottom and a start of the next quick upswing. The natural question is if we are about to see the same thing once again.

As always, there are no sure bets in any market, but it does appear likely based on the above chart alone. We see the sell signal from the daily Stochastic indicator, but we saw it also many times in the previous weeks, including the mid-February case, and miners moved higher nonetheless. Consequently, it doesn’t seem that the daily version of this indicator alone can really be trusted. Naturally, this doesn’t change the very important and bearish medium-term implications of the weekly Stochastics.

There’s one very important difference between now and the middle of February that needs to be taken into account and that practically nullifies the bullish implications of the above.

The Hidden Power of the USD Index

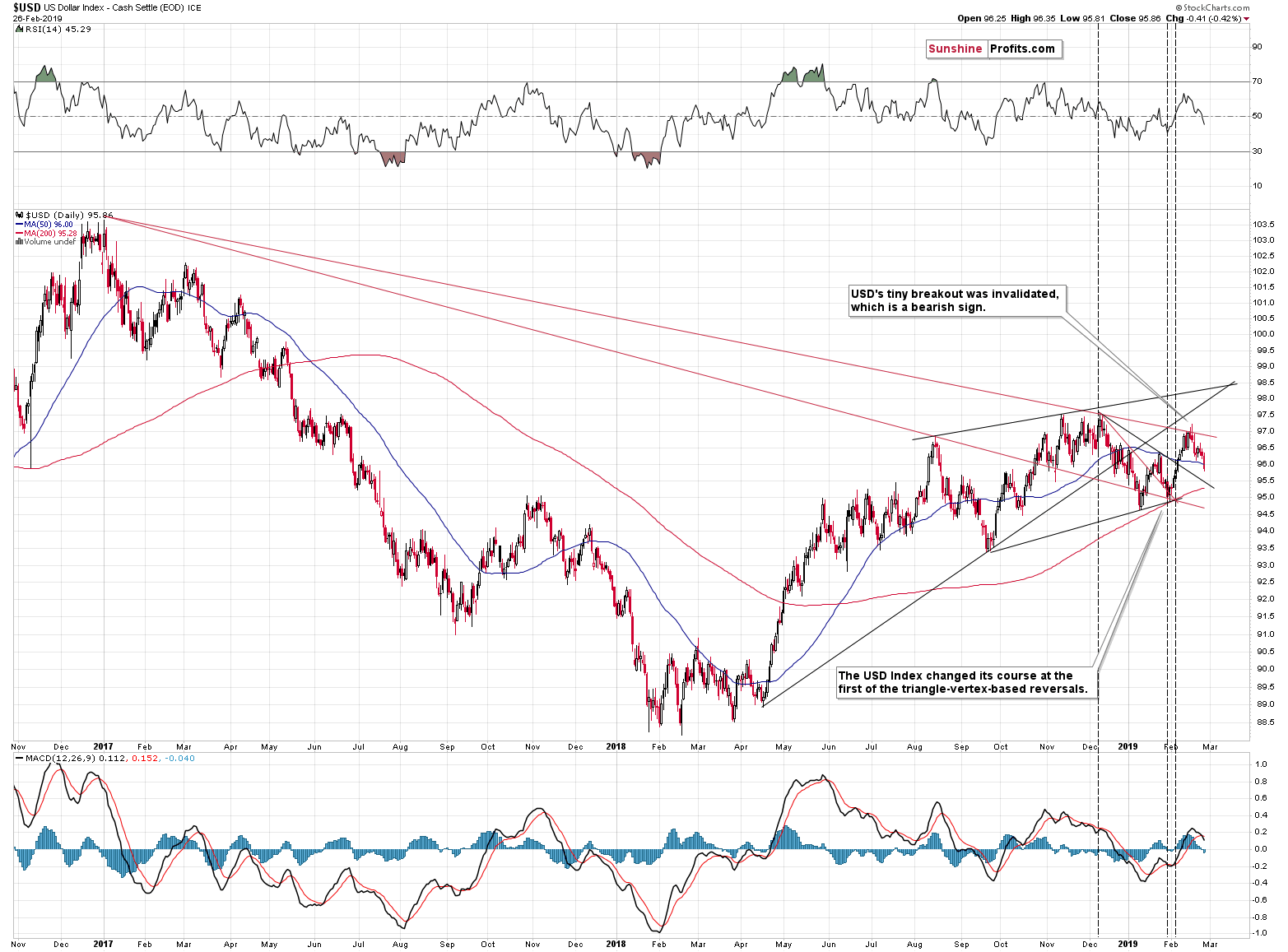

The USD Index was rallying when miners moved lower in mid-February and it topped at that time, which triggered a rally in the precious metals sector. Right now, instead of rallying, the USD Index is after a decline and quite likely to form another local bottom soon. This is not what we saw in mid-February – it’s the opposite thereof.

The intraday performance looks like the miners really wanted to move and break lower, but the declining USD Index simply didn’t let them do so.

And the USDX itself? It may simply be verifying the breakout above the declining short-term support line that we marked with black. In early February it verified an analogous – red – line and bottomed right there.

Let’s not miss the forest while discussing the trees.

