The USDJPY And The Price Of Gold

Well, we've finally reached "contract expiration" day as the Dec16 COMEX gold and silver contracts go off the board and into "delivery" at the close today. With total COMEX open interest now back to the levels of last December, could price finally be near a bottom? As usual, we must look at the USDJPY for clues.

As of last evening, total Dec16 COMEX gold open interest was down to just 30,773 contracts and about 50-60% of those will be liquidated and closed out today, leaving 10,000-15,000 "standing for delivery" when "delivery" notices begin being sent out this evening. Last December only saw a total of 2,073 gold "deliveries" so we'll likely be on pace again for something 5X or greater by the time "deliveries" wrap up at the end of the month.

Additionally, TOTAL COMEX gold open interest fell again yesterday to a meager 410,824 contracts. Check this out:

DATE PRICE TOTAL OI

11/25/15 $1072 393,110

12/31/15 $1065 415,220

7/11/16 $1364 657,776

11/28/16 $1191 410,824

So, do you see how this works? Taking their cues from a few key inputs, the HFT Specs buy COMEX paper gold exposure and price goes up. To limit the upside damage, The Banks issue new contracts in order to dilute the price impact of all this Spec buying. As the cues change and reverse, the HFT Specs liquidate their gold exposure and price declines. The Banks use this Spec selling to buy back their short positions and the open interest gets retired.

Have the supply/demand fundamentals of physical gold changed over the same time? Maybe just a little as sentiment and physical demand generally improve with a rising price. But by far the key determinant of "price" is the HFT Spec demand for the paper gold derivative, not the actual gold itself.

Some System Apologists will claim that this is efficient and smart...that the cost of acquiring, holding and storing real gold is too great and therefore these derivatives and synthetic forms of gold are preferable. NONSENSE! What I see instead is a Banker Profit Scheme and Confidence Game. The Banks create and manage nearly all of the forms of synthetic gold exposure available today, from futures contracts to unallocated accounts to the GLD, and because they have the power to create from thin air as much synthetic gold as "the market" demands, they also have the de facto power to control price. And they do.

So, OK then. It is what it is. As long as The Banks retain control, the only way you can get "the price of gold" to move higher is to move in your favor the key inputs which drive the buying decisions for synthetic or paper gold. And what are those key inputs?

- Forex...specifically the USDJPY

- In a larger sense, the US dollar as measured by the POSX

- And, as it's the US dollar gold price that we measure most, the general trend and level of US interest rates, particularly US interest rates adjusted for inflation or "real" rates

That's it. It's those three. Get all of those three working in your favor as we did in the first half of 2016 and you get a 30% rally. However, when all of these turn against you as they have since late September, WATCH OUT!

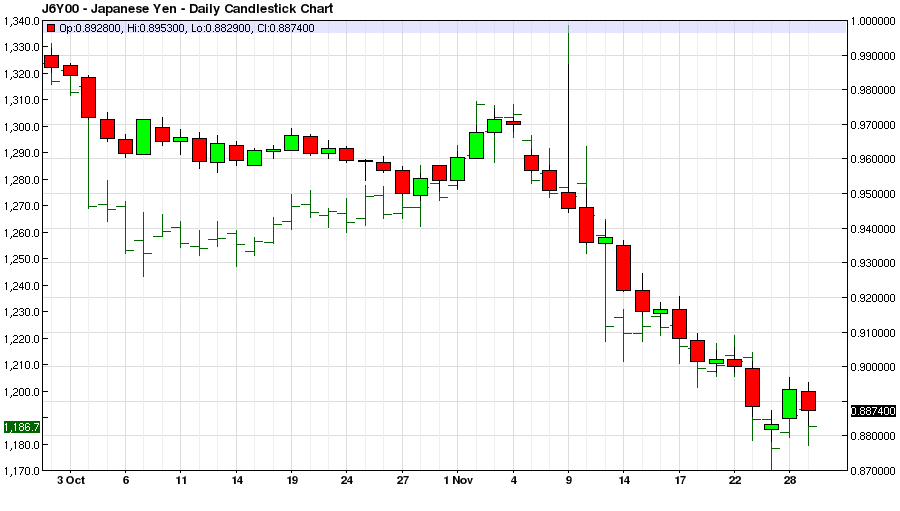

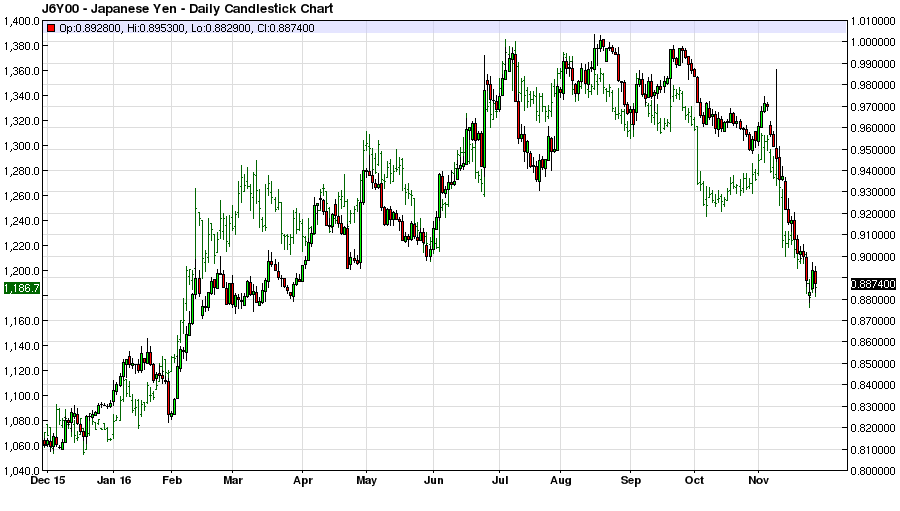

You've now seen these charts for what must seem like a million times. The inverted USDJPY is in candles and the "price of gold" is in bars. Again, do you see a fundamentally-derived "price of gold" in these charts or do you simply note two closely-correlated digital "assets", where HFTs "see" a move in the USDJPY and instantly buy or sell paper gold in response?

To that end, let's end this post on a positive note...

A week ago, some eco-quants at JPM issued a forecast for the USDJPY that projected a fall back to 100 or even lower. Well today, UBS came out with a nearly identical forecast. I would strongly suggest that you take the time to read this very closely: http://www.zerohedge.com/news/2016-11-29/usdjpy-could-plunge-low-98-after-trump-bubble-bursts-ubs-wealth-warns

Again, when the USDJPY was near 100 last summer (or 1.00 JPYUSD on the charts above), "gold" was primarily between $1330 and $1380. Why? The HFTs had observed the fall in the USDJPY from 120 to 100 and, in turn, purchased "gold exposure" at the COMEX. Total COMEX open interest surged by over 50% and the price of that gold exposure rallied by over 30%.

Could we be on the verge of another such rally? Well, I hope by now you've figured out that the USDJPY holds the key. If the quants at JPM and UBS are correct, prepare for upside in 2017 and not the doom-and-gloom downside that the usual perma-bears are attempting to convince you is coming.

Courtesy of www.tfmetalsreport.com/subscribe