Wouldn’t Be “Unreasonable” For Gold to Hit $4,000

Strengths

-

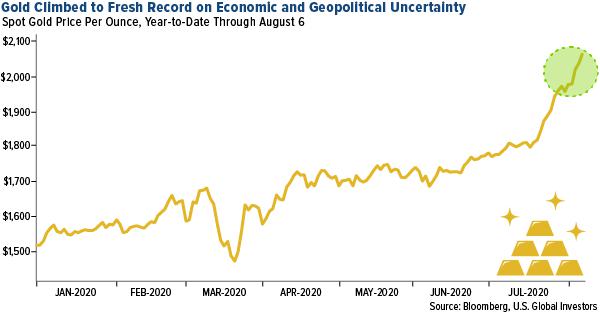

The best performing precious metal for the week was again silver, up 16.04 percent despite hedge fund managers cutting their net bullish positions to a six-week low; thus the physical market is driving the price. ETFs added 126,842 troy ounces of gold to their holdings on Thursday, bringing 2020 purchases to 26 million ounces and marking the 30th straight day of inflows. Total gold held by ETFs rose 31 percent so far this year. Gold continued to climb above its $2,000 an ounce level set last week on growing economic and geopolitical uncertainty.

-

The Perth Mint reported gold coin and minted bar sales of 56,104 ounces in July, up from 44,371 ounces in June. Silver sales remained flat at 1.57 million ounces. Gold imports in India rose 25 percent year-over-year in July to 25.5 tons. This is double the 13.2 tons bought in June, reports Bloomberg. This is sign of improvement after purchases fell 95 percent year-over-year in the second quarter.

-

Nigeria is introducing measures to stem illegal gold exports and regulate production by informal miners. As much as 18 tons of gold leaves the country annually and is mostly produced by artisanal miners. This move will help diversify Nigeria’s economy by reducing dependence on oil and allow it to stockpile the metal. It may open the stage for international mining companies to enter the country and perhaps start what would be the country’s first gold mine done with responsible environmental and social protocols.

Weaknesses

-

The worst performing precious metal for the week was gold, still up 3.02 percent. Gold prices pulled back on Friday on stronger-than-expected U.S. unemployment data. Payrolls increased by 1.76 million in July, beating estimates for a 1.48 million gain. Some investors think the V-shaped recovery is reinforced by the strong job gains over the last three months, but Deutsche Bank economist Brett Ryan noted that the easy gains from people going back to work in the service sectors is now done and further improvements in the labor market may be slower.

-

Silver consumption in India could fall by 50 percent this year from 6,000 tons in 2019. Metals Focus reports that imports were down by half in the first six months of this year to just 1,735 tons. Consumers are skipping purchases due to higher prices and a weak economy. Bloomberg notes that silver prices have rallied more than 60 percent in India so far this year.

-

The Bank of Nova Scotia dropped out of the daily gold and silver auctions that set benchmark prices for the metals and Citigroup has joined in its place. Bloomberg reports that Scotiabank is winding down activity in the sector. The auctions set metal prices and were introduced in 2014 and 2015 to replace “fixing”, where traders at banks negotiated benchmark prices over the phone.

Opportunities

-

Michael Cuggino, CEO of Permanent Portfolio Family of Funds, says that gold is still relatively cheap and could move higher. Cuggino said in an interview that it would “not be an unreasonable move” for bullion to breach $4,000 an ounce. VanEck CEO Jan van Eck said in a note this week that gold could reach $3,400 an ounce as the level of stimulus and system risk resembles that during the financial crisis.

-

Bank of America’s global commodity research team said it is “feasible” for silver to hit $35 per ounce in 2021. Bloomberg notes that the analyst said silver benefits from low interest rates and demand for green technologies.

-

Money managers are increasingly moving bond positions into gold as real yields are at record lows and monetary dangers could be ahead. Some investors are rethinking the traditional 60/40 portfolio where 60 percent of a portfolio is in stocks and 40 percent in bonds, which are considered a safer investment. Plurimi Wealth LLP’s CIO Patrick Armstrong said he had cut back on his bond positions and now hold a 7.5 percent weighting in gold. “The reason I want to hold gold is because the future just going to be a continue of what’s happening now: more money printing.”

Threats

-

According to Kitco’s weekly polls, sentiment in the gold space remains bullish, but bearish calls are gaining popularity. Many are betting that gold is looking at an overdue correction next week after hitting multiple record highs above $2,000 an ounce this week. SIA Wealth Management chief market strategist Colin Cieszynski said, “technically gold has been rising on falling volumes, and is extremely overbought on the RSI indicator.”

-

Mark Hulbert of MarketWatch cited research by Duke University professor Campbell Harvey that the gold price is as high as it’s ever been in inflation adjusted terms. Their research suggests that when the inflation adjusted price is high, gold’s subsequent performance tends to be low and vice versa five-years later. They caveat their abstract noting that massive buying of physical bullion by the ETFs may still push prices higher.

-

Despite stronger than expected jobs data this week, the economic turmoil in the U.S. could be worsening. According to the Census Bureau, an estimated 27 percent of adults missed their rent or mortgage payment for July. The federal moratorium on evictions expired on July 31, as did the end of the $600 per week boost to unemployment benefits.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of