Gold Rising Despite Strong US Dollar

The price of gold has been rising in 2016 despite the strong greenback. What does it imply for the gold market?

The price of gold has been rising in 2016 despite the strong greenback. What does it imply for the gold market?

The US dollar has appreciated more than 1.7 percent against the euro this year so far. Despite this appreciation, the London P.M. spot price of the shiny metal has risen 3.4 percent in January so far. It means that other factors have to explain the rebound in gold prices. Undoubtedly, the pace of the U.S. dollar’s appreciation is slowing down, but the major drivers are the decline in interest rates and the rise in risk-aversion among investors.

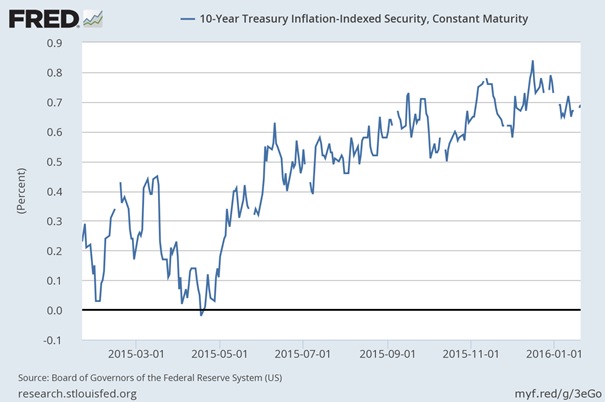

US Real Interest Rates Declining

The chart below shows U.S. real interest rates (gauged by yields on 10-year Treasury Inflation-Indexed Securities) has been declining since December. It means that investors assume a slowdown in the U.S. economy and that they believe that the Fed’s monetary policy will be more gradual than expected. It also shows that U.S. real interest rate may affect the gold market independently of the U.S. dollar.

Chart 1: U.S. real interest rates (yields on 10-year Treasury Inflation-Indexed Security) over the last twelve months.

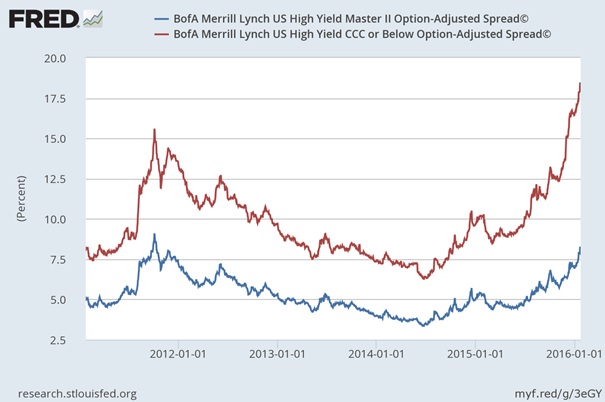

Investors Becoming More Risk Averse

The second chart shows the rise in credit spreads. There is a real panic in the junk bonds market. Those worries combined with the drop in oil prices, the decline in the U.S. stock market and concerns about Chinese economy led to increase in safe-haven demand for gold.

Chart 2: The BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread (blue line) and the BofA Merrill Lynch US High Yield CCC or Below Option-Adjusted Spread (red line) over the last five years.

The widening spreads indicate that investors have become more risk-averse and flee more intensively to safety. This is why gold gained both in the euro (the London P.M. spot price of the yellow metal has risen 4.22 percent in January so far) and the U.S. dollar. It seems that it is becoming clear to investors that the U.S. economy is not as robust as it was commonly believed and that the days of easy capital gains in stocks are over. Given that the bond valuations are also elevated, part of the capital will be shifted into other safe securities, like gold.

The bottom line is that the price of gold has been rising in 2016 despite the strong greenback. It means that other fundamentals of the gold market – the U.S. real interest rates and the risk-aversion – have improved. Absent a strong greenback, the price of gold would have risen even further. However, it is definitely too early to announce a bull market. In 2015, the price of gold was rising in January or in October, but the increases proved to be short-lived.