This Week in Gold

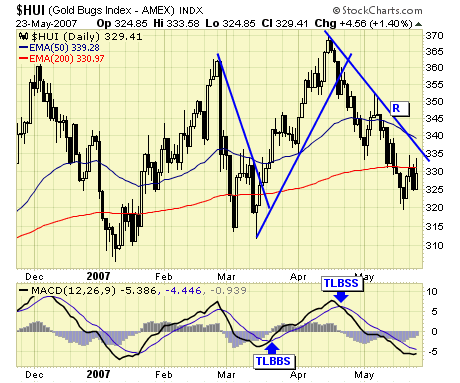

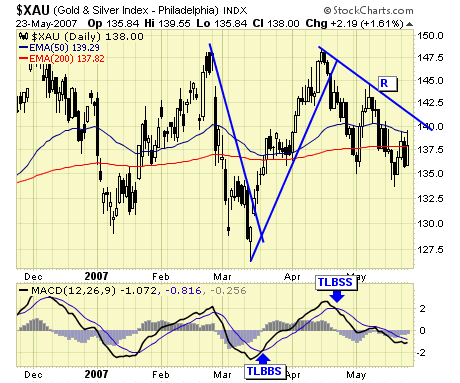

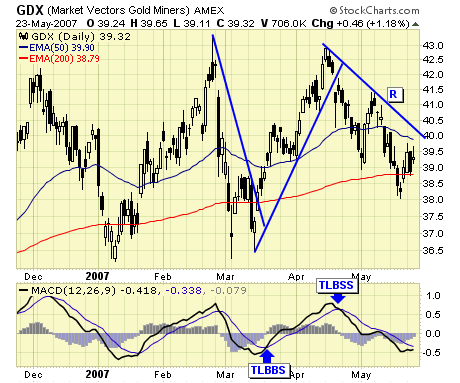

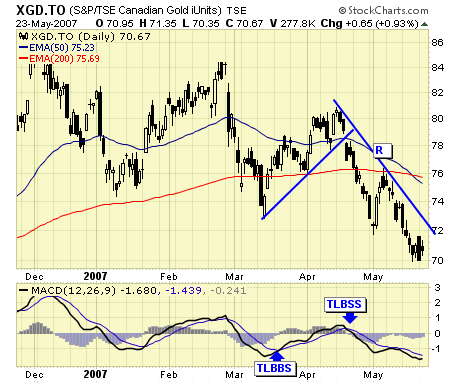

The gold sector remains on a sell signal since April.

$HUI - is now below the 200ema support and oversold.

$XAU - consolidating at the 200ema.

GDX - has found support at the 200ema.

XGD.TO - the Cdn ETF is deep below the 200ema support and deeply oversold. The daily configuration is now bearish and any rally is considered corrective as long as 200ema provides resistance.

Summary

The gold sector indices and ETFs continue to be oversold and can bounce sharply from current levels. However, we will remain in cash until we have a signal, set up, and reasonable stop.

********

Disclaimer: Words of caution: public readers of my commentaries should exercise their own judgment as to whether to buy or sell anything. Never trade based on other people's analysis. Knowing which way to place our bets is only half of the formula to success. Wishing you peace and profits......................................