This Rising Wedge Spells Trouble. Big Trouble.

It’s like yesterday, but with an additional SELL signal for the miners. Here’s why:

Shutdown Drama, Market Reality

That’s what I wrote on the USD Index - quoting:

The fact that we did see the government shutdown doesn’t change that much. What matters is how long it will remained shut down. And I don’t think that this will happen for any reasonable amount of time. I view the current closure as a hard-ball negotiation pressure and… well, another part of the political theater. I fully expect this to be reversed any day now.

And apparently, the markets are catching up to this as well.

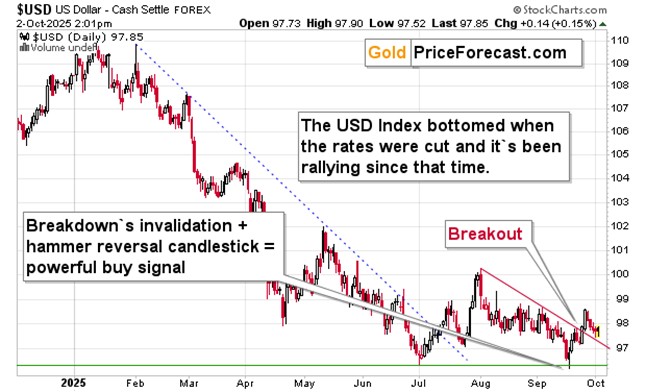

The USD Index is slightly up after an intraday reversal. No biggie.

What happened from the technical point of view is actually bullish – the USD just verified its breakout above the declining red resistance line.

This remains to be the case – we saw another bullish reversal and another move higher.

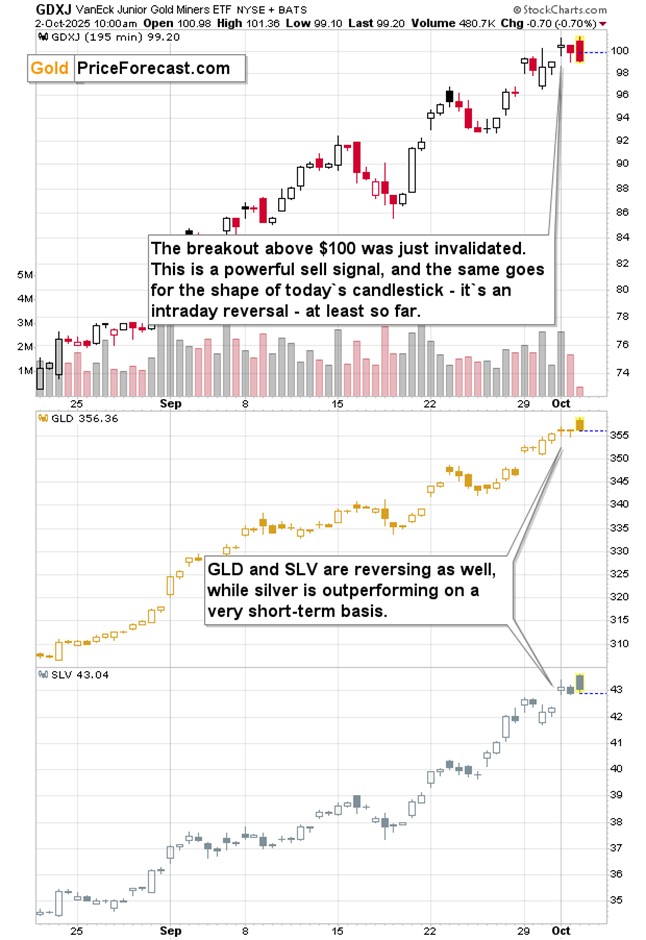

While the USD Index’s reversal is bullish, we see exactly the opposite thing in gold, silver and mining stocks.

All of them reversed, and GDXJ even invalidated a small breakout above one of the roundest numbers possible – the $100 level. Both are sell signs. If GDXJ closes below $100 today (which seems likely), this powerful sell signal will be complete.

The GDXJ closed yesterday’s session below $100, and the sell signal was complete. The fact that it once again moved above $100 and then back below in the first minutes of today’s session, further confirms that “this is most likely it” for the miners.

Rising Wedge Breakdown

The additional – small yet big – signal comes from the breakdown below the rising wedge pattern.

- It’s small, as the move below the wedge is not sizable yet.

- It’s big because the rising wedge patterns are quite often followed by vertical price drops, and given how extremely overbought miners are right now, this is exactly what could be in the cards.

Besides, gold and silver are reversing as well.

The invalidation is most profound in case of the GDXJ, but the “reversal theme” is here.

This perfectly fits the bullish reversal in the USD Index, and the fact that the latter survived even the U.S. gov’t shutdown. The universally hated and beaten down U.S. dollar refuses to fall further despite all that it’s thrown at it. This is exactly the kind of behavior that we see at major bottoms.

And when the USDX finally rallies in a meaningful way, the price drops in the PMs are likely to be epic.

This could be another trigger for a major sell-off in the stock market as well, together with the two that I had outlined before:

Gold just moved to this level (precisely to $3,899.15) and then it declined – erasing more than the entire overnight gains. This happened while the USD Index was insignificantly down. Gold is likely in the final blow-off part of the speculative parabolic upswing, and it’s “doing its own thing”.

To be clear – gold didn’t permanently disconnect from the USD. We simply have a moment where it’s moving “on its own” as the rallying prices make it more attractive to other buyers (that’s how investment goods differ from consumer goods, which are less attractive to buyers when they are more expensive). But once the parabola breaks, the slide can and is likely to be huge.

And the decisively rallying USD Index is a likely trigger. There can be more of such triggers, though, for example serious turmoil on the job market. Those statistics triggered the 2020 sell-off, and it seems to me that we’re going to see problems there due to either (or more likely both) of the following:

- The AI revolution, which causes job losses

- The tariff hikes – their consequences are slowly creeping up

The problem here is that while the job losses in 2008 were temporary, the results of the above could be permanent or at least of medium- or long-term importance.

As always, I’ll keep my subscribers informed.

Thank you for reading my today’s analysis – I appreciate that you took the time to dig deeper and that you read the entire piece. If you’d like to get more (and extra details not available to 99% investors), I invite you to stay updated with our free analyses - sign up for our free gold newsletter now.

********

Przemyslaw Radomski,

Przemyslaw Radomski,