The Golden Corral

Gold took the exit ramp south Monday, meeting expectations that the nearly three month rally was poised to stall. With the Fed decision on the menu for tomorrow afternoon, fresh near-term catalysts for gold will likely be served a la carte. How participants and pundits receive and consume the Fed's offerings largely depends on the tone in the communiqué and how participants choose to handicap future action. Generally speaking, a more upbeat and hawkish statement could generate greater near-term pressures on gold and vice versa should the doves win out. Taking into account the economic data that's predominantly firmed since the Fed's last meeting in January and the more stable conditions present in the financial markets over the past month, it seems reasonable to expect that the Fed will deliver a brighter outlook.

Gold took the exit ramp south Monday, meeting expectations that the nearly three month rally was poised to stall. With the Fed decision on the menu for tomorrow afternoon, fresh near-term catalysts for gold will likely be served a la carte. How participants and pundits receive and consume the Fed's offerings largely depends on the tone in the communiqué and how participants choose to handicap future action. Generally speaking, a more upbeat and hawkish statement could generate greater near-term pressures on gold and vice versa should the doves win out. Taking into account the economic data that's predominantly firmed since the Fed's last meeting in January and the more stable conditions present in the financial markets over the past month, it seems reasonable to expect that the Fed will deliver a brighter outlook.

Since we first highlighted last December the similarities in gold with the initial taper in December 2013 (see Here and Here, gold has followed its trajectory higher as the US dollar has increasingly come under pressure after listing with popularity as the macro trade to be placed once again in 2016. With gold now following the March 2014 seasonal pivot lower - the question becomes: will gold and commodities succumb to another disinflationary squall, or have underlying conditions in the currency markets shifted to more benevolent times for valuing hard assets and participants should expect a more moderate pull-back in gold?

From our perspective we believe the latter is more likely and continue to hold a near-term target of around 1190 for gold. This opinion is based in part on the following assumptions and observations:

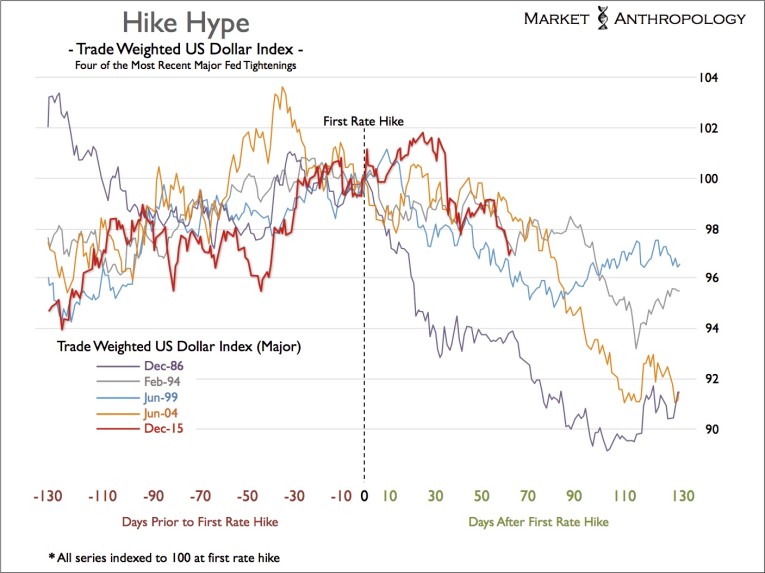

- Longer-term, the US dollar is turning down - as it has in previous market environments where the Fed has moved to raise rates.

- Although we believe the Fed's reach this time around will ultimately be significantly less than their projections (see Here), the currency markets have begun unwinding the overshoot that began in 2014 as the Fed postured towards the next phase of normalizing policy from extraordinary conditions. The "sell the news" reaction borne out in the markets since the rate hike last December has followed this counterintuitive pivot typical of the dollar.

- Considering the assumptions that became built into positions in the historically long expectation phase of this atypical tightening/normalization cycle - we expect the dollar's decline will have significant road to run on the downside from the relative performance extreme it achieved last year.

- All things considered, we believe gold and the dollar will diverge from the paths taken in the back half of 2014, when the dollar enjoyed open road against the significant policy differentials with many of the world's largest central banks.

- Moreover, noting the market response in the euro following last week's ECB meeting, one could argue that there is now "sell the news" reactions to policy in place on both sides of the Atlantic, as Draghi fired his bazooka - but implied the significant measures taken were sufficient towards growth and that no further cuts would be necessary in the foreseeable future. Simply put, the policy differential towards future expectations narrowed.

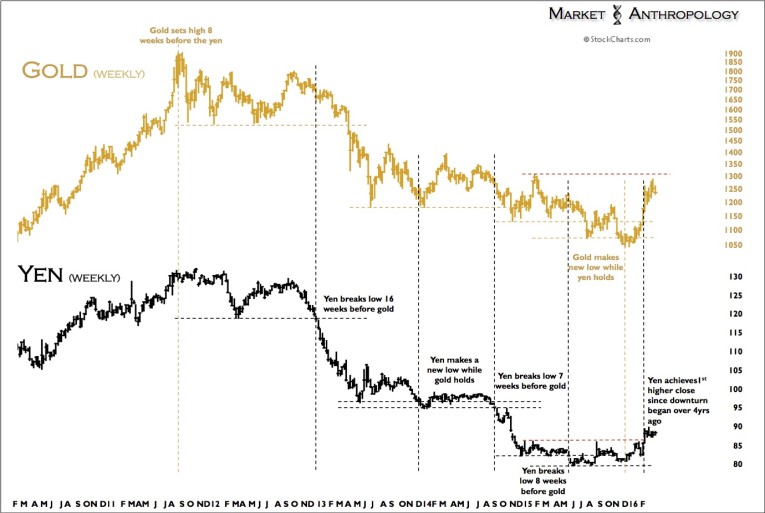

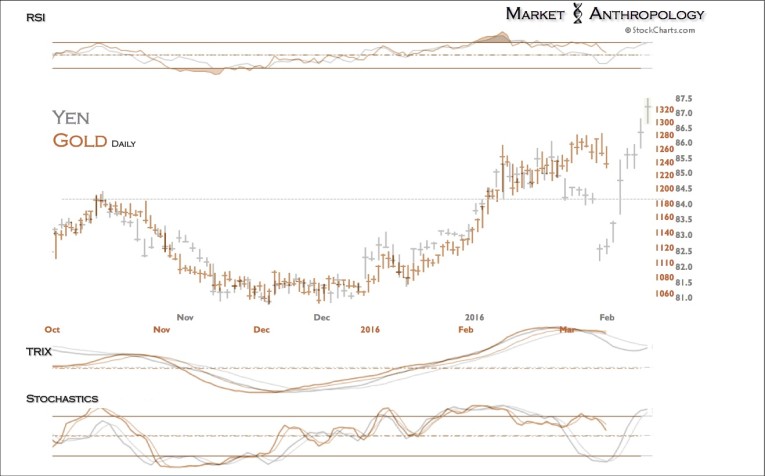

- Gold continues to loosely follow the yen's lead, implying that a breakout move above 1300 would approach after the current retracement decline runs its course.

- While we've pulled in our estimates for a retracement rally in the dollar, we continue to follow the January 2009 retracement decline in gold and other reflationary trends as a more bullish near-term comparative profile. For more information, see Here.

********

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.