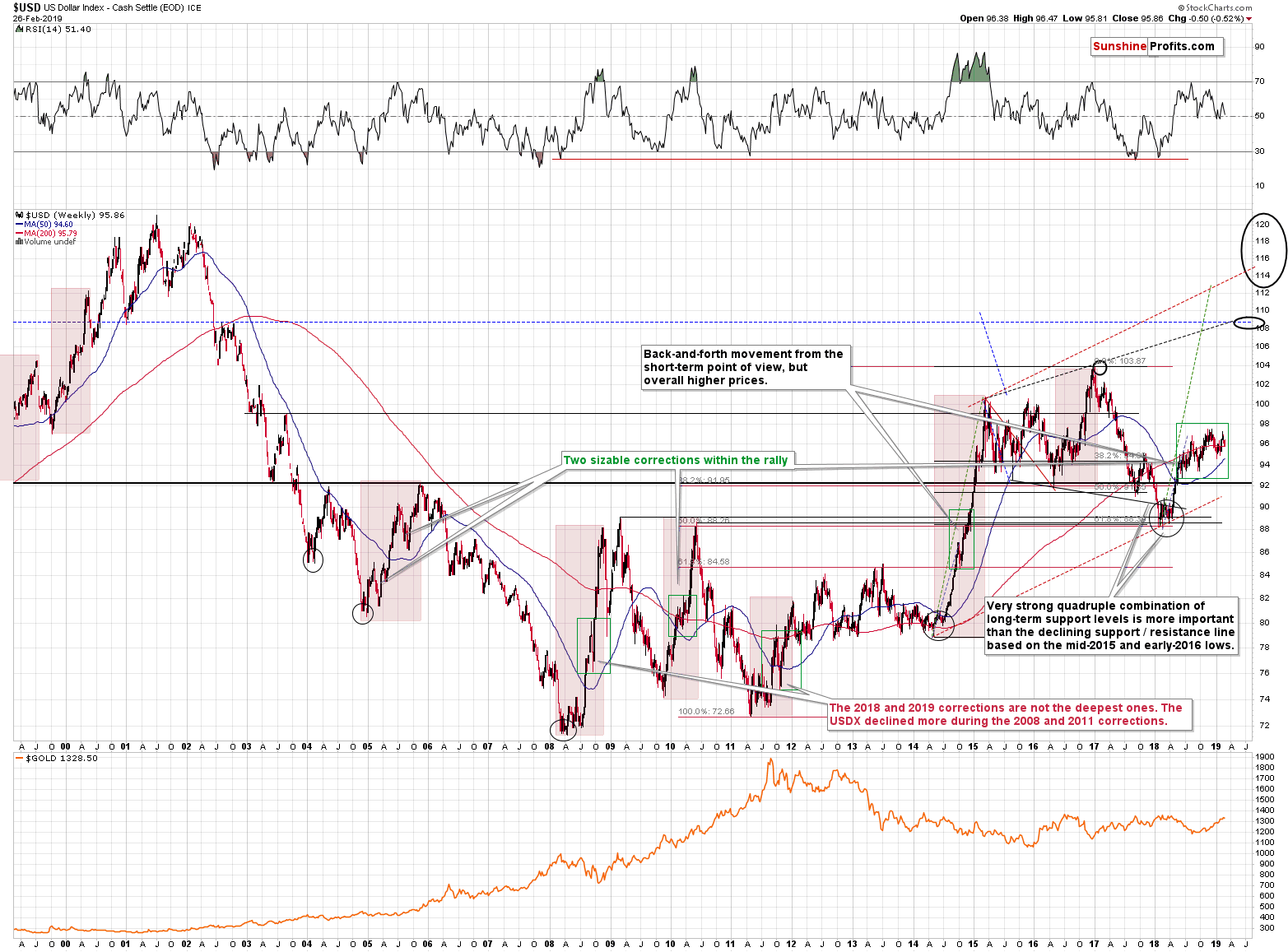

The USD Index is in a medium-term rally and the last couple of months have been a corrective stage of the move. Such corrections are normal in any bigger upswing, and their shape can tell us something about the strength thereof. The fact that the USDX moved higher on average even though it moved sideways from the short-term point of view (forming higher lows and higher highs), attests to the strength of the bulls. Please note that even the Fed’s recent dovish comments didn’t trigger any sizable move lower.

Consequently, the big picture for the USD Index remains bullish, and the short-term picture shows that the USDX may reverse quite soon (the declining short-term support line is at about 95.5). Miners’ reaction to USD’s action also suggests that the precious metals market doesn’t really want to move higher anymore, but that it’s instead ready to resume its medium-term downtrend.

The Many Perspectives of the Gold-USD Correlation

We have recently received one subscriber’s input in the form of a shared article link that discusses the gold-USD correlation. The article aimed to say that gold is bucking is long-term correlation to the dollar and that therefore the gold-dollar link is breaking down as the title boldly claimed. Indeed, the fact is that both gold and USD Index are now higher than they were more than three months ago. In the part of implications for gold, the article summarizes that although it’s generally assumed that this is bullish for gold going forward, gold’s gains since that occurrence weren’t much better than random.

