Gold: All Good?

Mohammed Ali was known for floating like a butterfly, leading with his left, and then a “bee sting-like” knock-out punch. Similar to how he led with his chin, Mr. Trump stunned the globe on Liberation Day, imposed painful triple-digit tariffs on almost 150 countries, and delivered the knockout blow to a select few, grateful to pay a once unthinkable 15 percent levy and tributes to spend billions in the United States. Japan even went one step farther and promised to lend or invest an estimated $550 billion, or 14% of its GDP. The EU accepted a baseline 15 percent and promised to spend “hundreds of billions” on US goods, which if came to fruition would aggravate an already large trade deficit, that earlier miffed the president.

Today the president has his tariff wall, incoming revenues and Congress passed his beautiful big protectionist agenda. What did he give up? Nothing. America is first. America is winning.

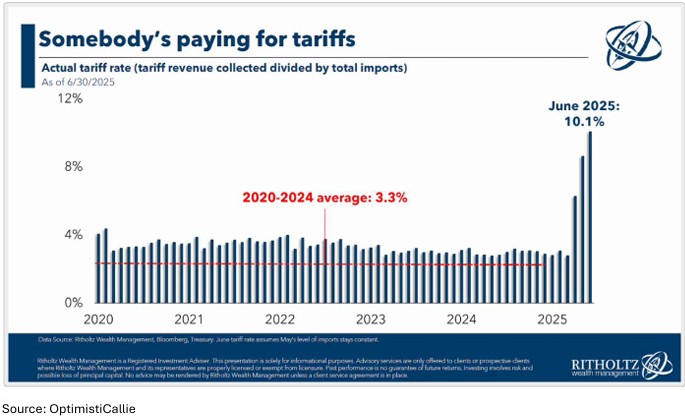

In six months, the president reshaped America and the world. He promised a crackdown on immigration, downsize government and brand-new tariffs. He succeeded despite the doom-and-gloom predictions that tax cuts and tariffs would fuel an inflation leading to higher rates. Interest rates have yet to drop and there still no peace in the Middle East or Ukraine. Inflation though is higher at 2.9 percent but not yet at the devastating levels predicted by us and others. Even with the draconian deportations, the labour market remains healthy but growth is slowing. Higher tariffs on nearly all US trading partners will mean that the US will soon pick up about $300 billion a year in tariff revenues. Markets celebrated vindicating the president’s high risk/high reward agenda that averted an all-out tariff war on economic exceptionalism.

All good?

The Art of Tariffs

We think not. Before he takes his victory lap, much is expected to change. Front-loading inventory building was made possible by the on-off tariffs, which distorted the economic data. The reality is that foreigners aren’t paying. Money does not grow on trees. Tariffs hurt Americans more, with households and businesses paying the cost. America is the chief victim here. More relevant is that this new framework marks a departure from the US tradition of market discipline, rule of law and American power. The president's use of "economic might," such as tariffs, to increase revenues and further geopolitical and diplomatic goals, runs the risk of causing global instability through a free-for-all. In a tit-for-tat reprisal tactic reminiscent of the 1930s, other countries are implementing US-style tariff increases to prevent imports. Moreover Mr. Trump doesn’t keep promises so the joint texts are not worth the paper it’s written on, if they are written down. Besides, the president reneged on his own USMCA deal that he negotiated with Canada and Mexico in his first term.

And, the chairman of all boards’ deal-making has created a de-facto export tax which gives the government an unprecedented 15 percent kickback slice on Nvidia’s and AMD’s critical Chinese chip sales, in a pay-for-play gambit. The Pentagon is now the biggest shareholder in a junior rare earth mining venture, and Mr. Trump's government acquired a 10% share in the faltering chipmaker Intel as part of his new state capitalism strategy. US Steel even gave the government a “golden share,” to win approval for the Nippon Steel takeover. What’s next? Nationalizing Boeing?

His mercantile approach to diplomacy has contributed to the dismantling of the half-century global architecture that saw American interests imbedded in the international economic and financial system, even though the wider long-term impact of tariffs on the global economy and markets is yet uncertain. Ironically, while the US Federal Court of Appeals ruled that his sweeping tariffs were illegal, Trump’s lawyers are warning that an adverse ruling would risk “financial ruin” and an economic depression, setting up a showdown in the US Supreme Court. It is just a tip of the iceberg. In upending the rules of global trading systems, America exceptionalism has become one-sided where the US takes all. Countries must pay for access, maybe 15 percent for now and pledge to invest in the US but receive nothing in return. That will change of course, when the US requires help to finance their big beautiful deficits or fight the next war.

