Gold: Is The Consolidation Ending?

Bank analysts and excited gold bugs alike are near-unanimous in forecasting that higher prices are coming when the current consolidation ends.

Are they correct? Well, there’s no question that de-dollarization continues; central banks, foreign governments, and family offices are all concerned that the dollar has been weaponized.

While US tariff taxes have been softened, the threat of more financial attacks from the government hasn’t gone away, and that’s creating significant interest in gold... interest that is likely here to stay for decades to come.

Also, the US jobs situation is shaky, with AI likely gobbling up far more jobs (and faster) than anticipated. The government hasn’t cut spending much, but there’s no big increase either, which could begin to weigh on GDP.

Further, wage growth continues to lag “boots on the ground” inflation. Clearly, it wouldn’t take much to create a global citizen stampede into gold and it’s already happened in Australia.

The citizens of India are the world’s most aggressive buyers when there’s a significant sale (for either price or time). October saw heavy Diwali-related buying… and strong demand related to the 10% sale in the price.

Regardless of whether gold goes higher in the manner anticipated by most analysts or not, what’s most important is this:

Gold is supreme money. There are no contenders to its mighty throne. When gold goes on sale, it must be bought. The only issue for investors to contend with is how much to buy.

What about the technical action?

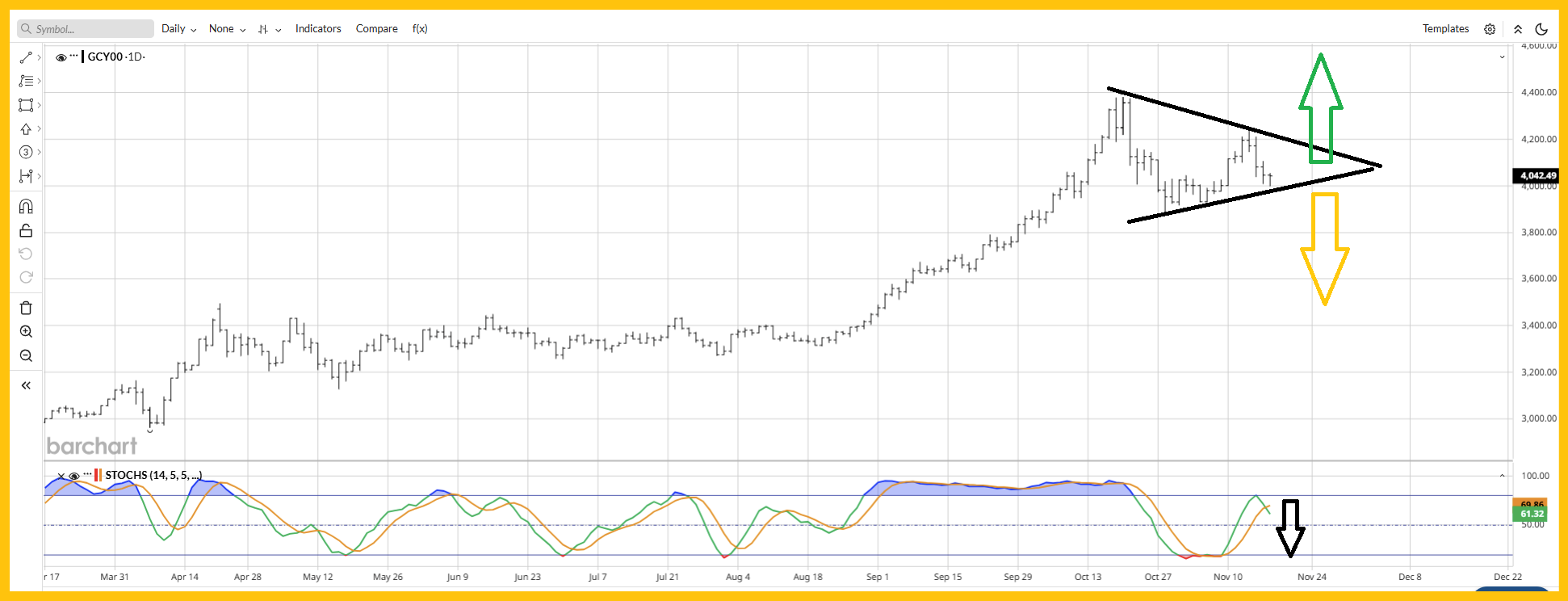

This is the daily chart. There’s a significant triangle pattern in play.

Basis Edwards & Magee (the “chart bible” authors), these formations have a rough 67% chance of consolidating the existing trend, which in this case is up. Stochastics (14,7,7 series) is a bit of a fly in the bullish ointment. It’s flashing a sell signal.

For a closer look at supreme money gold versus inferior US fiat:

On this four-hour bar chart, Stochastics is much perkier and an inverse H&S pattern is in play.

As long as the price doesn’t go too much under the big round number of $4000, that H&S pattern stays alive and suggests a rush to fresh highs is imminent.

This is the key weekly chart. If gold fails to rally and instead drops into my huge buy zone of $3500-$3200 it’s clear that India’s “titans of ton” will be near-maniacal buyers as that event occurs.

In such a situation, I’ll dare to suggest that all gold bugs in the West may want to buy with that same level of excitement.

The bottom line: in the Asia-dominated gold bull era, using gold like a stock to make fiat profits is a questionable endeavour at best. Now it’s all about… getting more gold!

For a look at silver:

Silver looks enticing. There’s a range trade between $46 and $54 with clear inverse H&S action in play. The bull wedge could mark the end of the consolidation and help launch a breakout above $54.

A move to the rough $63 target range would turn the $54 area into the biggest floor of support in the history of the silver market. I also have additional target prices of $80 and $100 and those come into play if $63 is hit while gold trades above $4400.

The miners?

This is the CDNX daily chart. The outrageously overvalued US stock market has begun to show concerning action and that’s put a bit of pressure on the CDNX stocks.

This is the weekly chart. Unlike the stock market, the CDNX pullback was expected to occur at the 900-1100 neckline zone of the huge H&S pattern… and it’s orderly.

The big news for junior mine stock enthusiasts is the Canadian “MPO” (Major Projects Office), which is fast tracking “incredibly important” projects of potential size.

In turn, that’s creating a huge competition amongst the junior miners to get on the prospective projects list. A breakout over 1100 for the CDNX should be accompanied with key breakouts in the GDXJ and GDX ETFs.

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

This is the stunning GDX weekly chart. A new and ultra-bullish scenario is presenting itself, which is a gigantic cup and handle pattern with the handle likely only beginning to form from around $100.

Gamblers can buy near $67 or on a breakout over $85. Investors should already be in and holding large positions with a very big grin!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: