S&P500, Gold & Oil Trend Trading Charts

Market volatility continues to shake things up making it profitable for traders who are quick to spotting key reversal points, manage risk and taking profits before it evaporates. On Tuesday we saw the market go up and down more than I have seen in a long time… It moved over 5% as it trended up then down in 1% increments as shown in the chart below. Members of FuturesTradingSignals were able to capture a 1-2% gain which may not sound like much but when trading the leveraged ETFs, Futures or CFD's we are making 4-200% profit within a few hours. That being said this type of price action is proof that the market just does not know which way to go and why trades must be very quick to enter and exit positions.

The S&P500 daily ETF chart shows my simple volume analysis during market corrections. During the early stages of a trend, pullbacks are quick and simple. But as a trend matures we start to see corrections become much more complex. We first saw the simple 1 wave corrections in 2009, then we saw a much deeper 3 wave correction which was enough to shake most retail (average Joe's) out of the market before heading higher, and now it looks as though we are headed into a complex 5 wave correction which should be enough to shake out the majority again.

It's important to note that the longer a trend lasts the larger the corrections/shake outs must be in order to get everyone out. From what I am reading and seeing everywhere online are doom and gloom scenarios. In my opinion this is good. One more leg down should be enough to shake everyone before we see a nice 10-20% rally. Once we see that bounce/rally then we can reanalyze the market to see if we are headed back up to test the 2010 highs or if its just a bear market rally. In the end it does not matter as we play both the long and short side of the market.

The Gold ETF continues to unfold as planned. We caught a good chunk of the recent rally and are now in cash waiting for another low risk entry point in the coming days or weeks.

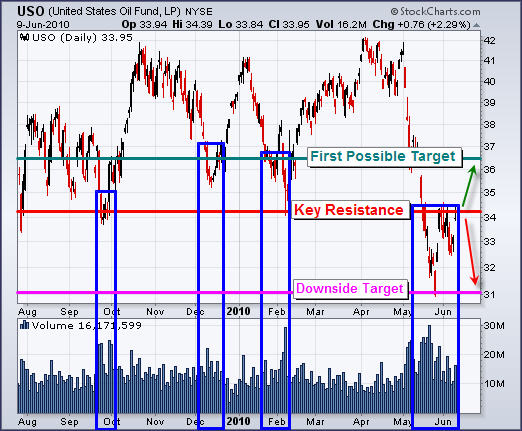

Crude oil Fund (USO) has been struggling to stay up the past 2 months. As you can see the chart below it's trading at a key resistance level and at this point it could go either way… I don't like to get involved in trades when they look to be a 50/50 probability of going each direction. If anything I would think oil will head back down as the US dollar continues its strong rally.

Mid-Week ETF Trading Conclusion

In short, the broad market is in a down trend and selling volume continues to rise. Investors around the world continue to accumulate gold and the US dollar as they seem to be the safe havens for the time being. Oil is also in a down trend and trading at resistance which means we should see lower prices for oil and oil companies and this will weigh heavily on the equities market.

Cash is king and during times of uncertainty that's for sure… It is very comforting to know we are in cash most of the time and only get involved with the market when there is a low risk, high probability setup on the charts.

If trading Gold, Silver and Index Futures and ETFs interested you check out my trading services at www.TheGoldAndOilGuy.com

Chris Vermeulen