SWOT Analysis: Wage Growth Could Push Inflation Expectations Up Creating A Tailwind For Gold

Strengths

Gold futures headed for the biggest gain since June after the U.S. September jobs report came in lighter than expected on Friday, 214,000 vs. 230,000 forecasts. The jobs report supported ongoing speculation that the Federal Reserve will continue to hold interest rates low amid tepid global growth.

One-month gold lease rates in London, the cost to borrow bullion, soared to 0.3405 percent on Thursday vs. 0.001 percent in September, reaching a high not seen since December 2008. Reasons cited for the rate upswing ranged from supply/demand imbalances to borrowing by traders in order to short the metal.

The U.S. Mint has temporarily run out of American Eagle Silver coins after October sales jumped 40 percent to 5.79 million ounces from a month earlier.

Weaknesses

Lower oil prices create a headwind for gold as inflation expectations are pushed down. This reduces the inflation hedge demand for the metal.

Holdings in the SPDR Gold Trust slid 0.3 percent to 738.8 metric tons on Tuesday to the lowest amount since September 2008. A confluence of factors has influenced the flight from the metal held my some investors as a safe haven. First, there is a mistakenly held notion in the markets that gold is one of the most volatile asset classes. In actuality, the return on equities as measured by the S&P 500 is typically twice as volatile as the return on gold bullion. Second, low gold prices have prompted some investment advisors to recommend a zero allocation to gold. Third, new highs in the equity market continue to increase investor appetite for risk assets.

There was a selloff in gold stocks amid a broad based de-rating in the gold sector. The selloff brought a slew of gold miners near to, or below, decade lows. Among them were Barrick, Goldcorp, Newmont, Kinross and Yamana.

Opportunities

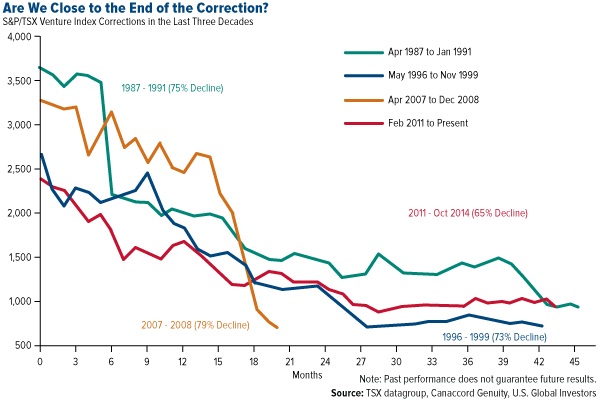

Canaccord Genuity came out with a study looking at the four major S&P/TSX Venture Composite Index corrections in the last three decades. The TSX Venture index is considered a good proxy for small cap gold stocks. The study found the current correction, at 43 months, the second longest as compared to the 45-month correction between April 1987 and January 1991. The study also showed the best three months to gain exposure to gold has historically been December, January, and February. With the authors believing the end to the correction could be nearing, the next couple of months could provide an attractive entry point into gold equities.

The World Gold Council forecast in September that gold demand in China will rise 20 percent in three years. Additionally, Standard Chartered called for a $1,100 price floor, citing firming physical demand indicators out of China and India.

Wage growth could push inflation expectations up creating a tailwind for gold. BCA’s U.S. Wage Tracker suggests that the underlying trend in wages has indeed increased this year. Various states such as Alaska, Arkansas, Nebraska, and South Dakota have already voted in favor of measures raising the minimum wage. Furthermore, Tuesday’s elections results showed that voters from across the political spectrum support increasing the minimum wage.

Threats

A slew of negative forecasts have cast a cloud over the direction of gold prices. ABN Amro NV forecast a year-end price of $1,100 an ounce, sliding to $800 by year-end 2015. An analyst at Oversea-Chinese Banking Corp. called for a further drop of at least 13 percent and a price that could go lower than $1,000. The UBS Economics team released its global economic forecast for 2015 and 2016 and the outlook for gold was also negative. Reasons cited included weaker China growth, a faster than expected rate hike by the Fed, and a strong U.S. dollar fueled by a capital expenditure led boom.

Clean Diesel Technologies announced a new proprietary technology to replace costly use of platinum group and rare earth metals in catalytic converters. The company has been granted the first two of a family of patents for Spinel, a proprietary clean emissions exhaust technology. With original equipment manufacturers (OEMs) currently spending over $6 billion a year on platinum group metals, the technology could create major disruption in the commodities’ demand if the patents take off.

Looming gold reserve cuts threatens write-downs for gold miners. If gold prices stay low, gold miners will be forced to lower their reserve price assumptions, leading to write-downs. B2Gold is especially vulnerable as its 2013 reserve assumption stands at $1,350 an ounce.

********

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of