A White Hot Metals Christmas

With Christmas now just days away, the question many stunned investors are asking is: “Hi ho, hi ho, how high can these mighty precious metals go?”

For some key insight into the matter:

Most investors incorrectly view gold and silver as tools (schemes?) to get more vile government fiat.

As fiat loses ever-more of its purchasing power, they desperately flail away, trying to get more of it. Eventually, the situation becomes like that of Venezuela today or Zimbabwe in the past; the meltdown of fiat versus gold gets completely out of control.

Horrifically many (most?) investors have “top called” themselves out of their metals by then… and they find themselves almost as impoverished as the rest of the citizens who never owned gold.

The good news is that a gold bull era has begun and it is themed on the gold-oriented citizens of China and India. In a nutshell: The need to top call the metals market is gone. It’s been gloriously replaced by the need to get more gold!

Items like platinum, palladium, oil, technology stocks, crypto, and mining stocks are all tools that can be successfully used by savvy investors to accomplish the task.

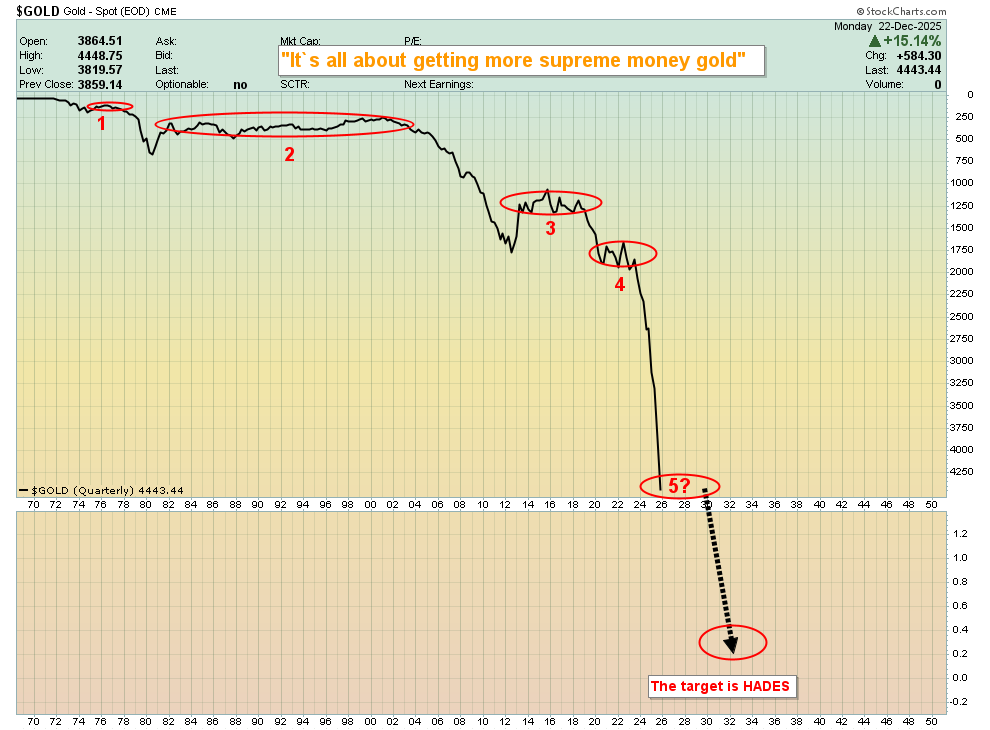

This is the stunning weekly gold chart. The upside action likely continues into the spring with the round number of $5000 acting as a possible magnet for the price.

It’s important for investors to find the right balance of metals and fiat so they can enjoy this phenomenal Elliott Wave C ride… and at the same time be 100% ready to buy the coming Wave D in 2026.

What about politics? Well, when the metals are in a buy zone, my suggestion is to view it like a technical oscillator on a chart; if silly government action (or inaction on debt) is positive for gold, slightly larger buys could be made but ultimately…

The decision to buy more gold should relate to the size of the price sale and the amount of support present when the price stops falling. On that very important note:

This is the daily chart for gold. This week’s upside breakout is turning the $4400-$4000 zone into massive support.

In turn, that opens the door to Elliott Wave D ending at or in that zone, rather than at the already-established zone of $3500-$3200.

Savvy investors think ahead. Projecting the next move to the upside is exciting, but it’s more sizzle than “get more gold steak”. Zones where investors can buy with both significant size and reduced risk need to be identified. The $3500-$3200 area is currently the big one but $4400-$4000 is coming nicely into focus now too.

What about the white-hot metals like platinum, palladium, and silver?

This is the platinum chart. My suggestion is to sell trading positions now and hold a core… until death do investors part.

For palladium, I recommend less exposure and selling nothing until the price reaches the $3000 mark.

For a look at silver:

This is arguably the greatest breakout chart in the history of markets, and certainly one of them.

The rectangle target is $100, and an overshoot to $150-$200 is likely. That overshoot relates to the time involved in the rectangle (almost 50 years!).

Tactics? Investors could trade 30% of their silver for supreme money gold now and hold the rest as a glorious bull era core.

The miners?

This weekly CDNX chart is another contender for the world’s greatest chart title. Incredibly, numerous junior explorers are already “100 baggers” from their lows… before the CDNX has even moved over the neckline of its massive inverse H&S pattern.

As noted, it’s not a gold bull market. It’s a bull era and it should last for 100-200 years. The potential gains that lie ahead for the miners are mindboggling.

I’ve been asked about tax loss selling. In a nutshell, this is not a time to be selling low-price juniors to get a tax credit. It’s a time to buy.

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

For a look at the senior miners:

GDX is now in its fourth minor bull wave from the $68 area lows.

Strong markets often feature this five-wave format and there’s no question that GDX and associated miners are very strong.

At this point, some profit booking can be done, not to call a top in the miners but simply to get richer! There will be pullbacks in 2026 and at least one of them will be significant. To ensure they have the merriest Christmas, savvy mine stock investors should have solid core positions and lots of dry fiat powder too!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: