When Central Banks Buy Stocks

The investment story of the year to date is the central bank-led financial market recovery. While everyone is aware of the impact the Fed’s $85 billion-a-month asset purchases is having on stocks, few investors realize that central banks are making direct purchases of stocks. The implication of this new development is shocking.

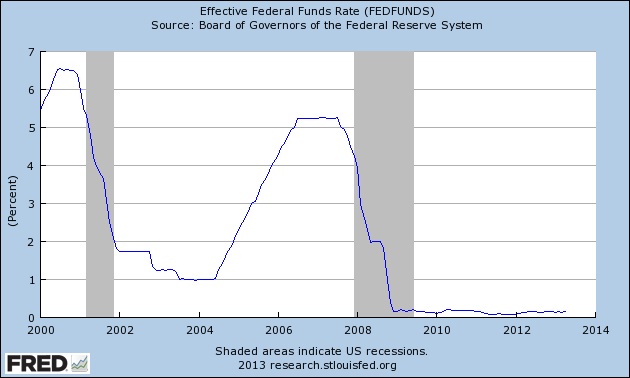

Bank of America stated that global central banks have cut rates an incredible 511 times since June 2007 in an effort at re-inflating the global economy. “Most central banks in our coverage universe still have a bias to ease,” Morgan Stanley economists led by London-based Joachim Fels said in a recent report. “Given this disposition, it doesn’t take much in terms of downside surprises in growth or inflation to tip the balance for more central banks to pull the trigger for more easing.”

Mohamed El-Erian, CEO of Pacific Investment Management, stated: “Central banks are our best friends not because they like markets, but because they can only get to their macro objectives by going through the markets. The hope is that improving fundamentals will validate what central banks have done.”

As if to underscore the unified commitment of the world’s central bankers to fighting deflation, the Reserve Bank of Australia cut to a record 2.75 percent this week, while the European Central Bank and Reserve Bank of India acted to ease last week. And while the Bank of Japan (BOJ) and the U.S. Federal Reserve refrained from changing policy at their last meetings, the BOJ doubled its monthly bond purchases in April and Fed policy makers last week raised the prospect of increasing their pace of bond buying above $85 billion a month.

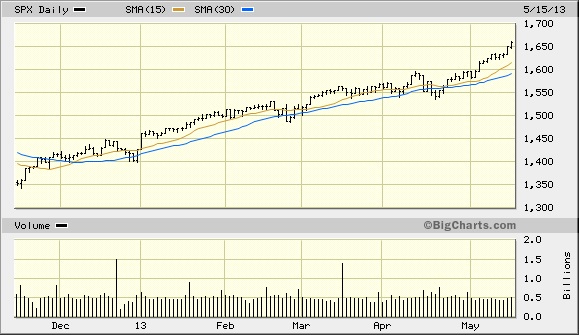

The simple yet undeniable reality here can be summarized in two Wall Street bromides: “The trend is your friend” and “Don’t fight the Fed.” Not only are central banks like the Fed paving the way for continued financial market recovery by purchasing bonds and mortgage debt, some are now directly buying equities according to a recent report.

In an April 25 Bloomberg article, Sarah Jones reported that some central banks are buying stocks in “record amounts” as falling bond yields entice investors to look toward equities. In a survey of 60 central bankers last month by Central Banking Publication and Royal Bank of Scotland Group Plc, 23 percent of respondents said they own shares or plan to buy them. The Bank of Japan, holder of the second-biggest foreign-exchange reserves, said April 4 it would more than double investments in equity exchange-traded funds to 3.5 trillion yen ($35.2 billion) by 2014.

The Bank of Israel bought stocks for the first time last year while the Swiss National Bank and the Czech National Bank have boosted their holdings to at least 10 percent of reserves, according to Bloomberg. Germany’s Bundesbank appears to be open to the possibility of buying equities. While neither the U.S. Federal Reserve nor the Bank of England are buying stocks directly, some analysts are already speculating that the Fed may soon step in to do so, using its mandate of “price stability and maximum employment” as an excuse.

“Managers of banks’ assets are looking for alternatives to holding government bonds after efforts to stimulate growth from the Federal Reserve, the Bank of Japan and the Bank of England helped send yields near to record lows,” Jones reported in the Bloomberg article. The survey of 60 central bankers, overseeing a combined $6.7 trillion, found that low bond returns had prompted almost half to take on more risk. Fourteen said they had already invested in equities or would do so within five years. “Those conducting the annual poll had never before asked that question,” according to Bloomberg.

As one institutional trader aptly put it, “Equities are the last asset class standing.” Now that dividend yields on stocks exceed bond yields, it only makes sense that banks are chasing yields via the stock market. It also puts into perspective the relentless stock market rally of the past six months. Not only is it being fueled by the Fed’s $85 billion in asset purchases per month, but we now know that foreign central bank purchases of dividend-yielding stocks contributes additional strength to the rally. This provides even greater context behind the relentless rally of the last six months as shown in the following graph of the S&P 500 Index (SPX).

Writing in the May 2013 issue of the Market Cycle Dynamics Letter, David Knox Barker asked some interesting questions of the central banks foray into equities: “There is a radical difference in a financial world where central banks served as commercial bank overnight lenders, to now being actively engaged in equity investment. Will they eventually also go short? Do they have a fiduciary responsibility to hedge their long positions? Do they trade through major commercial banks?”

These questions and others will eventually be answered. For now suffice it to say that an equity market receiving the additional support of central bank buying will likely be further insulated against a major crash occurring anytime soon. While the existence of the so-called “Plunge Protection Team,” or PPT, may have been debatable in the past it certainly isn’t debatable anymore.

