Gold SWOT: Gold Companies Appear Well-Positioned to Capture Higher Margins in 2025

Strengths

- Platinum was the best-performing precious metal this past week, rising 1.46%. Vox Royalty announced the $11.7 million acquisition of a cash-flowing royalty on the producing Kanmantoo copper-gold mine in South Australia. The deal is fully financed through Vox’s credit facility with the Bank of Montreal. Operated by Hillgrove Resources, the mine is located 55 km from Adelaide. The 2.5% NSR royalty is paid monthly and steps down to 0.5% after 85,000 tonnes of copper are produced. Closing is expected within a week.

- Hudbay Minerals rose as much as 12% after the mining company reported first-quarter adjusted earnings per share that beat the average analyst estimate and maintained its full-year guidance, according to Bloomberg.

- For many, a Costco membership is as good as gold—and for some, a membership means buying gold. Just not too much of it. The retailer’s gold bars have garnered much attention since their June 2023 launch. Now, gold has proven so popular that the chain recently placed a one-bar limit on purchases, according to Bloomberg.

Weaknesses

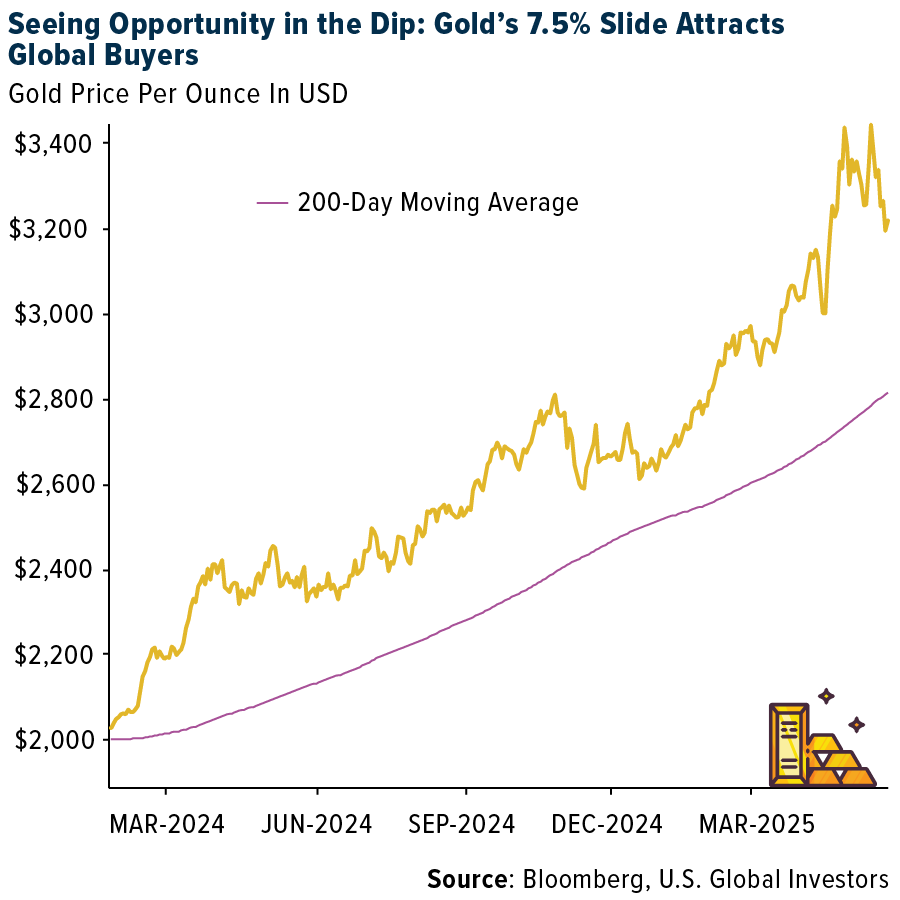

- The worst-performing precious metal for the past week was gold, down 4.72%. Despite the dip in gold prices—driven by easing U.S.-China tariff tensions—it seemed more like a buying opportunity. Rwanda plans to start adding gold to its reserves in July with Basel III implementation. Madagascar announced it will add eight tonnes, and Uganda is partnering with artisanal miners to boost its holdings. Three central banks buying gold during a pullback—and not a word about U.S. dollars.

- Fresnillo has apparently sold the majority of its once-significant ownership stake in MAG Silver, potentially leaving Pan American Silver with an unchallenged path in its bid to take control of the strategic silver asset. MAG Silver recently derisked the project, with commercial production scheduled to begin in 2025.

- A bomb blast in jihadist-ridden western Niger has killed at least eight workers at the Samira gold mine in the Tillaberi region, local sources told AFP on Tuesday. Located in the borderlands straddling Niger and its conflict-stricken Sahel neighbors, Mali and Burkina Faso, the Tillaberi region is a hotbed for Islamist militants affiliated with either the Islamic State group (IS) or Al-Qaeda, according to AFP.

Opportunities

- Mid-cap and senior equities have begun to outperform gold, with select emerging companies also trading well on the back of positive exploration and development results, strategic investments, and M&A sentiment. Price-to-net asset value (P/NAV) ratios for Canaccord’s covered senior and intermediate precious metals stocks now average 0.77x, while their developer/explorer names average just 0.45x. Although 0.77x remains below historical averages, the valuation gap may be encouraging larger producers to use their equity as currency for acquisitions.

- Pan American Silver has announced a definitive agreement to acquire all issued and outstanding shares of MAG Silver, for a total consideration of $2.1 billion. The deal includes 60 million Pan American shares and $500 million in cash, according to Bank of America.

- In short, gold companies appear well-positioned to capture higher margins in 2025, driven by elevated gold prices and expected improvements in operating performance. Valuations still reflect upside potential, as operators are trading below spot gold prices, according to Scotia. Additionally, as cap rates compress amid rising capital costs and with the 30-year Treasury yield hovering near 5%, real estate investors seeking yield diversification may turn to gold mining equities. Cap rates, in this context, can be directly compared to the free cash flow yields of gold and precious metals mine operators.

Threats

- Nearly every factor that could propel gold higher is currently working against it, which is why further gains may take time to materialize. Bullion has struggled to make headway in May following four months of outsized gains. However, with the positive momentum through April still providing some support, any near-term declines may be shallow, and gold could continue consolidating until new catalysts emerge, according to Bloomberg.

- Lab-grown diamonds lost market share in April. Month-over-month, the import value of lab-grown diamonds rose by 53%, while export value fell by 17%, suggesting a delayed inventory restocking cycle, according to Morgan Stanley.

- Precious metals refiner Heraeus reported that a record 597 GW of global solar capacity was added in 2024, consuming 197.6 million ounces (Moz) of silver. Although solar installation rates increased 33% year-over-year in 2024, silver use per gigawatt declined from 429 kilograms (Koz) to 331 Koz—implying a 23% year-over-year silver thrifting rate. Global solar PV growth is expected to slow to 10% this year, reaching 655 GW of new installations.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of