Take a Peek At What The Top 1 Percent Have In Savings

You’ve likely seen the reports: A whopping 44 percent of Americans wouldn’t be able to afford a $400 emergency expense without borrowing it or selling something. That’s according to the Federal Reserve’s findings in 2017. And earlier this year, financial services firm Bankrate reported that only 39 percent of Americans would be able to pay off an unexpected expense of $1,000 from their savings alone.

These figures have long-term implications. When someone doesn’t have enough in their savings account to cover an unexpected $400 to $1,000 emergency, it raises questions about how prepared they are for retirement.

So how does your savings account stack up to the average American’s? How about the top 1 percent’s? And just as a reminder, the entry point to the highest of earnings brackets is “only” $480,930 a year, according to 2015 income tax data.

How Does Your Savings Account Stack Up?

Personal finance firm MagnifyMoney recently looked at how much Americans have in savings, based on income level. As of June 2018, the average U.S. household has $175,510 in savings, including bank and retirement accounts. Compare that to the average household in the top 1 percent, which has close to $2.5 million in savings.

These are averages, remember. If we look at medians, or the middle values of savings accounts, these numbers change dramatically. According to MagnifyMoney, the median American household has only $11,700 in the bank. This means that half of the approximately 126 million U.S. households have more than this, while the other half has less. The median top 1 percent savings account, by comparison, holds just under $1.2 million.

It’s clear that too few working-age Americans are preparing for retirement adequately, and many who are retired worry that they won’t be able to maintain the lifestyle they desire. According to the most recent Employee Benefit Research Institute (EBRI) survey on retirement confidence, only 32 percent of retirees—nearly a third—said they felt “very confident” in their ability to live comfortably during their years outside the workforce.

Not Your Father’s CDs

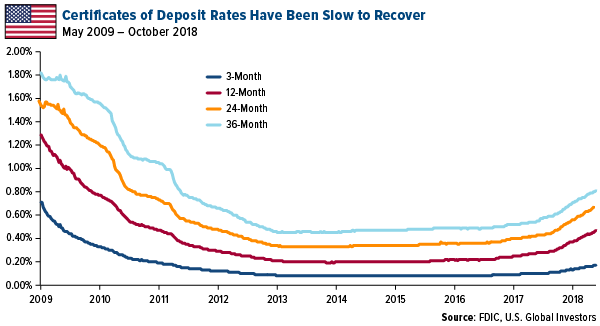

Besides not having enough in savings, many Americans aren’t doing enough to grow their wealth. Back when interest rates were close to 20 percent, thanks to former Federal Reserve Chairman Paul Volcker, yields on certificates of deposit (CDs) were attractive enough that many households favored them over riskier assets such as stocks.

Today, however, CDs—though protected by the Federal Deposit Insurance Corporation (FDIC)—just don’t yield enough to justify locking your money up for any period of time.

Now let’s take a look at the stock market. The S&P 500 Index is up almost 200 percent from 10 years ago. The compound annual growth rate (CAGR), then, is 11.6 percent. With dividends reinvested, the CAGR becomes 13.9 percent.

There’s a reason why Albert Einstein allegedly called compound interest the greatest invention in human history.

Too Few People Are Participating

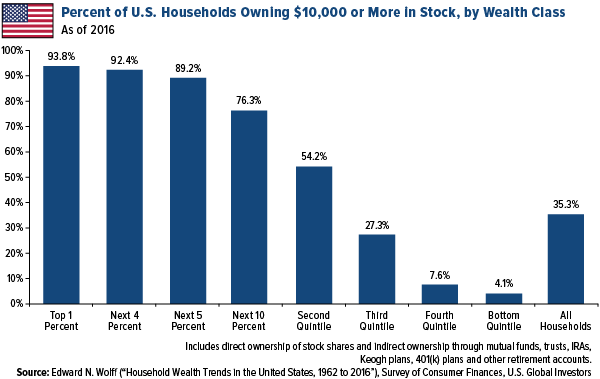

The problem is that too few Americans have participated in this bull market. Of the bottom half of U.S. earners, only about a third own stocks, according to Fed estimates. Perhaps not surprisingly, the more a household earns, the more likely it is to invest in the stock market.

Take a look at the chart above, based on data produced by American economist Edward Wolff. Of U.S. households that rank in the top 1 percent, nearly 94 percent own $10,000 or more in equities. From there, the ownership rate drops off. Less than 5 percent of the bottom 20 percent of earners have $10,000 or more invested in the stock market, either directly or indirectly. Only 35 percent of all American households do.

If you ask someone why they’re not invested, chances are they’ll say that it’s too risky. It’s easy to see why they might feel this way, especially after the huge selloff last week.

Stocks Have Been Up for the 10-Year Period

But when you have a long-term view—10 years or more, for instance—investing in the stock market looks very attractive. As my friend Marc Lichtenfeld put it during an interview back in August, stocks have historically been up for the 10-year period.

In fact, the only two times when stocks weren’t up for the 10-year period, according to Marc, were “the middle of the Great Depression and in 2008-2009 during the Great Recession. You would literally need to cash out in the middle of historic downturn not to make money over 10 years, and that’s if you sold right at the bottom. If you had waited another year or two, you might have come out at least breaking even, if not better.”

Cost is another reason some people aren’t invested—but it doesn’t have to be a barrier. With the ABC Investment Plan, investors can invest a fixed amount in a specific investment at regular intervals. The minimum investment with the ABC Investment Plan is just $1,000 initially and then $100 per month.

Learn more about the ABC Investment Plan by clicking here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The CD interest rate is typically fixed and payable on a set maturity date. The CD rate and principal are typically insured up to $250K.

The Retirement Confidence Survey (RCS) is the longest-running survey of its kind, measuring worker and retiree confidence about retirement, and is conducted by the Employee Benefit Research Institute (EBRI) and independent research firm Greenwald & Associates.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The ABC Investment Plan doesn’t assure a profit or protect against loss in a declining market. You should evaluate your ability to continue in such a program in view of the possibility that you may have to redeem fund shares in periods of declining share prices as well as in periods of rising prices.

*********

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of