US Jobs Report: Key Driver For Gold Price

While the December 31 selling in gold and gold stocks may have rattled gold bugs a bit, the fact is that gold begins 2017 in pretty good shape.

Big fundamental themes that weighed on the “ultimate asset” in 2016 appear ready to reverse and become supportive for higher price action.

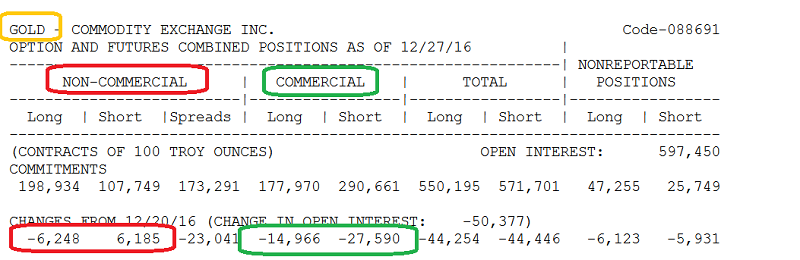

For much of 2016, the size of the commercial trader net short position was a headwind for gold.

That’s been reduced quite significantly in recent weeks

Leveraged hedge funds have also reduced their long positions. That’s healthy action because the funds use too much leverage. As a result, modest selling by the commercial traders creates margin calls for the funds, and gold community investors can feel pain too.

The bottom line is that in terms of the overall positioning on the COMEX, the gold market is in a much healthier position now.

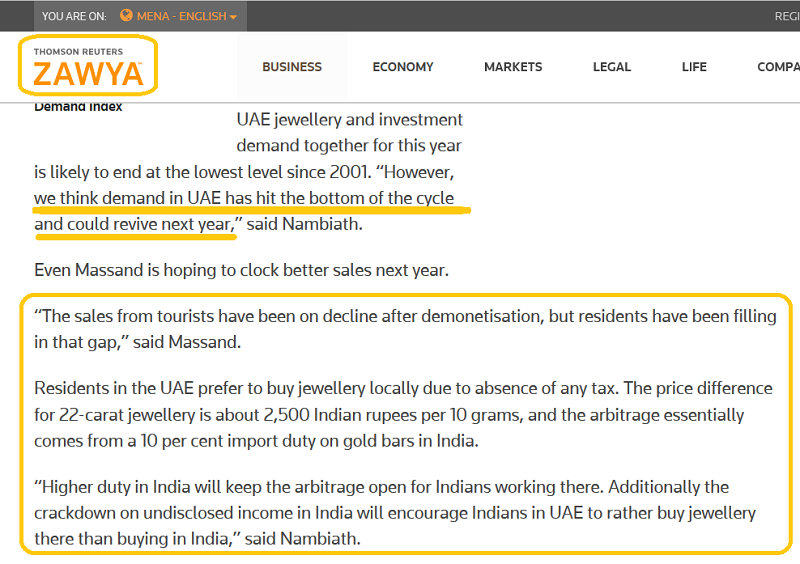

Top jewelers in Dubai are predicting that the gold jewellery demand cycle is bottoming, and 2017 will see both Indians and UAE residents buying with confidence. This is very good news.

Dubai is known as the “City of Gold”, and the Shanghai Gold Exchange is very active in building gold market infrastructure there. This partnership is likely to strengthen in 2017.

In the short term, gold has a rough general tendency to decline ahead of the US jobs report, and then rally after the report is released. The next report comes out this Friday.

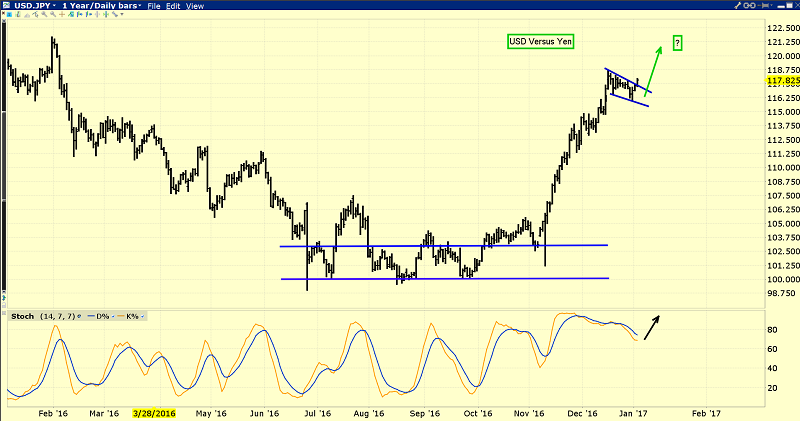

In the world of fiat currencies, the price action of the US dollar versus the yen has tremendous influence on the gold price.

There’s a pennant-like pattern in play on this daily chart, and a run to the 125 area looks likely.

In the big picture, though, there’s a major bull non-confirmation taking place. The dollar is making intermediate trend highs against the USDX index, but not against gold or the yen.

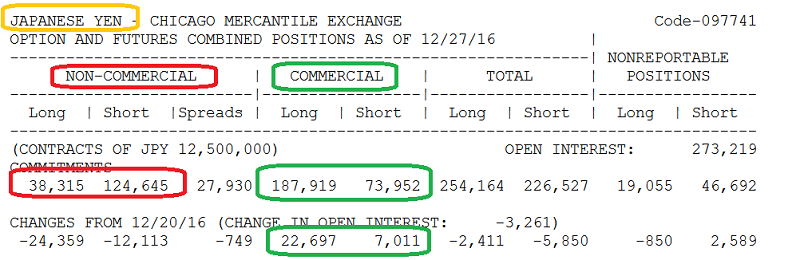

The commercial traders are buying the safe haven yen aggressively, while the leveraged funds are shorting it.

For the funds, this is a very dangerous situation, and one that could produce a violent move higher in the gold price at a time when that seems impossible.

The inauguration of Donald Trump on January 20 could also coincide with a price of 125 on the dollar versus yen chart. If so, the rally in the gold price of the past few weeks could be set to accelerate then, in a very big way.

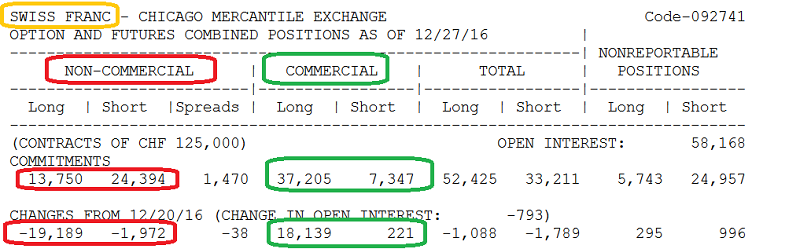

The franc is another safe haven currency, and its price action against the dollar has a high correlation with gold’s action against the dollar.

The commercial traders have an outstanding track record in both the gold and fiat currency markets. They are suddenly buying the Swiss franc against the dollar, and doing so very aggressively.

Gold bugs should pay attention to current commercial trader liquidity flows, which suggest that a major gold price rally is either imminent, or already underway!

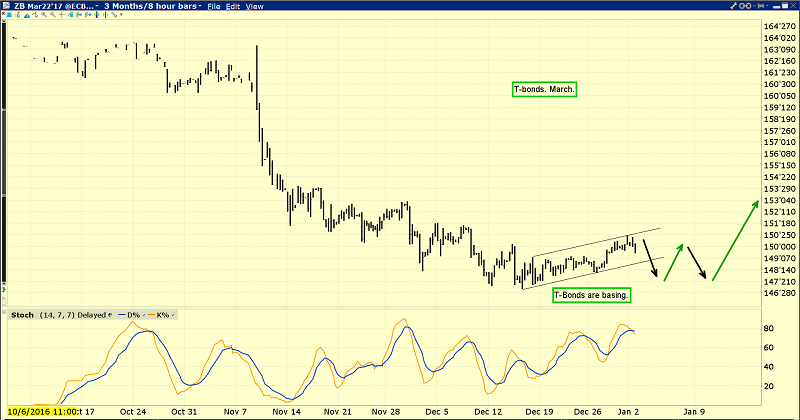

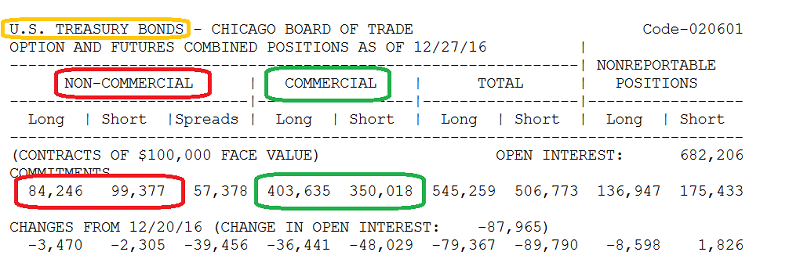

Another important correlation for gold investors to follow is the T-bond chart priced in US dollars.

The T-bond appears to be basing, and commercial traders have also been buyers recently.

The commercial “smart money” traders are now net long the T-bond. Do they have information that other traders are missing? Perhaps they have some insight into what will happen after Donald Trump gets inaugurated?

Regardless, they are clearly strong buyers of safe haven francs, yen, T-bonds, and decent buyers of gold.

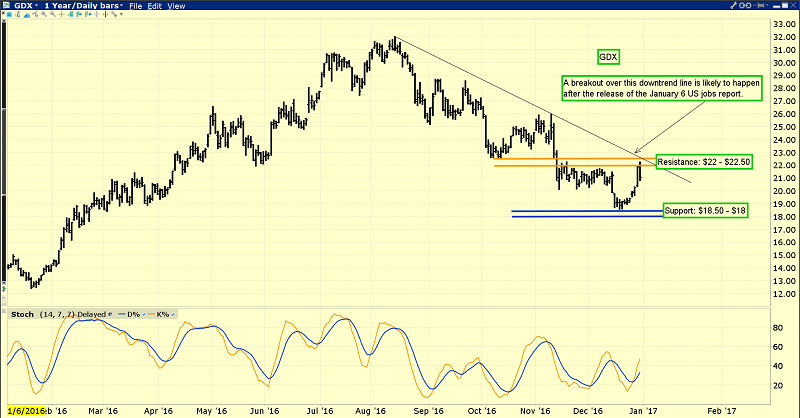

This is the GDX chart.

I’ve been pretty emphatic that the $18 area is for buying GDX and $22 is for selling. From both a technical and fundamental perspective, it’s logical that gold stocks pause here ahead of the US jobs report. This pause will help them launch a second and more successful assault on the $22 - $22.50 resistance zone, after the report is released!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Stocks Power Play” report. If an investor could only own six gold/silver stocks, which ones should they own? I cover ten candidates, and show investors my top six picks!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: