What Would a Drop in Gold Prices Below $1,900 Mean?

Gold has fallen and appears to be on its way to invalidating the recent breakout. What happens when it slips below $1,900?

Gold Moved Lower

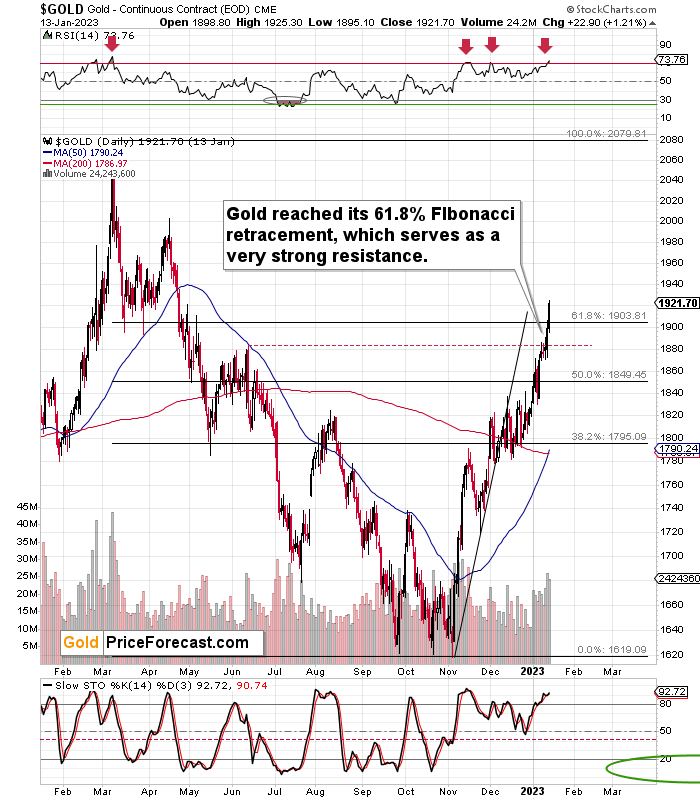

In a recent extra Gold Trading Alert, I wrote that gold would be likely to invalidate Friday’s (Jan. 13) small breakout above the 61.8% Fibonacci retracement level, and it seems that it’s on its way.

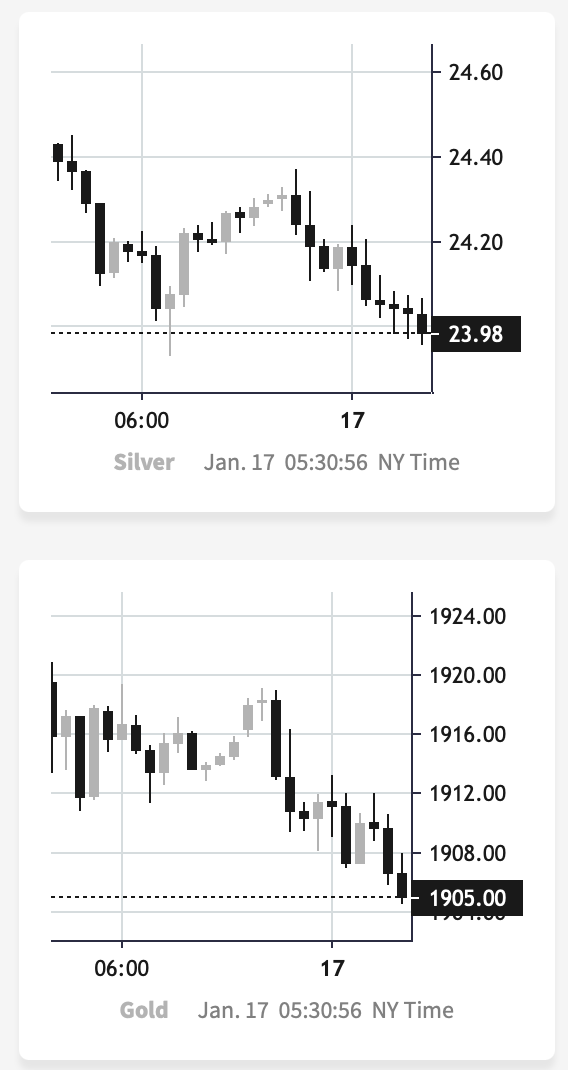

In today’s pre-market trading, gold moved lower, which means that the scenario in which it invalidates the above-mentioned breakout and slides in tune with its post-2012-top analogy became even more likely based on today’s pre-market action. Consequently, what I wrote yesterday remains up-to-date.

Once gold slides below $1,900, there will be a breakdown below the very short-term rising support line and invalidation of two breakouts: above the $1,900 level and above the 61.8% Fibonacci retracement. This is likely to happen shortly, and when it happens, it will be a clear sell confirmation.

The above also makes perfect sense in light of the recent sell signal from the RSI indicator based on the daily gold prices. It moved above 70, and this has corresponded to local peaks many times in the past. And yes, it was also what we saw at the 2022 top.

What’s the Signal for Gold Stocks?

At the moment of writing these words, gold futures are trading at about $1,907, and gold’s intraday high on Jan. 9 was about $1,886. That’s important in light of what’s happening in junior mining stocks in today’s London trading.

Junior miners are already back below their Jan. 9 high, and let’s keep in mind that they didn’t manage to move to their 61.8% retracement based on their 2022 decline.

Why am I writing this? To emphasize that junior miners are underperforming gold in a visible manner. This is a bearish indication.

Also, please note that silver (chart courtesy of https://SilverPriceForecast.com) is once again below $24 – this level seems to be the ultimate resistance for the white metal at this time, as it’s been unable to hold above it for long.

I know it might not be easy to view anything as bearish after a short-term rally, but the reality is as above. One might choose not to view this as important, but miners’ underperformance of gold is one of the more reliable trading techniques on the gold market.

Overall, while the recent rally may appear bullish at first glance, the outlook for the precious metals market in the medium and short term is currently bearish, in particular for junior mining stocks.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,