To Trump, tariffs are a beautiful thing, a means to an end, and political tool. Tariffs are used to settle Mr. Trump's scores both geopolitical and personal, causing chaos and disruption. The president had no qualms for example in meddling in another nation’s domestic affairs, when he imposed a 50 percent tariff on Brazil, unless the country cancelled former president Bolsonaro’s charges that he was planning a putsch to overthrow the government (Bolsonaro was found guilty). However like his trade policy, Trump’s blustering shock and awe of realpolitiks has run headlong into the limits of geopolitical reality. The conflict between Russia and Ukraine continues despite the president's pledge to put an end to conflicts. There is currently no ceasefire in the Middle East. He shifted his focus to Asia and left Europe to defend itself yet asked the EU to impose 100 percent tariffs on India and China. The president imposed a 50% tariff on India in retaliation for purchasing cheap Russian oil, hastening the country's reunion with China. On China, there is an uneasy truce but only after China’s near monopoly of rare earths, magnets and critical minerals almost shutdown America’s businesses and military force. And were only eight months into the Trump II term!

China Is the Main Beneficiary

Demand, which is crucial to the global economy, is being harmed by Trump's tariffs, which are pushing prices higher. As a result America’s adversaries are the main beneficiary and now the biggest focus. While there is a de-facto truce with China and with the geopolitical environment fraught with risk, history shows that economies cannot stay stable forever. Wall Street minimizes the president’s postponement of tariffs in the belief that they will drag on and, because markets don’t discount the same event twice, there is an unhealthy market complacency, particularly when artificial intelligence and technology seems to outweigh any near-term economic weakness or, the president’s recklessness. And while complacency is high, consumer prices rose to 2.9 percent in August even though tariffs were only 9 percent. Noteworthy is that wholesale prices surged at the fastest pace in three years, up 2.6 percent over the past 12 months. Tomorrow's consumer prices are determined by today's producer pricing. For now, analysts are factoring a 15 percent levy or $2,000 per household income loss according to Yale’s Budget Lab. With tariffs at the highest in a century, the full effect is yet to hit. Inflation won’t be transitory this time.

In theory the auto industry, the flagship of US manufacturing, was to be the main beneficiary of Mr. Trump’s tariffs. In practice American business is bearing the cost, not foreign exporters. US manufacturing has fallen for six months in a row. General Motors reported that it took a $1.1 billion hit from tariffs and the overall cost is estimated at $4 and $5 billion this year. Due to higher tariffs on components like aluminum, Ford Motor, the second-largest automaker, is at a disadvantage and lost $800 million in the second quarter. Ford manufactures 80% of its vehicles in the United States. Despite record shipments, US-based steelmaker Cleveland Cliffs which is protected by Mr. Trump’s 25 percent levy on foreign steel, recorded a loss of $247 million in the second quarter because higher steel prices also meant lower car sales. Procter & Gamble raised prices to offset $1 billion of tariff costs following tariff-related price increases by Walmart and Best Buy. And it is just the beginning.

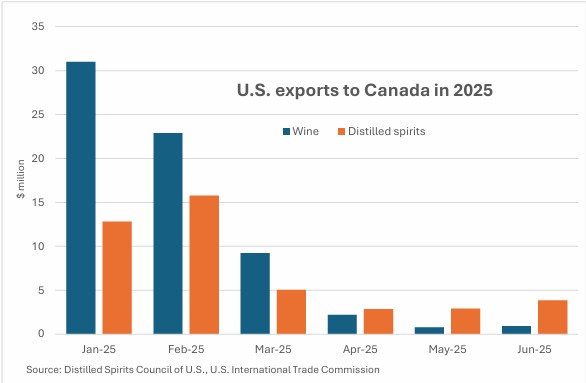

While most countries have capitulated, only Canada and China have retaliated as America’s largest trading partners have yet to sign deals. Canada, major ally and trading partner, pushed back and a boycott of US spirits saw exports fall 62 percent in the first six months. Ontario imports nearly $1 billion of US wine annually and Canadian trade to the US is down. Even though Mr. Trump's tariff battle is just getting started, growth is being hurt because American consumers and businesses are having to pay more for their goods than those from other countries. The only certainty is uncertainty.

Trump’s Tariffs Meet Reality

And how about those revenues? The US imports about $4 trillion annually or 14 percent of the nation’s economy and in imposing 20 percent tariffs would net about $500 billion not even covering the interest cost on their debt and well short of paying for the US deficit. Producers or exporters must either absorb the increase or more likely, pass the increase along to inflation-shocked consumers. Although tariffs are only beginning, expectations are that a dollar spent on tariffs is a dollar lost, with fewer dollars to recycle into US financial assets. Tariffs lower profit margins for companies, but they must eventually be made up for through reductions, layoffs, or, most likely, passed on. In essence Mr. Trump’s tariffs is a VAT tax or HST that reduces consumption which is anti-growth and the resultant slower economy will reduce demand with higher prices for housing, cars, drug plans, clothing and computers.

On the other hand the president believes that his big beautiful bill will turbocharge economic growth and lower inflation through reduced energy prices but the prospects of a massive amount of stimulus through a grab bag of new spending, does nothing for deficit reduction. The Fed’s dilemma is that the massive amount of bonds from successive rounds of quantitative easing and now Mr. Trump’s spendthrift-type plans needs to be financed while some $9 trillion of existing Treasury debt comes due over the next 12 months. With US debt surpassing $37 trillion, the runaway debt picture has interest costs alone at $1 trillion, surpassing America’s spending on defense. Money supply (M2) grew 4.5 percent in June to a record $22 trillion, for the twentieth straight month of increases. The July deficit was a whopping $290 billion despite that tariffs are nine times higher than last year and the highest since the Great Depression. The fiscal deficit is heading for 8 percent of GDP. We know how that ended.

Mr. Trump's big beautiful bill is more about extracting wealth than creating wealth, a novel form of income distribution – take from the poor to give to the rich. While the tariffs and tax cuts were a big part of his bill, little was said about energy, except for scrapping his predecessor’s incentives to encourage more renewable energy, in the form of electric vehicles, solar panels and credits which ironically will hurt Mr. Trump’s made-in-America artificial intelligence revolution that needs more power. Mr. Trump has reversed the decade-long shift to clean energy and instead is maintaining and escalating the usage of fossil fuels. The world is going the other way, encouraging more renewable energy, out of necessity as new temperature records are set.

Although China remains the world's largest consumer of fossil fuels, the world’s second largest economy has scaled down its coal and oil usage. China currently controls more than 55 and 70 percent of global mining and processing of critical minerals respectively. China dominates the clean tech supply chain from solar to EV’s and, renewables are a national priority. In fact, China has a surplus and an overcapacity of electric vehicles with autonomous cars costing less than $20,000 and Xiaomi, China’s largest smartphone maker producing EVs every 76 seconds. Chinese investments account for the majority of wind, solar and waste to energy projects in the world which importantly reduces China’s dependency on foreign oil. Even Saudi Arabia which is heavily reliant on oil has made massive investments in renewables. Mr. Trump’s America is a different story. Energy is a common denominator among nations and the winners will be those who can produce energy at a cheaper cost than others. America is not exceptional here.

Don’t Shoot the Messenger

Erika McEntarfer, the commissioner of the Bureau of Labor Statistics (BLS) which collects economic data was fired for publishing disappointing non-farm payrolls at 75,000 jobs as well as routine downward revisions of previous months which not surprisingly reflected the slowing US economy from the DOGE firings. Mr. Trump also wants to force Fed Chair Jay Powell to quit because he has not lowered rates. That the truth can hurt is given less importance by the Trump’s administration interest to manage the message. In Mr. Trump’s new world, science, data and now its institutions are being discredited. In shooting the messenger, the president’s norms damage the pillars of trust and independence in American financial system and is a gift to America’s enemies, at a time when America needs to finance its deficits with help from foreign investors.

While Mr. Trump was elected to increase American’s income and reduce inflation, his tariffs won’t help him achieve both. Today's US government needs to borrow more money, and America's financial credibility is being ruined by Mr. Trump's intention to replace Fed Chair Powell, whom he first nominated during his first term. Fed Chair Powell has not co-operated, and at Jackson Hole said it would be best to wait to see if tariffs would push up inflation. He noted, “risks to inflation are tilted to the upside, and risks to employment to the downside.” While households and business believe that central banks will do what is needed to bring inflation down, the firing of Mr. Powell would remove a potential independent check on government finances and of course inflation. Although the Fed kept rates at 4.25 percent to date, the former real estate baron would like to see them at 1 percent which would be the lowest on the planet. In firing Fed Governor Lisa Cook whose term expires in 2038, Trump is trying a workaround to stack the Federal Reserve Board with loyalists who will force Fed Chair Powell to deliver a looser monetary policy, exactly the wrong move at the wrong time. Such a move would mark a seismic shift putting yet another department under White House control, giving him management of America’s printing press and $37 trillion debt. Noteworthy is that fears of the Trumpian habit of shooting messengers extend beyond trade and tariff policies. History shows that the more politics enters into interest rates, the more volatile inflation is likely to be, and the more compensation investors at home and abroad will want for that risk.

The threat to eliminate the world’s most powerful central bank’s independence and hand control of the money supply to politicians, draws comparisons with Germany in the Twenties, or Argentina’s last decade, or Turkey’s President Erdogan’s sackings of his central bank chiefs for failing to lower rates, which ultimately led to even higher rates, soaring inflation and a lower Turkish lira, forcing Erdogan to raise rates. Similarly, US history showed that President Harry Truman’s pressure to peg interest rates during World War II and maintain low interest rates during the postwar boom, caused chaos and inflation to spike. Then there was the pressure of Richard Nixon strong-arming Arthur Burns who acquiesced and pumped up monetary policy to aid Nixon’s re-election in 1972, but shortly thereafter, the resultant economic chaos drove up inflation, requiring Fed Chair Paul Volcker to clean up the mess. Decades of fiscal profligacy can’t be fixed by firing the Chair, or tariffs, or a Turkish-style monetary expansion. Needed is a return to fiscal responsibility and spending reductions.

Delusions of Hegemony

President Trump has taken control of everything from food, to politics, to universities, and corporate America, ironically borrowing from China’s playbook of state-run capitalism. Worse, his expansion of presidential power over once independent agencies like the Fed or DC police and now the Bureau of Labour Statistics raises investor uncertainty over the politicization of freedom and free markets, allowing him to pick winners and losers which weakens the entire basis of trade and business. Science, transparency, rule of law, evidence-based thinking has been cast aside. There appears no guardrails or red lines here, except for the economy and stock market. What about the mid-terms? While Donald Trump’s approval ratings have dipped, the Democratic party has fallen further, problematic since both parties have resorted to a redistricting war (gerrymandering) after Mr. Trump asked Republican controlled Texas to redraw the map to find five seats in the Republican controlled House.

Around the world, opinions on the US are changing. While the US pulls in its horns, imposes tariffs on foes and allies alike, the nation has become fundamentally more isolationist leading to the advent of a multipolar world order. The downside is that the era of US leadership is past whilst China has become a peer. After three rounds of protracted talks, China’s negotiations have taken a different tack from the point-by-point negotiation of others. Neither side can be bullied because the stakes are high. China’s tactics of pauses, export controls, focus on critical mineral strength and symbolic concessions (steel limits) is all part of an orchestration or elaborate multi-dimensional approach to the talks. The US has adopted a different approach, even relaxing once secure technology restrictions as Mr. Trump pushes for a summit with President Xi Jinping.

To that end China’s different direction capitalizes on Mr. Trump’s retreat from global multilateralism with the centre of gravity shifting. As an example, BRICS has expanded in size and scope with China’s Belt and Road Initiative (BRI), a major source of investment for developing countries, extending China’s economic and political reach across the globe. New trade settlements today are in renminbi and not dollars. In the first six months of this year, Chinese construction contracts and investments in the BRICS bloc of emerging countries totaled $124 billion in the first six months of the year, up from $122 billion all of last year. Trump’s tariffs have forced countries to explore elsewhere for markets and investment alternatives. Semi-conductors are at the center of the trade spat between Washington and Beijing as both countries compete to create the most sophisticated AI computers. American sanctions and tariffs have backfired with China tripling total output for next year while the US struggles with capacity as well as lacking a domestic rare earth supply chain for magnets and minerals used in electric vehicles, smartphones and fighter jets.

Will that mean a relaxation of restrictions and rapprochement? Will the world’s two largest economies escape the Thucydides Trap? We think not. We live in a hostile world. Distrust and fractious ties between China and the US, together with the US abandonment of the global order exacerbates relations increasing risk and miscalculation. Graham Allison, the Harvard professor noted that rising tensions between the two superpowers risks falling into the Thucydides Trap when a hegemonic ruling power was threatened by a up-and-coming rival, that at least in 12 of past 16 cases, the result ended in bloodshed.

What Damages Trust in the US Damages the Whole World

To be sure the pace of de-dollarization has picked up as building relationships have given way to a zero-sum game of trying and figuring out the next round of tariffs or the President’s next unpredictable move while he reorders global trade. Today trade, supply chains, semiconductors and currencies are being weaponized. Having broken the laws of diplomacy, Trump has also smashed the laws of economics weaponizing finance, trade and media to get his way. We are even entering a new paradigm as America embarks on a significant experiment of state-run capitalism and intervention with tariff walls and an end to the multilateral trade globalization that America helped create. Money however is mobile and there is more capital leaving than coming into the US at a time when foreigners hold almost 25 percent of US debt.

Tariffs aren’t enough. America's excessive debt issuances will continue to require foreign funding. Cutting spending requires compromise but that’s unthinkable in Trump’s world. Given that required expenditures on Medicaid, Social Security, and Medicare which account for two-thirds of the budget and the greatest spending package in history aims to reduce taxes on wages, companies, and even tips, the deficit's rise will in our opinion unleash powerful inflationary forces. Debt service cost alone is $1 trillion, more than they spend on defense. Despite this, tariffs are expected to generate only $300 billion, which is not enough to cover the $1 trillion economic damage or finance the $2 trillion deficit. After half a century of mostly balanced budgets, America has operated a reckless financial system whose main characteristics is a rising stock market and deficits, fueling financial bubbles for decades. Making Americans pay more via tariffs won’t fix a broken system which makes an accident ever more likely to happen.

Coincidently the dollar’s 10 percent retreat this year was one of President Trump’s goals which ironically will end up boosting inflation. America’s finances are in disarray with the country living beyond its means, depending on foreigners to pay its bills that undermines the fundamental source of its strength, especially when the US deficit skyrocketed to $291 billion in July in spite of tariff income. Without a plan to pay it off, the risk of an old-style fiscal crisis will force America to inflate their way out of their big debt problem. Trump’s bill is big, not beautiful.

At the same time the centre of gravity has shifted elsewhere as foreigners scramble to reduce dollar exposure, the heart of American power and hegemony. China’s State Administration of Foreign Exchange for example noted that dollar payments have declined from 80 percent in 2010 to 40 percent in 2024, while renminbi payments have increased to from nothing in 2010 to 55 percent in 2024. Coincidentally the share of US dollars in central bank reserves have declined from 71 percent in 1999 to 58 percent last year (gold’s share rose during the same period). Of concern is that while China weaponized its dominance of rare earths and critical minerals, the country has yet to weaponize its role as the world’s biggest creditor on the world’s biggest debtor.

As a result, the dollar's decline and its use undermines the foundations of America's economic might, making the Fed's funding issue unsustainable. Any realignment would accelerate if Mr. Trump gains control of the Fed giving the president the power of the pen. Maybe there is method in Mr. Trump’s madness. If the president gains full control of the Fed and its money printing machine, rates will fall which would reinforce a Wall Street rally for the ages. That would be good for stocks, but bad for the dollar and inflation. That is how hyperinflation starts. Already rates have widened on investor uncertainty as the king of debt looks to refinance America’s debt with unorthodox means. Crypto currency anyone?

Crypto: Good, Bad and Ugly

Crypto is another familiar reinvention of money, this time with computer code, all too reminiscent of 2007 when advocates of derivatives descended on Washington with a gift that would financially solve the nation’s housing ills After the 2008 bubble burst, sinking Wall Street giants Bear Stearns and Lehman Brothers, Wall Street’s implosion of "derivatives of mass destruction" in the form of CDS or sub-prime mortgages caused the Fed to intervene with bailouts and money printing to save the economy. Financial history shows that financial innovation, when left to its own devices can leave wreckage in its wake, exposing the fragilities seen in money markets in past crises.

We believe that America is flirting with the next financial crisis as they nudge the newest derivative, crypto tokens into the financial arena. Investors forget the previous lessons of using accounting trickery to get something for nothing and that bigger returns from the digital crypto currency or token market is fraught with risk. Crypto is an asset but with no intrinsic value, devoid of real-world uses. They are different but dangerous. Value is dependent on selling to someone else, preferably at a higher value or a greater fool. Ironically its supporters are the same who helped finance Trump’s election and not surprisingly then, the Trump administration has promoted privately issued tokens and legitimized stablecoins which is backed by a dollar or Treasury debt, which coincidently creates a brand-new source of demand for Treasuries to help finance America’s growing debt. The president’s World Liberty Financial, a family backed publicly listed company raised financing as a treasury platform merely to buy up to $1.5 billion of the president’s crypto tokens. The Genius Act, the first cryptocurrency law ever passed by Congress, was passed in July. It creates a regulatory framework for dollar stablecoins that are linked to Treasuries or have a 1:1 relationship to the dollar. We recall when dominant players, Tether’s USDT and Circle’s USDC, briefly fell broke their $1 peg wiping out $55 billion, so crypto may not be the expected panacea.

As the Fed tries to finance its increasing amount of US government debt with fewer and fewer participants, we think cryptocurrency is just another card in the US house of cards. We think that, if left unchecked, stablecoins that are based on the dollar, a fiat currency, endangers the public's faith in money and bear a striking resemblance to the bubble-like systemic dangers that preceded the 2008 collapse of sub-prime mortgage products. Currently there are $290 billion odd stablecoins in circulation as part of the estimated $4 trillion global crypto market, compared to only $120 billion after the collapse of FTX in 2022, the first crypto exchange fraud. To be sure, that will not be the last.

Not surprisingly then after a decade of ultra-loose monetary policy, crypto is multiplying the financial risks as an alternative to money. Because it can be transferred across the internet and remains outside the banking system, crypto can be hacked but often used by rogue states. And tellingly, crypto must increasingly be supported by newer and newer issuances and now with the government’s support, the bubble is set to burst. Mr. Trump even signed an executive order opening up the $9 trillion 401k retirement market to crypto, moving it closer to mainstream usage. However in opening the asset class to pension funds and retail investors as a dollar alternative, the geopolitics of crypto also lessens the role of the Western backed SWIFT payment system, and dollar dominance itself. What then?

Cybercurrency like the dollar is a private liability, backed by confidence or now stablecoins. The anonymity of cryptocurrency holders, its online transferability, and its ease of use by criminals and money launderers are the main reasons for its appeal. Crypto does not meet any function as a mode of exchange nor store of value and lacks an issuer. A hallmark of speculation, the market's popularity is reminiscent of a pyramid scheme, where investors are always hoping that others would value an asset even more and be willing to pay more. Cybercurrency may well represent financial innovation but to us, it is just repackaged old risks. Caveat emptor.

The Best Trump Trade is Gold

Noteworthy is that other central banks have yet to embrace the “Made in America” tokens, but the creation of digital currencies by others is not far off, bringing up jurisdictional differences, regulatory arbitrage and sovereignty issues. What about America’s big gold stockpile? We believe that to tackle America’s rising debt load, the government is trying to finance its deficits with tariffs and crypto, because its stockpile of gold is already encumbered by record debt. Inflating their way out of debt in the past five decades has been an alternative and given its penchant to spend, crypto is the next big thing.

Money has been around since cavemen exchanged stone wheels as currencies. Money has intrinsic worth, as a store of wealth. But it is not permanent. Once before, the British pound sterling was the world’s currency because of Great Britain’s industrialization, leadership and hegemony. However, with the onset of the Second World War, Great Britain lost its dominance as the world’s leading power because its debts piled ever higher from fighting the war which weakened the pound, paving the way for its replacement, the US dollar. For most of the post war period, the Bretton Woods agreement guaranteed the international value of gold at $35/oz, fixing the exchange rate of currencies to the US dollar. The dollar was as good as gold. But then in the Seventies, American spending for the war in Vietnam and President Johnson’s social programmes led to the Great Inflation, forcing President Nixon to sever the dollar’s convertibility into gold, because too many creditors were demanding gold for their dollars, disrupting the flow of finance. Without the linkage to gold, the dollar devalued, and backed by only the “good faith” of the United States government, the dollar became a fiat currency. In the years that followed, the US was a huge importer of goods and services, flooding the world with dollars. Gold rose from $35/oz to more than $800/oz in the next decade, reflecting the loss of ninety percent of the dollar’s purchasing power.

Today the dollar remains a “fiat” currency, yet the dollar remains the keystone of the global monetary system. As a result, America can pay its bills enjoying a virtual unlimited line of credit, denominated in its own currency. And again as before, deficits are higher today but this time the US has less geopolitical and economic leverage than before. Today at $37 trillion, America’s debt is the world’s largest and after fighting wars in Afghanistan and Iraq, repairing the economy from financial crises of 2008 and subsequently Covid 19, the United States has serious financial problems.

Because America has been living beyond its means and has turned to money creation and debt monetization to keep the economy afloat, it is no surprise that the dollar suffered its worst performance in fifty years. Today Mr. Trump’s big spending on tax cuts and military has sapped America’s resources, threatening the loss of this “exorbitant privilege” that underpins America’s economy. America’s debt is its Achilles heel and because the US consumes more than it produces, owes foreigners much more than it owns abroad, America’s financial hegemony and the structural weakness of the dollar as a medium of exchange is vulnerable.

All good?

Another day, another record as gold powers through $3,600/oz. Gold has no limits, it is subject to supply and demand. As the dollar loses its store of value function, gold is the alternative because historically it is a trusted store of value and cornerstone of financial security for institutions and individuals alike. Gold is the world’s second largest reserve asset at 24 percent, surpassing US Treasury holdings for the first time in 30 years. China has added to its reserves for the tenth straight month while gold miners have become precious and for some countries, a critical mineral. Currencies are tied to the dollar in a hostile world and escalating doubts about the disorder in America, and its leadership has undermined confidence in the dollar. Without confidence in the dollar, the world has no reserve currency.

Gold has been a store of value for thousands of years and lately as an index of currency fears. It is a protection against inflation and an asset of last resort. In the past decade gold is up 219 percent and rallied more than 37 percent this year as investors sought safety from geopolitics, trade wars and Trump. Our view is that the best Trump trade is gold. Whilst Trump’s remake of America will make inflation hot again, the consequences will linger for many years. Gold rose 2,300 percent from $35/oz in 1971 to $850/oz in 1980 reflecting the deterioration of the US dollar after a decade of Great Inflation and collapse in confidence. In 1999, gold rose from $252/oz or twenty years after its peak, topping $1,900/oz in 2011 for a 653 percent increase following the burst of the tech bubble and 2008 financial crisis. While $3,600/oz may seem high, it is only 89 percent above the 2011 peak at $1,900/oz. This time we expect gold to reach $4,000/oz on an interim basis. Gold is the new global currency.

Recommendations

According to the World Gold Council in Q2, gold miners produced about 909 tonnes of gold while there was 1,249 tonnes of demand led by central bank and ETF demand. The deficit was met by recycling. There are supply problems as peak gold has arrived. China is the largest producer in the world as well as the largest consumer, yet China needs more gold. Consequently reserve replacement has become a major problem for the gold industry because few have replaced declining reserves. Newmont, the world’s largest producer faltered by acquiring Australia’s Newcrest for $19 billion in the hope that bigness was best. They were wrong and overpaid, taking on other people’s problems. Nonetheless we expect additional deal-making activity and rather than the big seniors, the smaller players like the developers’ brownfield projects will garner more attention and performance because they will be among the first to pour gold within the current gold cycle.

Among the seniors we like Agnico Eagle and Barrick for quality of Tier One assets. We particularly like the developers such as B2Gold and Eldorado which are bringing on production in the current cycle. We like Lundin Gold and Endeavour as future participants in the M&A game.

Agnico Eagle Mines Ltd.

Agnico posted a strong quarter producing 866,000 ounces from La Ronde, Malartic and Fosterville in Australia. Agnico is the premier Canadian producer with mines in Canada, Finland and Mexico and has organically grown its production through underground development of Canadian Malartic and Detour Lake. Agnico also acquired nearby Marban to send feed to the Canadian Malartic mill. Agnico reported $1.3 billion in free operating cash flow in the second quarter and ramped up its buyback of shares. Record free cash flow allowed Agnico to reduce debt and the company has a strong balance sheet with net cash position of almost $1 billion. Looking ahead we expect a growing production profile from Hope Bay, San Nicola and projects like Hammond Reef. At Odyssey, Agnico has 26 drills turning. With a low political risk profile, organic growth prospects and an astute management team, Agnico is a buy.

Barrick Gold Corp.

Barrick had a solid quarter with cash flow at $1.3 billion from Lumwana in Zambia and improvements at Nevada Gold Mines JV and ramp ups at Pueblo Viejo. Goldrush and the development of Fourmile are Nevada priorities. Barrick sold their last gold mine in Canada, Hemlo for $1.1 billion. As expected, the company wrotedown Loulo-Gounkoto (10 percent of Barrick’s NAV) due to the Mali government's seizure of the mine, citing unpaid taxes which Barrick opposes. Barrick is proceeding through arbitration, pursuing the renewal of its contract and the shares have adequately discounted the nationalization move. At Reko Diq in Pakistan, Barrick is looking for $2.5 billion to advance the project while it finalizes engineering. Reko Diq is considered one of the largest undeveloped copper/gold deposits in the world, projected to generate some $70 billion in free cash flow over its lifetime. Slated to begin in 2028 at an estimated Phase I cost between $4 to $5.6 billion, Reko Diq’s geopolitical risks is partially derisked by Barrick’s recruitment of various levels of government participation. Today Barrick has the largest array of Tier I assets and has organically replaced reserves. We continue to like the shares here.

B2Gold Corp.

B2Gold’s operating cash flow in the quarter was $300 million with improvements from Fekola, Masbate and Otjikoto that helped exceed production estimates. B2Gold is bringing on the Gramalote open pit project about 230 km northwest of Bogota in central Columbia. A revised Feasibility Study included capex at $740 million for a payback period of 3.4 years. Gramalote could produce 227,000 ounces over the first five years and 177,000 ounces over a 13-year mine life at AISC of $985/oz. B2Gold also advanced the Fekola Regional Project now that permits have been signed with the Mali government, allowing for underground development and a 2026 start. Importantly the miner announced first pour at the Goose open pit and underground mine in Back River Nunavut. Goose’s production will be around 120,000 and 150,000 ounces for the first six years, ramping up to 300,000 ounces per year based on a 2.5 million reserve. B2Gold has $800 million available in its revolver and drew down $200 million in June. Full year production should be about one million ounces with the Goose contribution. We like the shares here for its strong mine-building team and rising production profile.

Centerra Gold Inc.

Intermediate player Centerra Gold had a solid quarter but prospects are limited because of the lack of a flagship asset. Mount Milligan produced about 35,000 ounces in the quarter and Öksüt in Turkey 28,000 ounces. Meantime the Thompson Creek restart and molybdenum business was a cash drain again and, ironically Centerra is looking to expand its moly business despite mediocre returns. Looking ahead, the company surprisingly will proceed with the modest Goldfield project located in Nevada and is working on a PEA. Goldfield has a short seven-year mine life producing an average 100,000 ounces annually at AISC of $1,400/oz with capex of $252 million. Centerra also spent $28 million for a 9.9 percent interest in Liberty Gold for its Black Pine oxide gold project. Moreover, the company has dusted off Kemess exploring whether they can bring Kemess back into production. All in all we think the company is taking good cash flow to build modest properties with modest returns. We prefer B2Gold instead.

Eldorado Gold Corp.

Mid-tier player Eldorado Gold produced 134,000 ounces in the quarter earning $90 million or $0.44 per share with solid contributions from Lamaque and Kışladağ in Türkiye. Cash flow was $202 million but a large part went to build out the big Skouries copper/gold project in Greece, which is nearly two thirds complete and progressing as planned. Eldorado will spend $400 million to $450 million this year but has liquidity of $1.1 billion. We like Eldorado here for Skouries’ future contribution. Eldorado has a new president, industry veteran Christian Milau. We like the shares here.

Endeavour Mining PLC

Endeavour is the largest gold producer in West Africa with mines in Senegal, Burkina Faso and Côte d’Ivoire. The company had a strong quarter producing 647,000 ounces at AISC of $1,200/oz and recorded half a billion in free cash flow despite heavy tax payments. Production was slightly ahead due to the BIOX recovery at Sabodala-Massawa. Although Endeavour shares have lagged because of its West African exposure, the company has been able to deal with various governments and bring mines on stream and on time. The company has wide profit margins, growing production profile and attractive projects like Assafou, Houndé and Lafigué. We like the shares here.

Kinross Gold Corp.

Kinross Gold recorded record free cash flow of almost $650 million and first half of almost $1 billion. The company is on track to produce 2 million ounces at an all-in cost of $1,500 per ounce helped by better grades from Tasiast and Bald Mountain. Paracatu in Brazil had a strong quarter producing 149,000 ounces and La Coipa showed improvement. At Great Bear in Ontario, Kinross continues to sink money in this big project but the project is too far off in the future to affect near-term performance. Brownfield projects Curlew and Phase X are exceptions. While Kinross has a 26 million (M&I) resource base, the miner has a flat growth profile, and thus we prefer B2Gold here.

IAMGOLD Corp.

IAMGOLD continues to build out Côté Gold which produced 96,000 ounces helping generate $140 million of free cash flow. The balance sheet has cash of $220 million against net debt of $1 billion which the company stretched to fund Côté. Westwood produced 29,000 ounces and Essakane produced 77,000 ounces. As a result IAMGOLD is on track to produce 735,000 to 820,000 ounces this year at AISC of $1,900/oz. However we believe inevitable teething problems at Côté and higher costs will haunt IAMGOLD. We prefer lesser risk Eldorado here.

Lundin Gold Inc.

Lundin Gold had a strong quarter at Fruta del Norte (FDN) in Ecuador. Lundin has a strong balance sheet with almost half a billion dollars in cash and no debt. Not only that, Lundin has a new discovery at Trancaloma and Sandia, close to nearby main workings which may be a brand new copper/gold system as part of a huge porphyry system. Trancaloma drilling confirmed earlier results and nearby Sandia is 2 kilometers east of FDN. Lundin has AISC at less than $1,000 an ounce and is a cash flow machine with grades between 9 and 10 grams. Cash flow from operations was $255 million allowing a boost in the dividend. Of interest is that with its huge cash position, the company is expanding its drilling program outlining FDN east and a corridor along Trancaloma, Sandia and Castillo on the western border of Bonza Sur. We continue to view the shares a buy for its long-life outlook and exploration upside.

New Gold Inc.

Mid-tier New Gold had a disappointing quarter producing almost 79,000 ounces. Cash costs were higher however and the balance sheet has a net debt position of $428 million. While New Gold generated free cash flow of $60 million, New Afton and continuing problems at Rainy River hurt results. Rainy River’s open pit life will give way to a more expensive underground operation so grades are important. New Afton’s east extension should help. Nonetheless we view New Gold a sell.

Newmont Corp.

Newmont generated great headline free cash flow but problems remain with their legacy assets inherited from misspent acquisitions. The world’s biggest miner produced 1.5 million ounces in the second quarter after the sale of non-core assets and billions of writedowns. The good news is Newmont completed the sale of almost all non-core operations at attractive prices for a total of $4.3 billion, except for Coffee which is still for sale. Lihir’s production is expected to decline after a good quarter and Peñasquito in Mexico had better grades but still has a cost problem. Costs in fact are a problem for Newmont with them guiding a whopping $1,600/oz AISC, up from $1,400/oz. Looking ahead Boddington is a turnaround situation but the Red Chris cave-in disrupted production. Newmont reported a budget of $1.8 billion of which a good part is for maintenance and sustaining capital rather than organic growth. Finally Newmont has embarked on an overdue efficiency move but debt stands at $7.4 billion. Consequently, we prefer Barrick here.

John R. Ing

********