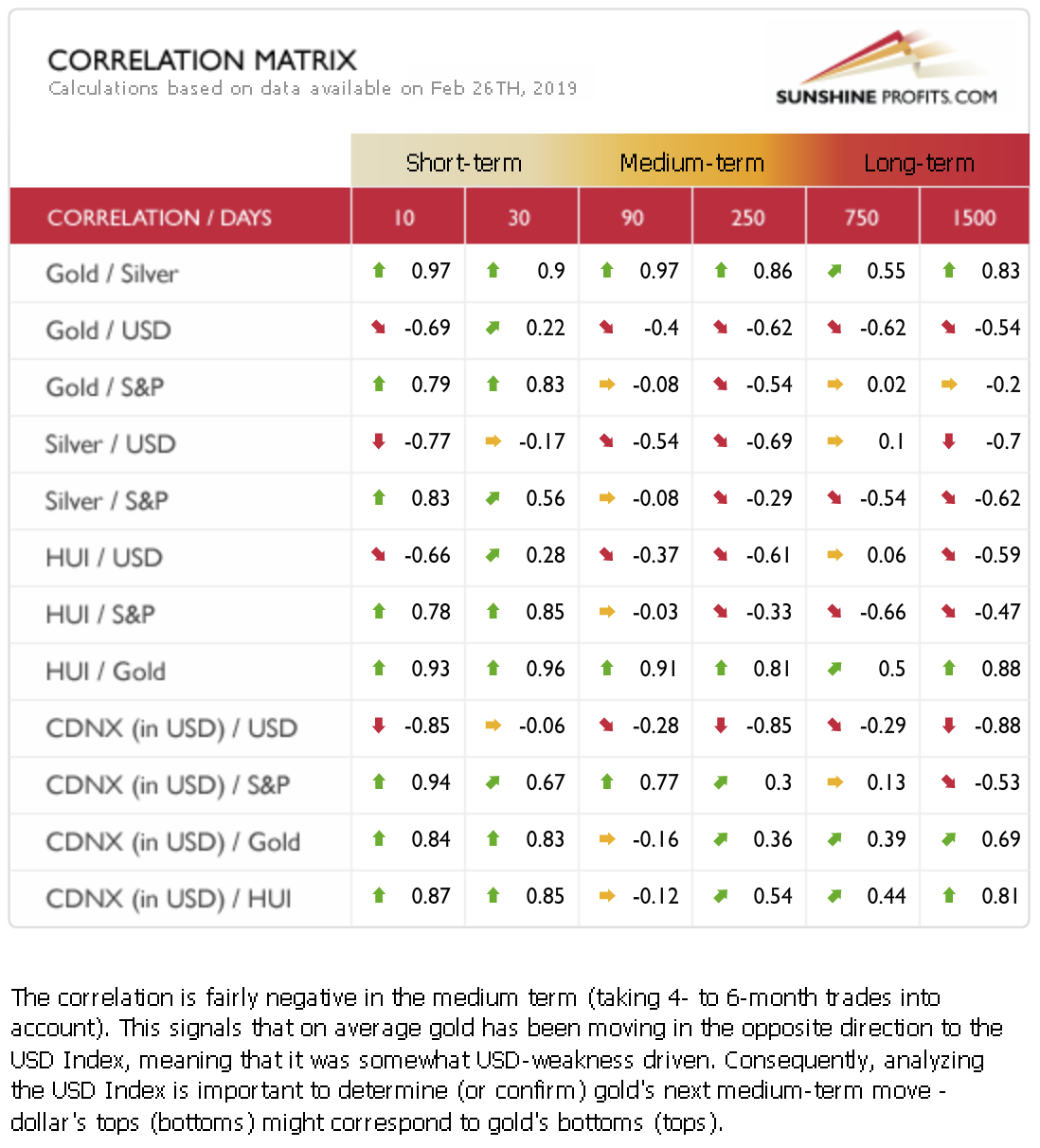

We would like to build on this contribution and provide our perspective. We’ll start by sharing a peek into our in-house developed, proprietary CORRELATION MIX. Let’s take a look at several timeframes that explore the gold-USD link as it stands on Feb 27th, 2019:

There are several aspects to reading this tool properly. First, it’s that the shorter the perspective, the more varied readings we get. This concerns mainly the 10-day perspective where the values’ range of mildly negative to strongly negative can change significantly over a few days. This is also valid for the 30-day perspective to a certain extent.

Moving to the medium-term, both the 90-day and 250-day windows provide a more stable panel of readings that we can base our actions on more confidently. The negative value of the gold-USD correlation increases over time, which in other words means that a breakout in USD Index gets caught up to by such a decline in gold that corresponds more closely to the USD breakout over time. Even more briefly said, gold tends to catch up to the USD Index movements more closely over time. This is further supported by the gold-USD effect carryover into the long-term period.

It’s also important to note that the correlation coefficient values evolve over time. It depends on the context of market situation both within gold and USD. It’s however most relevant to judge the current situation through the optics of the current strength and direction of the correlation coefficient and look for support to our decisions in the medium-term universe as that is both stable and relevant enough to taking calculated decisions. It still says that gold is likely to catch up to the downside (and do so more as time passes by) to strengthening USD.

In other words, if it wasn’t for the medium-term uptrend in the USD Index, the implications of the short-term correlation values might be viewed as neutral for gold, but in light of the big USD move that appear to be just around the corner, the short-term link is not as important as the medium-term one. And the latter suggest that gold is likely to catch up with the USDX, by moving substantially lower.

Summary

We have just shown you why it wouldn't be wise to take yesterday's show of strength in the miners at face value. The important distinction between their situation today and a similar one from the middle of February is the state of the USD Index. The USD Index remains in a medium-term uptrend while its short-term examination shows that it may actually reverse higher pretty soon. It seems that the precious metals market doesn't really want to move higher in earnest and is instead waiting for USD-induced cues as a catalyst for its next move. That is, for its medium-term decline resumption.

We hope you enjoyed today’s analysis, and we encourage you to sign up for our free newsletter. You’ll be updated on our free articles on a daily basis, and you’ll get access to our premium Gold & Silver Trading Alerts for the first 7 days as a starting bonus. And yes, it’s free. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,