Will Powell Cut Interest Rates, Triggering Gold Rally?

Yesterday we wrote about Draghi, so today Powell is our hero. Only one week separates us from the pivotal FOMC meeting. What should gold investors expect?

First Fed Cut Since 2008

In a week, the Fed may deliver its first interest rate cut since 2008. Given the market odds, the move is practically a foregone conclusion. Futures traders assign a 100-percent probability of a cut. The bone of contention is the size of the reduction: there are 76.5-percent chances of a standard 25-basis point cut and 23.5-percent odds of a 50-basis point slash. As Powell did nothing to alter these expectations, the U.S. central bank now has to deliver a cut, if it does not want to upset the financial markets. However, the 50-basis point reduction sounds be a bit too much. The economy is not yet in recession, and you do not fire a bazooka as an insurance just in case!

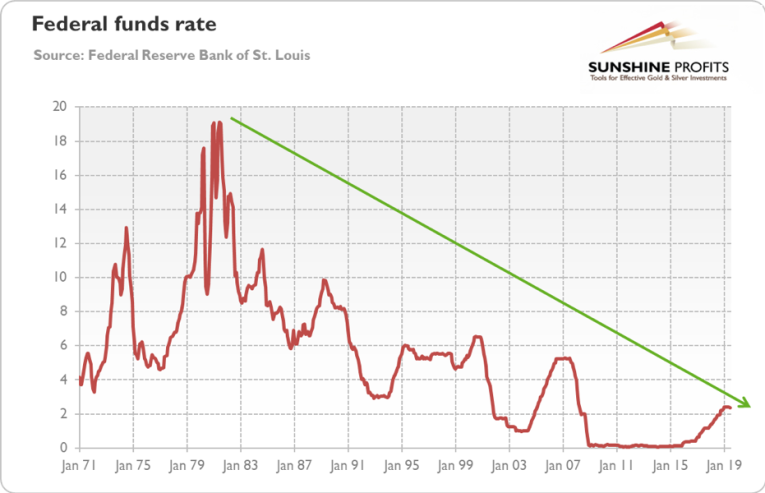

The FOMC’s asymmetric approach should be now clearly seen. It took six years since the end of the Great Recession for the Fed officials to start the normalization process. And did they returned to the pre-crisis position? Of course not! They managed to lift interest rates just to 2.4 percent, less than half of the 5.25 percent present before the financial crisis, as the chart below shows. Not to mention the still giant Fed’s balance sheet! The Fed’s dovish bias should be now obvious for everyone, and that’s not too bad for gold, actually.

Chart 1: The effective federal funds rate from 1971 to 2019.

What is not so obvious is why the FOMC is going to cut the Federal Funds Rate, as the macroeconomic targets the Fed is supposed to hit, do not justify such an aggressive move. It might be the case that we were right commenting that the Fed’s hikes were terribly delayed. They simply did not have the time to normalize the interest rates completely before the economic outlook darkens. So far, we experience just a global economic slowdown, but the inversion of the yield curve signals recession in a few quarters from now. And the Fed knows it.

Fed’s Cut and Gold Prices

So far, the Fed’s dovish shift was beneficial for gold. The soft rhetoric and the reduction in the projected path of the federal funds rate helped gold above $1,400. But how will the actual cut affect the gold prices?

It’s not an easy question. The last round of cuts from 2007-8 was bullish for the gold prices, but the yellow metal was already in the middle of the bull market. As the chart below shows, the previous cuts (before 2007) were not always supportive (or only with a substantial lag) for the yellow metal.

Chart 2: The effective federal funds rate (red line, right axis, in %) and the gold prices (yellow line, left axis, London P.M. Fix, in $) from 1971 to 2019.

So, if the rate cuts history does not provide a clear guide for the gold prices, let’s analyze the last tightening cycle. When the Fed was hiking interest rates, the pattern was clear. Gold struggled in anticipation of the hike at the FOMC meeting, but rallied after the actual hike. The argument a contrario would be that the gold prices rallied in anticipation of the interest rate cut at the FOMC meeting, but they will fall after the actual cut.

That’s possible, but there is one issue here. You see, gold rallied after the Fed’s actual hikes because these hikes were accompanied by the dovish projections. The Fed was hiking interest rates but at a much slower pace than anticipated by investors. The U.S. central bank was systematically reducing its estimates of the long-term level of interest rates, postponing or excluding some of the future hikes. But this time the Fed’s action might not be accompanied by the opposite signal. The dovish cut might come in tandem with some dovish signal about Fed’s future stance, which should serve gold well. A single interest rate cut would be very uncommon.

Of course, what matters here, is the reality versus the expectations. Investors expect three interest rate cuts overall this year. The Fed might dampen these overly dovish expectations in a week, which could be a really cold shower for the gold bulls. One or two cuts are more probable. But Powell and his colleagues have not tried so far to rein in the dovish hopes, so it’s far from certain that they will do so in a week. We will see.

Looking at the fundamentals alone, the end of the tightening cycle and the beginning of a fresh easing cycle are supportive factors for the gold prices, especially in the current environment of low interest rates. Of course, we’ll learn shortly just how serious the Fed is about its further easing plans – that will give hue to the above assumption.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Gold Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********