The US Stock Market And Gold: Robert Mugabe Rides Again?

The most disgusting form of socialism is of course…socialism for the rich.

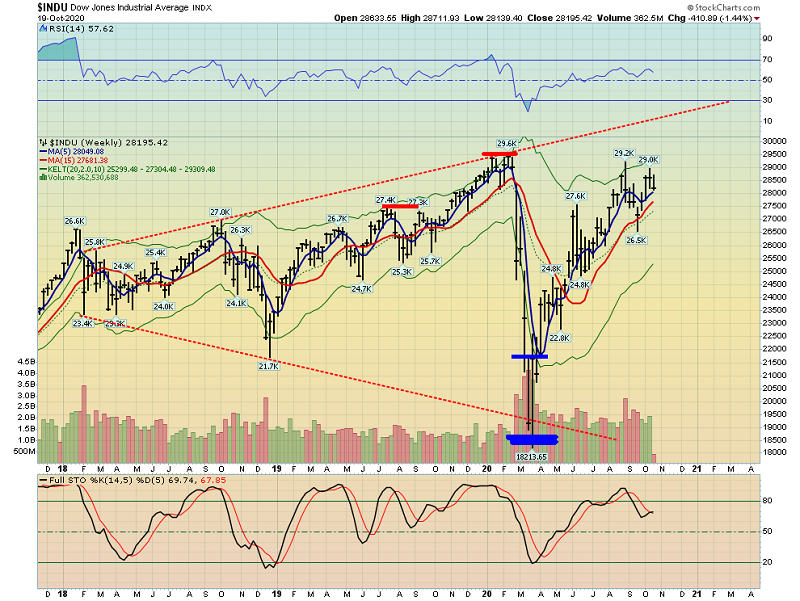

The “playground for the rich” US stock market chart.

There’s an enormous broadening formation in play, and that suggests a market that is out of control.

Stock market welfare has been in existence for hundreds of years, but the 2008 financial crisis was when it became truly enormous and permanent.

With the Dow down 400 points yesterday, US politicians raced forward to promise (again) that more borrowed and printed money to save the stock market welfare bums was imminent.

Having said that, investors should remember that the Zimbabwe stock market soared when Dictator Robert Mugabe ruled the nation.

Under Mugabe, the real economy suffered a massive depression while the fake economy (the stock market) soared relentlessly higher.

That’s because he was one of the biggest money printers in the history of the world.

It’s unlikely that money printing in America makes US stock market welfare bums as rich as it did in Zimbabwe, but since the lows of 2008 I’ve been adamant that investors could put some money in US stocks.

That’s based on the premise of money printing to infinity not just in the coming years, but in the coming decades.

Based on traditional forward-looking P/E (price to earnings) ratios, the US stock market can be considered overvalued.

Based on my forward-looking price to money printing ratios, the stock market is a roaring buy!

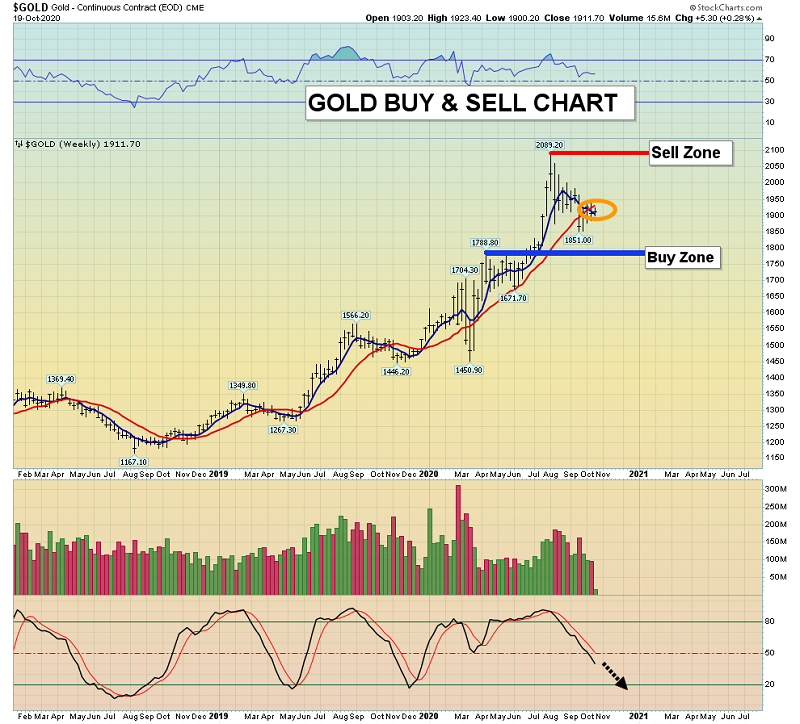

What about gold? The short-term gold chart.

A key third fan line breakout is in play, but the market is treading water as investors wait for the next tranche of borrowed money that the creep state calls “economic

stimulus for the mightiest economy of all time”. The weekly gold chart.

Unfortunately, there’s now a sell signal on the 5,15 moving average series and the 14,5,5 Stochastics oscillator is making a beeline lower.

The bottom line is that investors need to be prepared to see gold trade a bit lower and potentially approach my $1788 buy zone.

At first glance, this GDX chart doesn’t look very exciting, but investors can create their own excitement with good tactics!

It’s unknown whether gold actually reaches $1788 or not. Investors who are nervous about missing out can buy GDX now, based on the emerging pattern of higher minor trend lows and higher highs.

Stoploss enthusiasts can use $38 and/or $37 to buy now and protect themselves against a deeper reaction.

If there is no US election mayhem or fresh money printing, gold stock investors may need to wait until Chinese New Year physical market buying begins in December to launch the next big rally.

The GOAU chart.

Some mining stock ETF investors like GDX and others prefer GOAU. I like both! GOAU trades at about half the price of GDX and it can outperform GDX during major gold bullion rallies.

Stoploss fans can take note of the lows around $21.50 and $21 that I’ve highlighted on the chart. Investors who want to be a part of what could potentially become the most violent US election in history may want to cast a vote for gold, and place buy orders for some quality mining stocks right now!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Sweet Spot” report. I highlight key intermediate miners showing great relative strength, with key buy and sell tactics for each stock!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: