Will Trump’s Free Cash Help The Economy And Gold Market?

Economic data shows that the coronavirus crisis will be severe. To soften the blow, Trump announced his support plans for the economy. Will the stimulus package help? And when will gold finally rise?

COVID-19 Hits the US Economy

The global epidemic of COVID-19 has already hit the US economy. We start to see evidence how bad this crisis might be. First, retail sales dropped 0.5 percent in February. That’s the biggest drop in a year. But it will change quickly – just think about the number in March or April!

Second, the US consumer sentiment fell from 101 in February to 95.9 in March. Again, expect much worse readings in the future, as the number covers only the beginning of the month when Americans just started to acknowledge the coronavirus threat.

Third, the Philadelphia Fed manufacturing index fell from 36.7 in February to -12.7 in March, the lowest reading since June 2012. So, forget about recovery in the manufacturing recession.

Fourth, initial jobless claims surged from 211,00 last week to 281,000 yesterday. It means that more Americans applied for unemployment benefits. So, prepare for the rise in the unemployment rate!

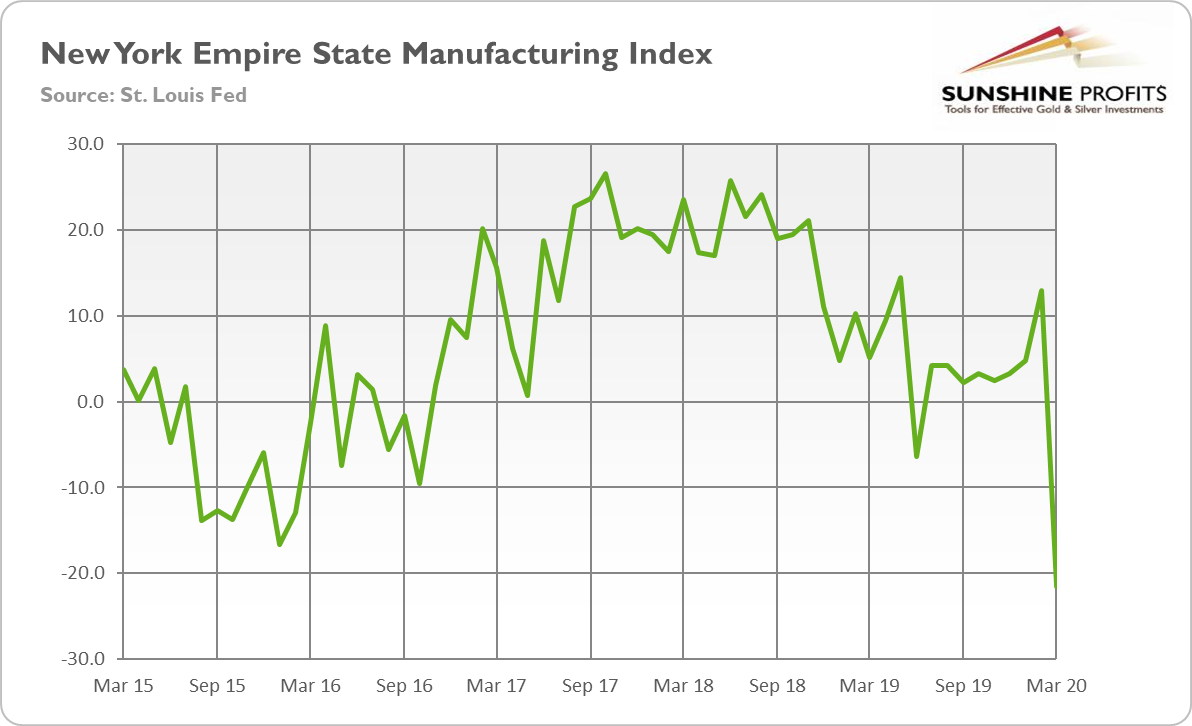

Fifth, as you can see on the chart below, the New York Fed’s Empire State business conditions index fell record 34.4 points to -21.5, the lowest level since the global financial crisis. As the COVID-19 epidemic in the US was still in its early stages during the survey, the worst seems yet to come.

Chart 1: New York Empire State Manufacturing Index from March 2015 to March 2020

Trump To The Rescue

On Tuesday, U.S. President announced a plan to send money to Americans as soon as possible to ease the negative economic shock from the coronavirus crisis. Trump said some people should get $1,000 as help with their living expenses because they cannot work under quarantine and social distancing. On Wednesday, he wrote on Twitter:

For the people that are now out of work because of the important and necessary containment policies, for instance the shutting down of hotels, bars and restaurants, money will soon be coming to you.

I also want one grand, can you send it to me as well, Mr. President?

The administration is also talking about a new stimulus package of around $850 billion to cover payroll tax cut, small business loans, and bailouts for airlines struggling from plummeting demand. However, Democrats, who control the House, prefer refundable tax credits for self-employed workers and ensuring that sick workers can get longer-term leave if needed rather than a cut in a payroll tax. It would be actually the third coronavirus aid plan to be considered by Congress just this month. Trump signed the first $8.3 billion package to battle the coronavirus two weeks ago, and he signed on Wednesday the second $100 billion package that would expand paid leave and unemployment benefits. Anyway, one thing is certain: the US government stimulus will be large!

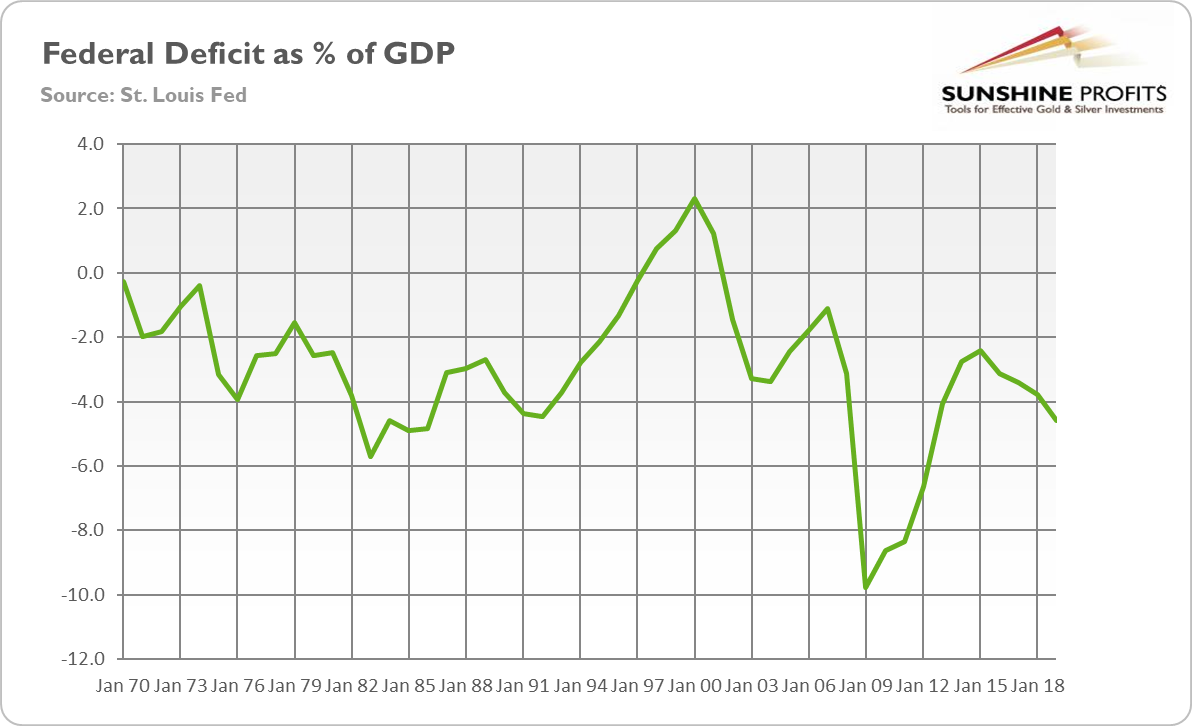

As you can see in the chart below, the fiscal deficit for 2019 is $984 billion, or 4.6 percent of GDP. Before the COVID-19 pandemic, the budget deficit for 2020 was projected to be $1 trillion. It means that the stimulus will balloon the fiscal deficit to $1.9 trillion, or to staggering 8.8 percent of GDP, the level not seen since the Great Recession.

Chart 2: Federal deficit as a percent of GDP from 1970 to 2019

But that’s not all. To make matters worse, the tax revenue will plummet, while the GDP is likely to shrink this year. Nobody knows how much, but let’s follow Goldman Sachs and assume that the annual GDP growth will decline 0.4 percent in 2020. So, the deficit will be even higher, definitely more than 9 percent of GDP! As a result, the federal debt will increase from $23 trillion, or 106 percent of GDP, in 2019 to almost $25 trillion in 2020, or 116 percent of GDP. Oops, we have a debt problem here!

Implications for Gold

What does it all mean for the gold market? Well, we are in a recession. The economy will be hit severely, especially in the first half of the year. The White House and Congress announced the stimulus package. But it did not help and calm the stock market – which is not surprising given the level of fear. What it will do, is to balloon the public debt and raise the likelihood of introducing the universal basic income in the future. All this means higher government expenditure, higher deficits and higher indebtedness. Soaring debt, combined with increasing money supply, very low real interest rates and global recession, is another fundamentally positive factor for the gold market. When the blood dries on the trading floor, investors will cease to sell gold in order to raise cash – and then we get the fundamental reason for the rally in gold to start. The similar dynamic occurred after the collapse of the Lehman Brothers – gold fell initially before rebounding sharply amid the loose monetary policy.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.

********