India to Allow Gold and Silver Investment in Pension Funds

Regulators in India have revised rules to allow pension funds to invest in gold and silver ETFs. This could further boost already booming investment demand in India.

India ranks as the world’s second-largest gold market and consistently falls in the top four silver-consuming nations.

For the government sector, the Pension Fund Regulatory and Development Authority (PFRDA) created a new investment subcategory called ‘Asset Backed, Trust Structured and Miscellaneous Investments’ that opens the door to gold and silver ETF investments. Aggregate investment in gold and silver in public pension funds is limited to 1 percent of total assets under management (AUM).

For private sector pension programs, pension fund managers will be able to include gold and silver ETFs totaling up to 5 percent of the fund’s AUM.

According to Bloomberg, the new rules could unlock up to $1.7 billion in precious metals demand.

World Gold Council India research head Kavita Chacko said the move “reinforces gold’s fundamental qualities as an effective portfolio diversifier.”

The Bloomberg report proclaimed, “The move by the Indian watchdog is an indication of the growing acceptance of the precious metals as a mainstream investment asset.”

Earlier this year, Chinese regulators opened the door for insurance companies to allocate up to 1 percent of their assets to gold.

Adding Fuel to the Fire

Gold and silver investment is already booming in India.

In Q3, physical gold investment rose by 20 percent year-on-year, topping 91 tonnes, according to World Gold Council data. In value terms, gold bar and coin demand increased by 67 percent to $10.2 billion.

Meanwhile, with gold prices rising and squeezing some investors out of the market, many Indians have turned to silver. A major surge in Indian silver demand was one of the factors driving the recent silver squeeze that pushed the price over $50 for the first time.

Historically, Indians have preferred physical gold and silver, but ETFs have grown in popularity since they were first introduced in the country in 2007.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

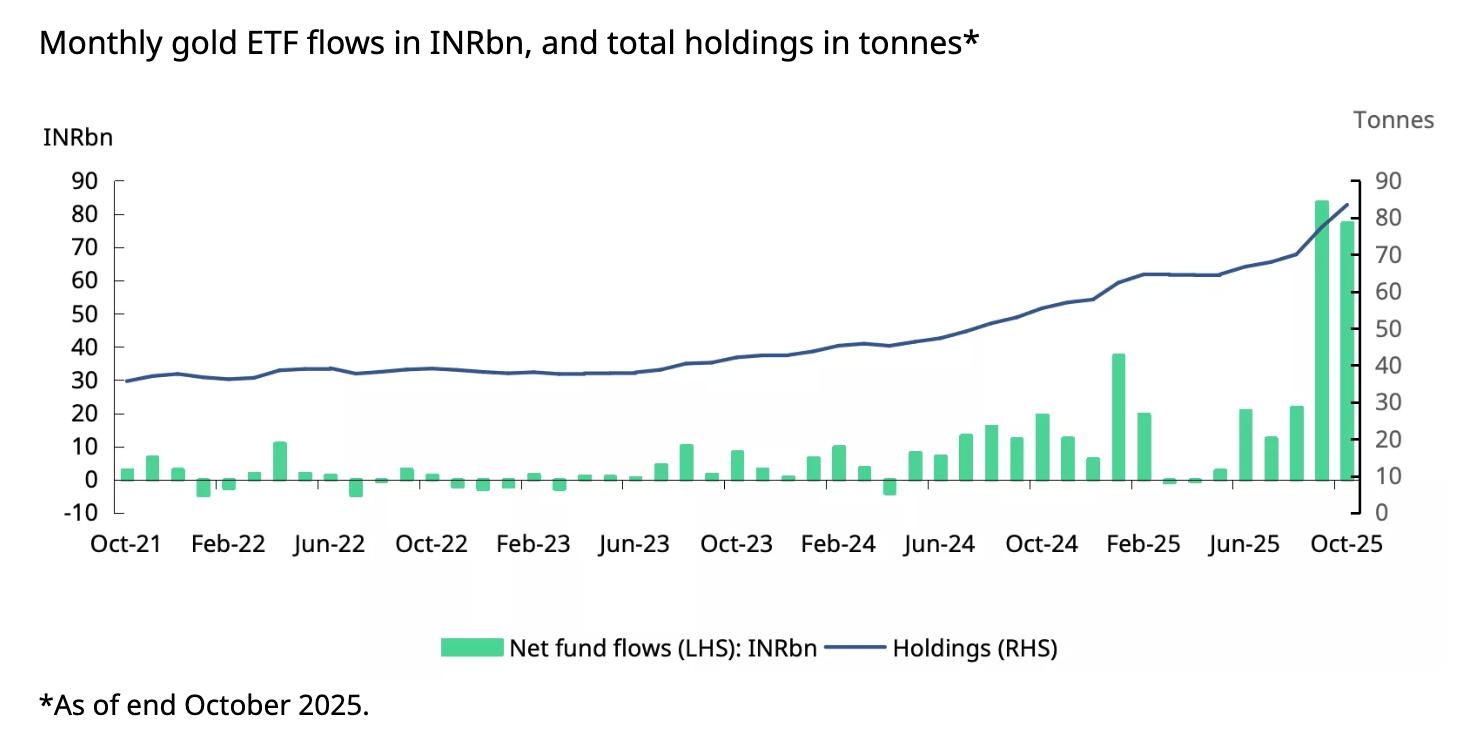

So far in 2025, cumulative inflows of gold into ETFs total ₹276 billion ($3.1 billion), the highest annual inflows on record.

According to World Gold Council data, there are currently 9.57 million gold ETF accounts in India.

Allowing pensions to invest in gold and silver could further boost demand.

Indians have a longstanding love affair with gold.

The yellow metal is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item.

Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government's response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

********

Mike Maharrey is a journalist and market analyst for

Mike Maharrey is a journalist and market analyst for