A Golden Gold Stocks Day

The revaluation of gold stocks continues… and does so at a torrid pace. The fiat prices of gold and silver bullion were “smashed” yesterday, yet most miners were barely down and some rallied with gusto!

The US CPI inflation report is today, and the PPI is scheduled for Thursday. Even if these reports are somewhat benign, money managers are beginning to anticipate stagflation from the government’s growing mountain of tariff taxes.

With just small but noticeable upticks in inflation, there appears to be growing US money interest in the miners, and it’s happening as job growth flounders.

What about Donald Trump, aka “Super Donnie Man”? Well, he did clarify that there will be no tariff taxes on gold. He’s working hard to restore law and order to the streets of America. Making the nation more self-sufficient is another solid move but…

As it relates to empire leadership, the US debt-swamped population is simply far too small for that leadership to do anything but fade. Over the coming decades, it will be replaced by the huge gold-oriented populations of China and India.

That’s good news for the stability of gold price discovery. US “fear trade” reports like the CPI and Fed rate meets have outrageous effects on the gold price. There should be $10/oz movements around these items, not $40, $50, $70, and even $100.

Almost nobody in China and India is going to buy or sell gold maniacally simply because government fiat money interest rates move up or down. This is also good news because: Western money managers like stability. As gold price discovery becomes more stable, these managers will become very comfortable with long-term ownership of gold and silver stocks.

Savvy metal bugs in the West need to be sure they are properly allocated to miners now, so that when the institutional embracement begins… they enjoy all the upside action!

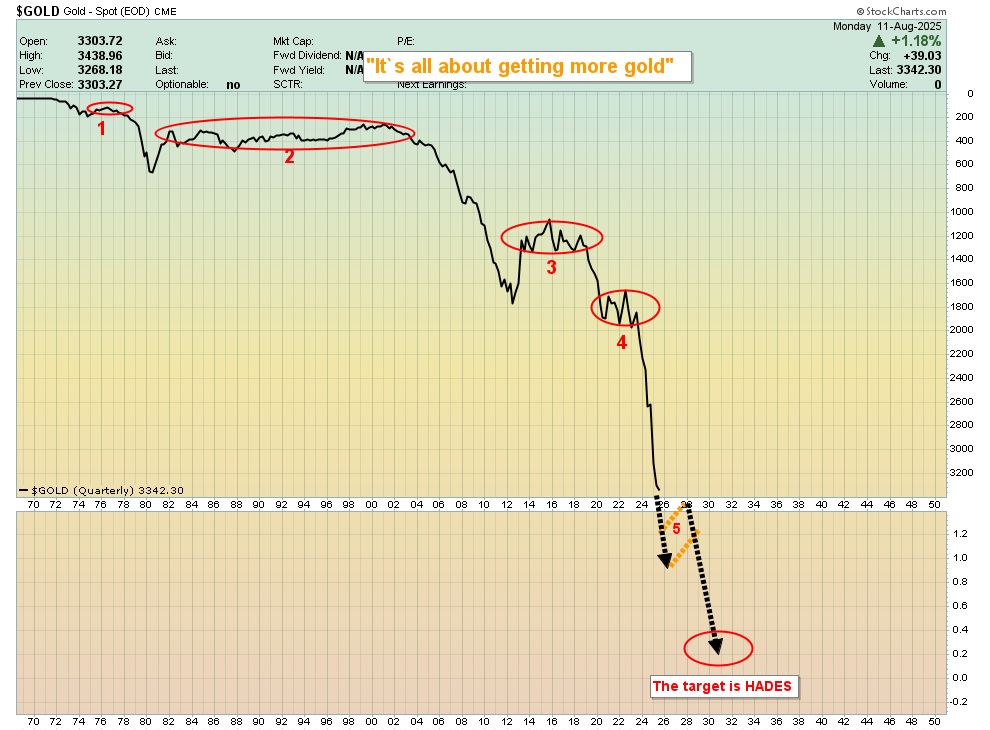

US gold was re-legalized for private ownership in the early 1970s, but it wasn’t reinstated as the nation’s money.

That was a catastrophic error, and arguably evil. Since 1974, most investors have used gold to seek fiat money profits, rather than use fiat to get more supreme money gold.

That’s why most amateur investors are focused on whether gold will break above 3440 or move down towards 3000, rather than identifying key zones where they will buy more gold.

An investor who tries to trade gold to get more fiat will have a very hard time (impossible, really) beating an investor who uses fiat to get more gold.

Suggestion: Investors with no gold should start by buying a modest grub stake at any price. It doesn’t matter if gold is “overbought” or “due for a dip”. Just buy. From there, focus on strategic zones to get more.

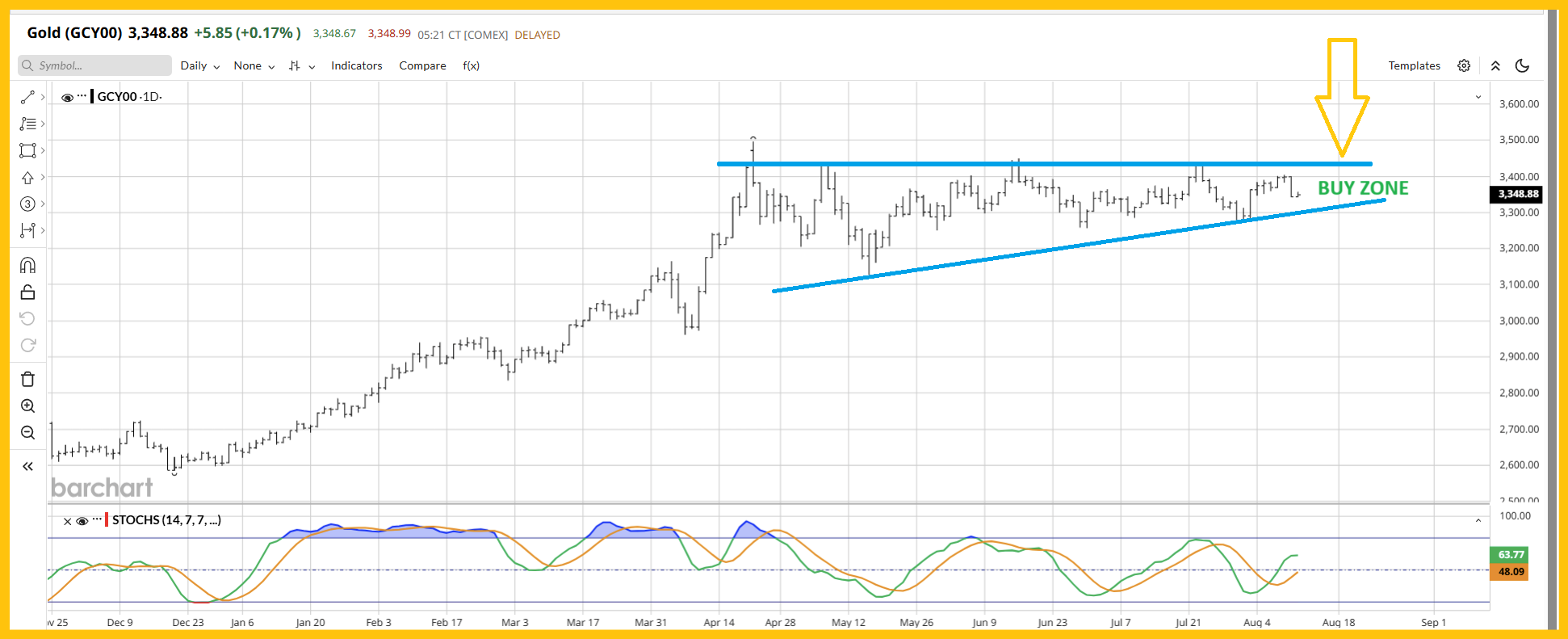

For a look at the next big buy zone for gold:

Professional investors think ahead… far ahead. Currently, the most important nearby buy zone for gold is the $3500-$3300 zone, on a dip into it from $3700-$4000.

This is a stunning junior silver stocks ETF chart. The massive rise in volume bodes well for a breakout over $18… and that breakout would open the door for a surge to at least $30.

For a look at the daily chart:

SILJ is pushing up from a broadening pattern. These formations indicate a loss of control in the market. Will this week’s CPI and PPI show a loss control, related to the tariffs? If so, will money managers surge into the miners, regardless of what happens to gold and silver? It’s likely to happen soon!

This is obviously one of the most spectacular charts in the history of markets. The CDNX rose yesterday… and did it while the US stock market fell, gold sunk $50, and silver tumbled about 70cents/ounce.

Many CDNX individual component stocks staged barnburner rallies and more are coming. Clearly, junior mine stock investing isn’t for everyone, especially with size, but as the gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

The outstanding mining stock action isn’t limited to the junior sector; GDX may be forming another bull flag. It roared back from yesterday’s morning lows and did that while gold closed the day down hard.

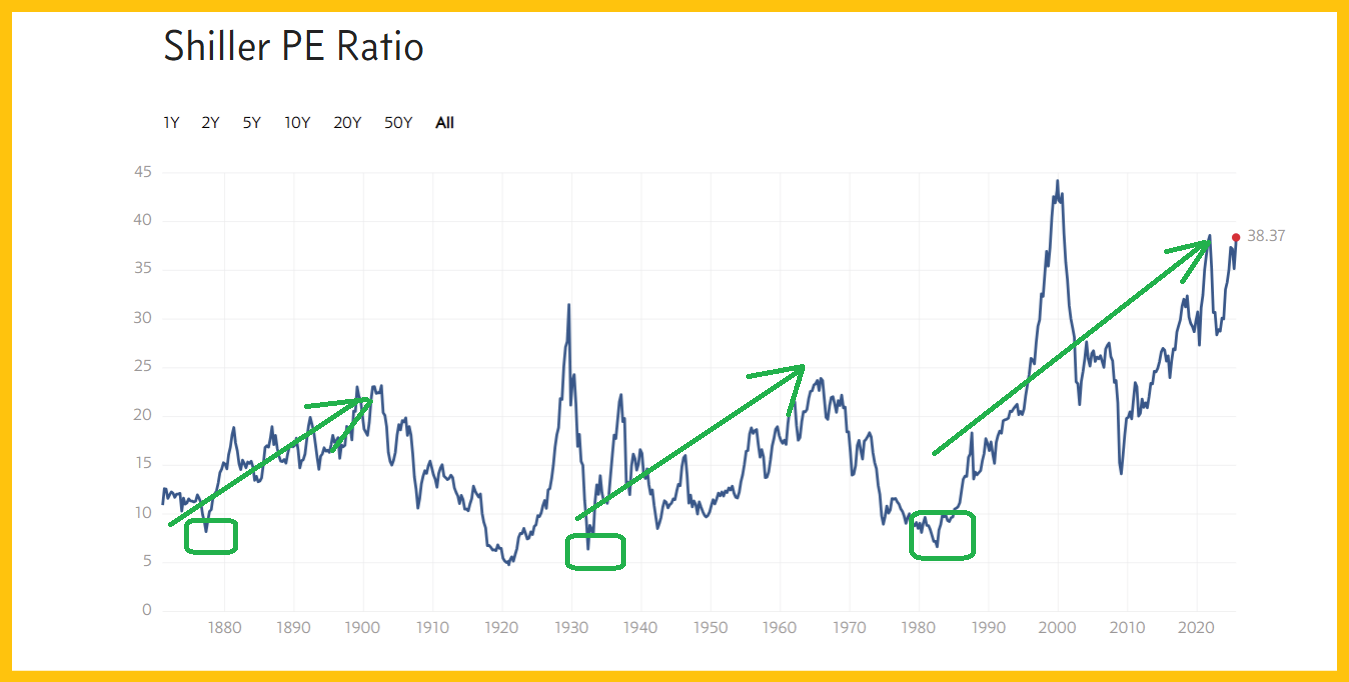

This is the US stock market valuation chart. In a nutshell, the history of the US stock market is the history of three great undervaluation zone buys.

The first was in the 1870s, the second in the 1930s, and the final one in the early 1980s.

From those sub10 CAPE/Shiller great value zones, the US stock market advanced for multiple decades (before collapsing again).

Gold stocks are in a similar state of undervaluation and beginning to come to life.

GDX could rise to $1000, $2000, or even $5000 before the massive 40year inflation and 200year empire leadership cycles see gold stocks become overvalued again. The “Chindian Gold Bull Era Put” will cause analysts to redraw the gold stocks map in ways that are currently unimaginable… and rampantly bullish! There’s clearly only one more thing to say, which is: Have a golden gold stocks day!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: