Look Which Precious Metal Is Beating Warren Buffett

Way back in January, I showed you that the price of gold had beaten the S&P 500 Index over a number of different time periods, including the month, quarter, year… and even the century (so far!).

Last week it was brought to my attention recently—in a tweet by Charlie Bilello, director of research at Pension Partners—that the yellow metal has also outperformed arguably the greatest living investor, Warren Buffett.

For the 20-year period, gold has returned more than 485 percent, beating Warren’s Berkshire Hathaway, which was up 426 percent.

Granted, gold saw an unusually strong rally in the 2000s, while equities were knocked down hard during the dotcom bubble and financial crisis. But that’s precisely my point. Those who had the prudence to diversify their portfolios during this period—and not just in gold but also bonds, real estate and more—were in much better shape than some other investors.

No Stranger to Silver

Most investors are aware that Buffet is an infamous gold bear. But what some might not know is that he was once a silver bull for a time.

The Midwest, where Buffett is from, has an historical affinity to silver over gold. In 1997 and 1998, Buffet and Berkshire amassed a record silver stockpile of 129.7 million ounces, which actually caused a shortage of the metal and drove up lease rates. In Berkshire’s 1998 letter to shareholders, Buffet wrote that in the prior year the company’s silver position “produced a pre-tax gain of $97.4 million for us.”

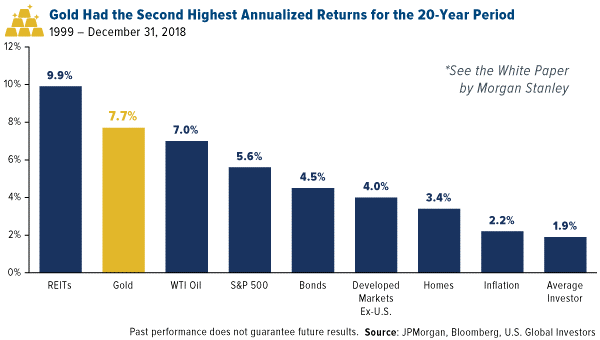

Buffet bought silver when it was under $5 an ounce and sold around the $13 mark in 2006. Turns out Buffet was early to sell, as silver hit its peak of $50 just a few years later in 2011. Why make a big bet on silver and shy away from gold? Especially since gold has been the second best performing asset class, behind REITs, for the 20-year period. Perhaps Buffett will rethink his strategy.

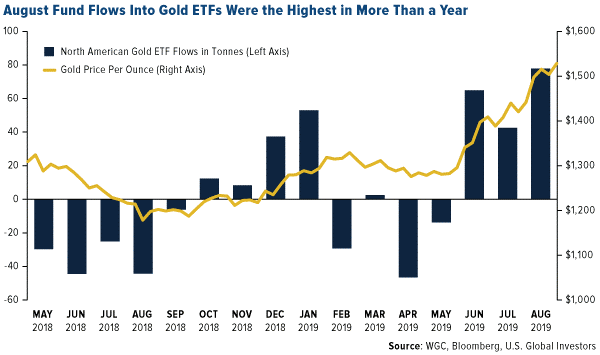

Retail investors are certainly rethinking theirs. We’re seeing greater appetite for gold and gold-backed investments right now as concerns of a global economic slowdown gain momentum. Not only has the price of gold been up for five of the past six months—it’s down so far in September—but August fund flows into bullion-backed ETFs were the highest in more than a year. North American gold ETFs rose by nearly 78 tonnes (2.7 million ounces) last month, totaling 122.3 tonnes worldwide, according to the World Gold Council (WGC).

In India, gold ETFs attracted the most money in more than six years “as investors poured in money seeking safe havens amid record high domestic prices and a slowdown in the economy,” Bloomberg reports this week. August net inflows rose to 1.45 billion rupees ($20 million), the most since December 2012.

Russia’s Gold Stash Is Now Worth More Than $100 Billion

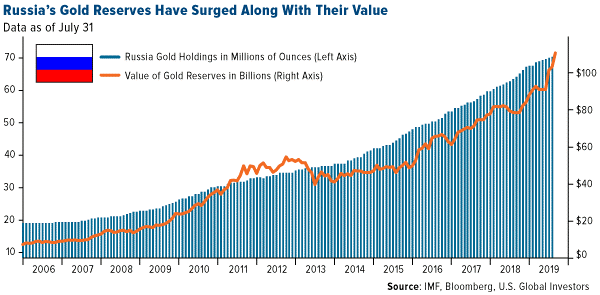

Retail investors aren’t the only ones in accumulating mode. Central banks, led by those in China and Russia, continue to load up on the yellow metal to diversify away from the U.S. dollar. Russia has quadrupled its gold reserves in the past decade, according to Bloomberg, and in the past year the reserves’ value has jumped 42 percent to $109.5 billion.

“There is a massive substitution of U.S. dollar assets by gold—a strategy which has earned billions of dollars for the Bank of Russia just within several months,” comments Vladimir Miklashevsky, a strategist at Danske Bank.

Meanwhile, China has added some 100 tonnes of gold to its reserves since it resumed purchases in December as a way to hedge against the trade war with the U.S.

I’ve made this point before, but it’s worth repeating: China’s official gold holdings represent only 2.8 percent of its foreign reserves as of this month. This is one of the lowest percentages among world banks. Gold held by the U.S., by comparison, represents more than three quarters of its total foreign reserves. What this means is that the People’s Bank of China (PBOC) still has mountains of gold to buy before its finances are adequately diversified. I can see China’s activity lending support for the price of gold for a long time to come.

Citigroup: Gold Could Hit $2,000 “in the Next Year or Two”

Speaking of support, perceived risks of a global recession and the likelihood that the Federal Reserve will lower rates to 0 percent could be enough to push gold up to a record $2,000 an ounce, according to Citigroup.

“We expect spot gold prices to trade stronger for longer, possibly breaching $2,000 an ounce and posting new cyclical highs at some point in the next year or two,” Citi analyst Aakash Doshi wrote in a note dated September 10, and reported by Bloomberg.

I agree with Citi’s projection. Last week I joined fellow goldwatchers Peter Schiff and Imaru Cassanova on Liz Claman’s Countdown to the Close, and I pointed out that gold is looking more and more attractive as central banks pursue easy money policies. When governments offer you a negative rate of return, that automatically makes gold much more appealing. What’s more, I think this easing cycle has just begun.

Are you following our weekly, award-winning Investor Alert? Click here to subscribe.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of