Gold

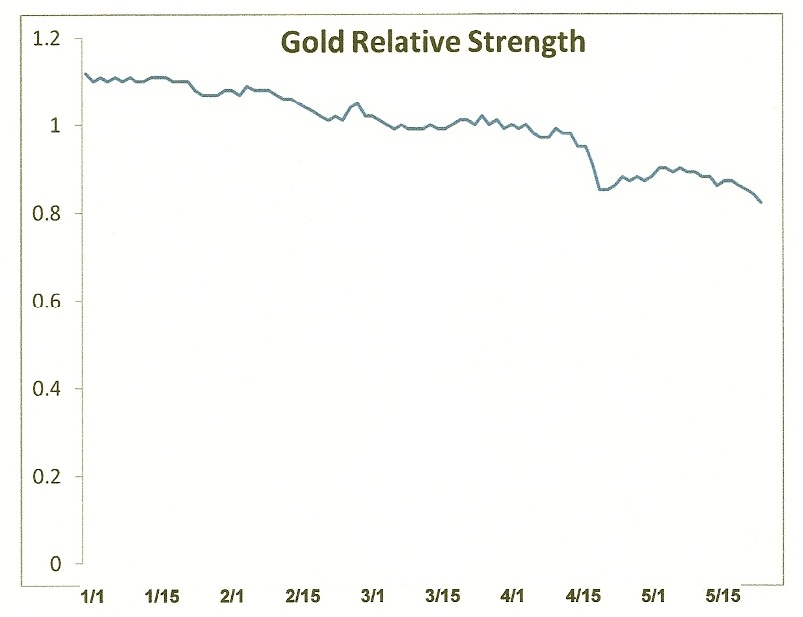

The unspoken reality for gold investors is that the increasing institutional demand for equities is taking the wind out of the sails of the gold market. As Kitco News reported Tuesday, “Continued exchange-traded-fund outflows, strong equities and U.S. dollar gains are limiting the upside for gold, while recently strong physical demand and continued central-bank accommodation are providing support.” While there has been strong demand for physical bullion since the April lows, especially in Asia, the fact that stocks are garnering an ever-growing share of “hot money” flows while gold is largely ignored by institutional and hedge fund investors isn’t helping the yellow metal’s cause.

Moreover, as the value S&P 500 Index increases while gold goes nowhere, it’s causing the relative strength for gold to actually decline. This gives hedge fund and other sophisticated investors who look at technical indicators one less reason to invest in gold in the near term.

Kitco reports, “A number of observers have cited the rotation into equities as one of the factors prompting an exodus out of gold exchange-traded funds so far this year….

“’The biggest negative continues to be the ETFs. We’ve had steady and constant ETF liquidation,’” said Bill O’Neill, principal with LOGIC Advisors, adding that many suspect the exodus is not over.

“Further, he said, once major hedge funds rotate away from such an asset, they typically don’t jump right back in anytime soon. ‘The big players are going to be slow coming back into the market,’ he said.”

Momentum Strategies Report

The stock market recovery is nearly four years old, and investors wonder if it will continue. While many experts have made forecasts for the coming year, few have been as impressive as the Kress cycles in projecting the market’s year-ahead performance since the recovery began.

Each year I publish a forecast for the coming year based on a series of historical rhythms known within Kress cycle theory. Last year’s forecast was remarkably accurate in predicting the pivotal market turns, including the June 1 bottom in the S&P.

Here’s a sampling from last year’s forecast:

“The first five months of 2012 will likely be characterized by greater than average volatility....This will create a level of choppiness to coincide, if not exacerbate, the market’s underlying predisposition to volatility owing to the euro zone debt crisis…the May-June 2006 stock market slide could be repeated in May-June 2012. Our short-term trading discipline should allow us to navigate this volatility and there should be at least two worthwhile trading opportunities between [January] and the scheduled major weekly cycle around the start of June 2012. From there, the stock market should experience what amounts to the final bull market leg of the current 120-year cycle, which is scheduled to bottom in October 2014.

“Keeping in mind that like snowflakes, no two markets are exactly alike, the Kress cycle echo analysis for 2012 tells us to expect a final upswing for stocks in the second half of the year with the first half of 2012 likely to be more favorably to the bears, especially if events in Europe are allowed to get out of hand.”

********

This is your opportunity to find out what the Kress cycles are telling us to expect for 2013. Subscribe to the Momentum Strategies Report now and receive as my compliments to you the 2013 Forecast issue.

In addition to that you’ll also receive the MSR newsletter emailed to you each Monday, Wednesday and Friday. MSR provides reliable forecasts and analysis of U.S. and global markets based on internal momentum, cyclical and technical factors. Low-risk stock and ETF recommendations are also made based on my proprietary system of selection. Specific entry and exit instructions are also given for each recommendation.

[For the complete 2013 Kress cycle forecast for the U.S. stock market and the latest newsletters, subscribe to the Momentum Strategies Report at the link below.]

http://www.clifdroke.com/subscribe_msr.mgi

Clif Droke is the editor of the three times weekly Momentum Strategies Report newsletter, published since 1997, which covers U.S. equity markets and various stock sectors, natural resources, money supply and bank credit trends, the dollar and the U.S. economy. The forecasts are made using a unique proprietary blend of analytical methods involving cycles, internal momentum and moving average systems, as well as investor sentiment. He is also the author of numerous books, including most recently “2014: America’s Date With Destiny.” For more information visit www.clifdroke.com