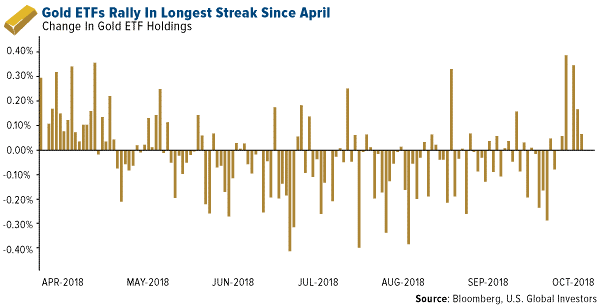

Gold ETFs Rally In Longest Streak Since April

Strengths

· The best performing metal this week was palladium, up 1.41 percent. Philip Newman, founding director of Metals Focus, said this week that palladium is the new market favorite and could hit an all-time record high next year. This week spot gold held near its highest level since late July as holdings of gold-backed ETFs rose to the most since early September, according to Bloomberg. ETF holdings grew each of the last seven trading sessions, marking the longest run of gains since April. On Wednesday, ETFs added 155,653 troy ounces of gold, which is the equivalent of $190.3 million in purchases. Gold is set for a third straight week of gains, the longest streak since January, as equities lose momentum and the Federal Reserve minutes showed that rate hikes will likely continue into next year.

· Central banks globally are stocking up on gold. Poland continues to purchase gold and add to their reserves. The nation’s central bank started buying gold over the summer with a purchase of 9 tons over the course of July and August. Poland’s gold reserves rose to 3.75 million ounces in September, up from 3.61 million ounces a month earlier, representing a third straight month of buying. Kazakhstan also boosted their reserves in September to 10.77 million ounces, up from 10.65 million ounces the month prior. Hungary’s central bank unexpectedly boosted its gold reserves tenfold, purchasing over 28 tons and bringing total holdings to 31.5 tons, citing a need to improve its holdings’ safety.

· Switzerland’s imports of platinum surged last month to their highest level since last December, while palladium imports also rose to a level not seen since August last year, according to Swiss customs data. Reuters writes that Switzerland is a major trading, refining and vaulting center for precious metals and increases in imports are positive for the metals. Gran Colombia Gold Corp’s third quarter gold output totaled 57,163 ounces, which is up 54 percent from the same period a year ago, reports Kitco News. For the first three quarters of this year, production was also up 33 percent from the same period last year. In M&A activity this week, Alio Gold Inc. has agreed to sell non-core assets in Nevada to Coeur Rochester, a subsidiary of Coeur Mining for $19 million in shares of Coeur stock. Alio says that it has reduced some of its debt and expects to eliminate all their debt with Macquarie Bank by the fourth quarter of this year.

Weaknesses

· The worst performing metal this week was platinum, down 0.92 percent. As gold continues to see gains, the VanEck Vectors Gold Miners ETF saw assets rise by 1.8 percent to $9 billion on Monday, the highest level in a least a year, according to Bloomberg data. This massive one-day inflow is the largest increase since June 29 and net inflows to the fund total $2.71 billion in the past year. Although this appears to be positive news for the yellow metal, the VanEck fund is a passive ETF and this huge inflow demonstrates that investors are still content to just invest in the most popular passive gold ETF, rather than go with active management in the gold investing space.

· India, the world’s second largest consumer of gold, might see gold jewelry sales slip in the run-up to the Diwali festival this year due to higher prices. The Indian rupee has been falling so far this year, leading to domestic gold prices hitting their highest level in more than two years. Bloomberg writes that the most auspicious day of the year to buy the yellow metal in the form of jewelry for gift-giving is Dhanteras, which falls on November 5. Chirag Sheth, an analyst with Metals Focus Ltd. in Mumbai, says that rising prices before the celebrations aren’t good for demand that that “if this trend continues, then it’s going to be a dampener.”

· Mine safety in South African mines is back in the spotlight, as this week it was reported that 69 workers have died so far this year on the job, with half of those occurring in gold mines. Bloomberg writes that the number of deaths this year is just one short of the 70 fatalities in 2017, a year in which the number rose for the first time in almost 10 years. Mine safety has been improving in South Africa for nearly two decades, but the trend appears to be reversing based on this years’ rate of fatalities thus far.

Opportunities

· Goldman Sachs is positive on base metals and gold going into next year, reports Bloomberg. In a note received on Tuesday, the bank included a price forecast of gold prices being at $1,250 an ounce, $1,300 an ounce and $1,325 an ounce in the next three, six and 12 months, respectively. Capital Economics is also bullish on the yellow metal and said in a note this week that it is “set to shine brighter as economic storm clouds gather” and as 2018 headwinds of rising bond yields and the strong U.S. dollar “turn into tailwinds next year.” Azerbaijan’s sovereign wealth fund has been increasing its gold holdings since 2012 and has purchased 14 tons of gold so far this year, accounting for 4.3 percent of the fund’s assets.

· Just days before gold was extending its rally last week, hedge funds made their biggest-ever bearish bet on the yellow metal, according to Bloomberg. Speculators increased their net-short positions in gold futures and options to the largest since 2006, then a few days later on last Thursday, gold began to rally. The last time that hedge funds were net short on the yellow metal for an extended period, the price rose almost 10 percent.

· Ulf Lindahl, CEO of A.G. Bisset Associates LLC, predicts that the U.S. dollar will fall by around 40 percent against the euro by 2024, citing a 15-year cycle of losses and gains, reports Bloomberg. Lindahl hedges foreign exchange risk for pension funds and family offices in the U.S. and Europe and has helped clients pick up around 100 basis points per year on their portfolios over the last 25 years. “We could see a very substantial decline in the dollar” and “it has massive implications for all the financial markets,” said Lindahl in an interview in August. President Donald Trump criticized Fed chairman Jerome Powell for hiking interest rates even when inflation isn’t a problem, telling Fox Business this week that “my biggest threat is the Fed because the Fed is raising rates too fast.” Historically, gold performs well during times of rising inflation and moves in the opposite direction of the dollar.

Threats

· According to a model tracked by JPMorgan Chase & Co., the probability of a U.S. recession within one year is almost 28 percent, while there is a 60 percent chance of a recession in the next two years. Bloomberg reports that fund managers surveyed by Bank of America Merrill Lynch this month are the most bearish on global activity in 10 years, with 85 percent saying that the global economy is in late cycle. Attila Dzsubak, investment director at MKB-Pannonia Fund Manager who oversees $2.4 billion in assets, said this week that “investors have to start looking for a way out from equities now” and that “past experience shows that exits can quickly become too narrow.” According to Bloomberg, Dzsubak has started to make his portfolio more defensive by purchasing gold, gold equities and ETFs investing in precious metals.

· Bloomberg reports that bond traders can make good money by dumping U.S. Treasuries and going abroad by entering a trade that takes the currency risk out of their euro-based returns. Traders can earn around 3.8 percent a year from ultra-low-yielding 10-year German bunds, which is more than a half-percentage point above Treasuries. Katherine Greifeld of Bloomberg writes that U.S. investors would have done better putting their money into the bonds of any developed nation this year rather than Treasuries. This underscores the longstanding narrative of the U.S. as a go-to destination for yield-seeking bond investors.

· The disappearance and suspected killing of dissident journalist Jamal Khashoggi in Turkey is causing tension between Saudi Arabia and many nations, while others are denying the country’s role in the events. Although there is evidence of Saudi officials closely linked to the prince being at the Saudi Consulate in Istanbul on October 2, the day the journalist disappeared, Russian President Vladimir Putin has questioned Saudi Arabia’s role. Several Wall Street executives and members of western companies have backed out of the Saudi Arabia Future Investment Initiative meeting, including Treasury Secretary Steven Mnuchin, in response to the situation.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of