Indian Gold Jewelry Market Optimistic Demand Will Rebound in H2

Indian jewelry dealers remain upbeat despite headwinds created by higher prices. They expect demand to rebound in the latter half of the year and are aggressively stocking inventory as the fall festival and wedding season approaches.

India ranks as the second-largest gold market in the world, trailing only China.

The India International Jewelry Show (IIJS) ran from July 30 through August 4. The event serves as an important barometer for sentiment in the industry, and Metals Focus sent its Mumbai team to the conference to assess the mood along the jewelry supply chain.

Metals Focus concluded that most market players are optimistic.

“The positive response at the IIJS suggests that manufacturers and retailers expect consumers to soon adjust to higher gold prices and in turn help demand to recover from the weakness seen so far this year.”

The analysts said that retailers have “started to stock up aggressively” for the upcoming season.

“Given that retailers in H1.25 mainly focused on paring down existing inventory, this creates an appetite for fresh purchases. As a result, manufacturers saw increased orders from larger chain stores and independents.”

Gold jewelry is deeply interwoven into India’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

Gold jewelry in India tends to be of a higher purity (22 karat) than that sold in the U.S.

Higher Gold Prices Create Headwinds

The rapidly rising price of gold has put a drag on Indian gold jewelry demand, with many people opting to buy investment bullion in the form of gold bars and coins.

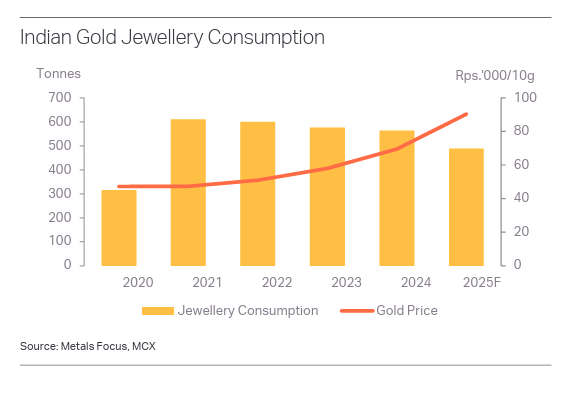

Gold extended its gains in July in rupee terms, remaining the top Indian investment class with a 30 percent gain on the year. Gold has been trading at or around ₹100,000/10g.

Seasonal weakness in June and early July, following the end of the wedding season, put a further drag on jewelry sales.

Metals Focus estimates that gold jewelry demand was down about 21 percent year-on-year through the first half of 2025. Gold consumption for jewelry manufacturing came in at around 160 tonnes in H1. It was the weakest start to a year since Metals Focus began collecting data in 2010, except for 2020 in the midst of the pandemic.

Indian consumers seem to be opting for smaller or lower-karat pieces.

According to the World Gold Council, anecdotal evidence suggests that Indians are monetizing their gold jewelry by exchanging old pieces for new, liquidating it altogether, or using it as collateral for loans. Some companies reported that a gold exchange was involved in as many as 40 percent of their sales.

The Market Adjusts

Even with the slowdown in sales, Indian jewelry dealers are reaping the benefits of higher prices. Listed jewelers posted double-digit revenue growth in the second quarter, despite flat or lower volumes.

Retailers and manufacturers in India have adjusted to the higher price by offering lighter-weight pieces. The goal has been to keep jewelry within specific price brackets such as below Rs0.1lakh (US$1,140), below 2lakh ($2,280), and below 5lakh ($5,700).

While there is plenty of optimism that domestic demand will return, jewelry exporters worry about the impact of a 25 percent tariff on Indian exports to the U.S.

Silver and Platinum Jewelry Demand

According to Metals Focus, the record rupee silver price has not “materially affected” silver jewelry demand. In fact, there has been a surge in demand for less expensive silver jewelry.

Silver jewelry is often sold on a per-piece basis in India and is available in purities as low as 30 percent.

According to Metals Focus, “Higher margins therefore help to mitigate the impact of rising costs.”

There has also been a shift to gold-plated silver jewelry.

“These pieces are available in designs that closely resemble traditional gold products, including certain bridal styles and temple jewelry. With positive price expectations, manufacturers have begun stockpiling in preparation for the upcoming wedding and festive season.”

According to the Silver Institute, retail demand for silver in India rose 7 percent through H1 2025.

Meanwhile, silver imports exploded by 431 percent year-over-year through the first five months of 2025, totaling 544.1 tonnes.

Indian interest in silver isn’t new. It’s just being revived by record prices. Over the last decade, investors have accumulated over 17,500 tons of silver in the form of coins and bars. The country ranks as the world’s largest consumer of silver jewelry and silverware.

Demand for platinum jewelry has also remained “resilient” with fabricators reporting an increase in orders at the IIJS.

“Despite a rally in platinum prices, the metal remains far more affordable than gold. Higher margins associated with platinum jewelry have also encouraged more retailers to stock the metal.”

Metals Focus analysts said they are “optimistic” about the outlook for Indian gold, silver, and platinum jewelry demand in the second half of 2025.

“If the gold price remains broadly stable at around current levels of around ₹100,000/10g, consumers may finally adjust to the elevated price and so return to jewelry outlets.”

********

Mike Maharrey is a journalist and market analyst for

Mike Maharrey is a journalist and market analyst for