When and Where Will Gold Bottom?

In this article, I will briefly examine Gold’s technicals, fundamentals, and sentiment to hazard a guess at when and where the major turn will be.

It is vital to consider all three tools to build a case.

On the fundamental front, we are well aware that precious metals have historically bottomed around the time the Federal Reserve ended its rate hikes or moved from a pause to cutting rates.

In some cases, it was a few months before the last rate hike in the cycle, and in other cases, it was after the last rate hike. In the previous nine Fed rate hike cycles, the median and average precious metals bottom was one month after the last rate hike.

I certainly have been too aggressive in my expectations of when the Fed will pivot. That being said, I expect November to be the last rate hike unless something blows up over the weeks ahead. If current market trends continue well into October, then do not expect any Fed hiking after November.

The S&P 500 appears to be following the path of the six cyclical bear markets within the previous three secular bear markets.

During three of the past four of those bear markets, Gold and/or gold stocks bottomed anywhere from 8 months to 12 months after the start of the bear market. (During the other bear, Gold and gold stocks diverged from the beginning of the bear market).

This timeline aligns with the timeline of the shift in Fed policy. The window for a bottom could be from now until a few months from now.

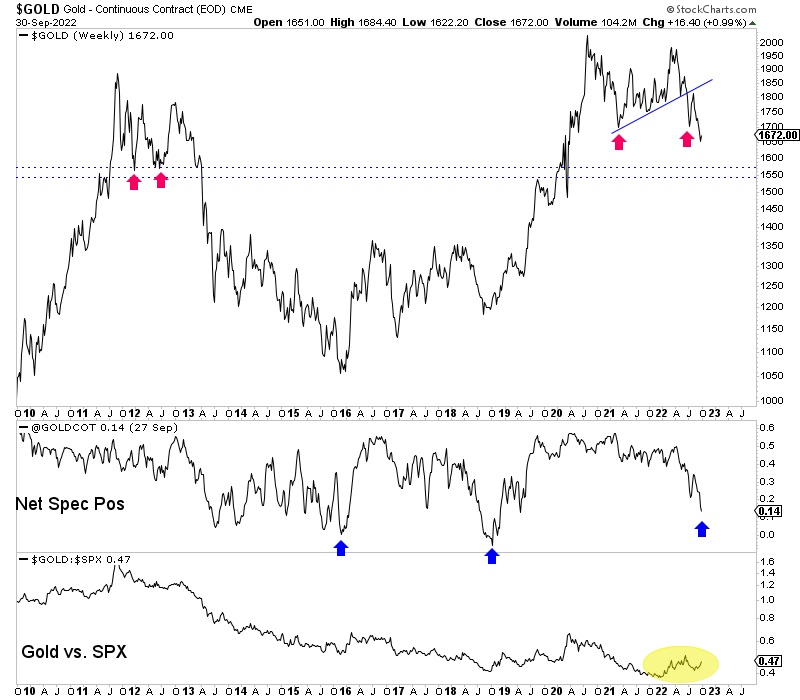

Gold is technically in a downtrend and has broken support at $1675.

While many compare today to 2013, there are a few important differences. At present, Gold only had one big rally from the support at $1675. Then Gold had two big multi-month rebounds from support at $1550. This summer’s second rally lasted only three weeks and $115/oz compared to then over three months and $250/oz.

Gold breaking the trendline from the 2021 low was a bigger break than recently losing $1675, and the price action confirms that. The break of that trendline has a measured downside target of $1580 to $1600.

The next confluence of strong support is in the $1550 to $1570 area.

On the sentiment front, the net speculative position in Gold hit 13.6% of Open Interest. Note, it was at 0% at the 2016 and 2018 bottoms. SentimenTrader.com’s Gold Optix indicator hit 23% bulls a few days ago. The lows from 2013 to 2018 were around 20% bulls.

Finally, the Gold to S&P 500 ratio, a long-term leading indicator for the sector, has been stable and steady since it bottomed at the end of 2021.

The balance of probability favors Gold finding a bottom in the mid $1500s in the next month or two. Strong technical support resides there, and further weakness could push sentiment indicators to major extremes. Also, the fundamentals are so close to being bullish but we are not quite there yet.

That said, it’s certainly possible a bottom could happen before or a little bit later.

When assessing fundamentals, technicals, sentiment, and some history, I expect the bottom will be behind us by the new year.

I continue to focus on finding high-quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.

Courtesy of The Daily Gold

********