Big Metals Roundup - Gold, Silver, Copper, Platinum, Palladium...

With a massive metals bull market in full swing, it’s always worth us stepping back from time to time to review the Big Picture. The background to all this is of course the accelerating collapse of the current fiat money system in the face of hopeless intractable mountains of debt with the “can kicking” enabled by derivatives etc coming to the end of the road as the amounts of new money required to just maintain the status quo accelerate into the infinite. The result will be hyperinflation that will render most fiat currencies utterly worthless. Small wonder then that the prices of assets with intrinsic value such as all metals and especially the Precious Metals are accelerating into a vertical meltup. In this environment an overbought condition becomes meaningless as the metals become overbought and stay overbought although of course they will hit occasional turbulence during their ascent along the way. So we will now proceed to see how the main metals bull markets are unfolding.

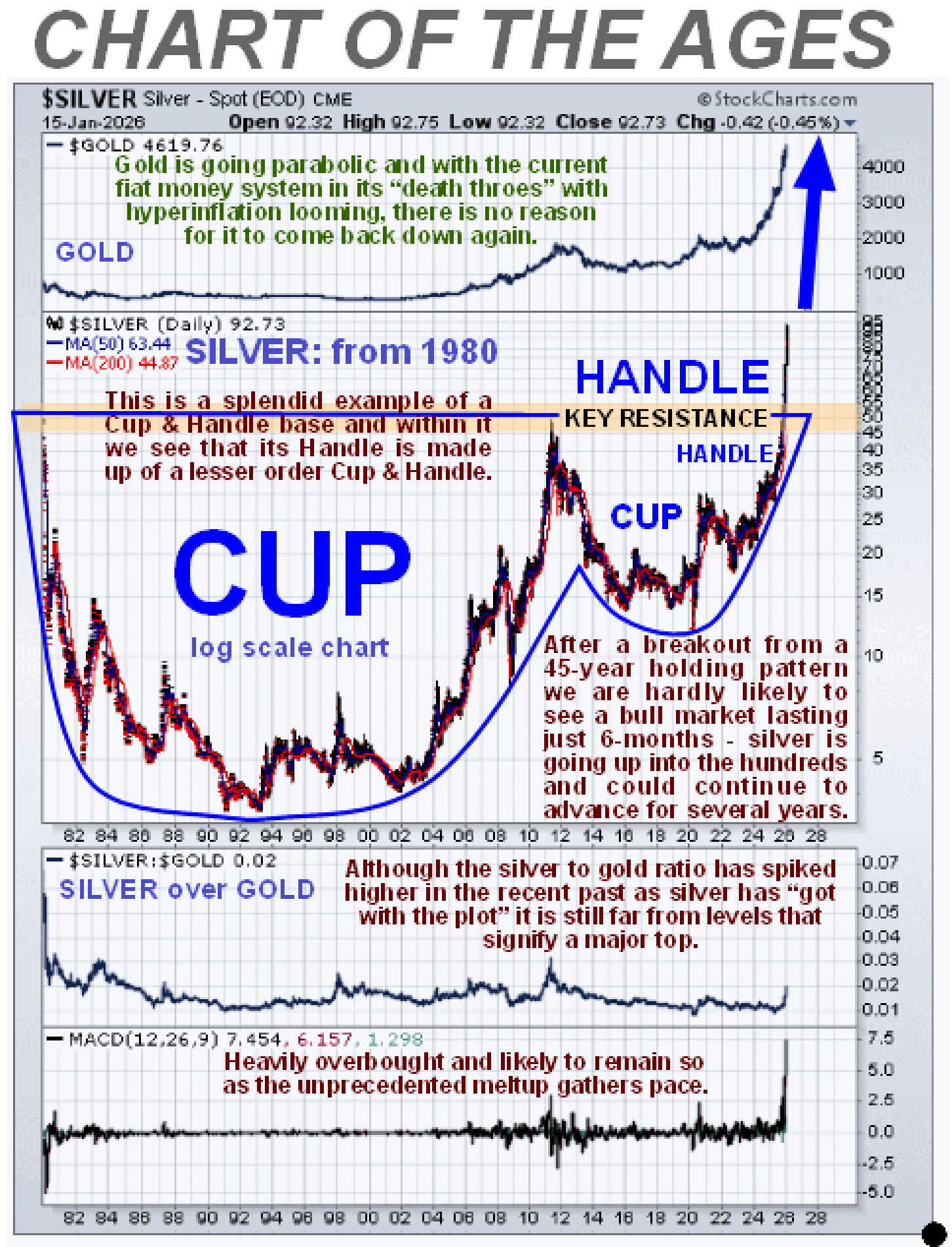

Starting with gold, the key point to make is that the current vigorous bull market can be considered to be in its earlier stages, as it is still a long way from equalling the great 2000’s bull market, especially in percentage terms and, as we are headed into an accelerating collapse of the current fiat money system, it should do much more than equal it. If we end up with Weimar 1923 style hyperinflation which is now looking like the most probable outcome, gold’s value in fiat terms will be infinite.

Silver has done exactly what was expected of it all along, except that it has not corrected back at all. Having broken out of its giant 45-year long Cup & Handle pattern it has now not surprisingly entered meltup mode, and the key point to make here is that, having taken 45-years to build up to this, the show is hardly likely to be over in 6-months – no, this bull market will probably last several years and take the silver price to levels that few can currently imagine. It’s the best investment of all at this time. Although massively overbought on its MACD indicator it is unlikely to do much more than consolidate occasionally and any weakness should be bought – the powerful uptrend is expected to continue.

In terms of not having made its move yet, copper is “the star of the show” at this time. Superficially on its 45-year chart it looks like it might have been marking out a gigantic top pattern from its 2006 peak, but this is hardly likely to be the case with a deflationary bust seemingly “off the table” as gold and silver go parabolic with hyperinflation looming.

Instead, on its somewhat shorter-term 25-year chart, we see that copper is being shepherded higher by a rising parabolic trendline that is driving it towards what will be a key breakout above an upsloping band of resistance dating back to 2006, which would be flat if we factor in inflation during this period or even downsloping. Once it breaks above this trendline it is expected to join the other metals in accelerating away to the upside and copper (and various copper stocks) therefore looks like a standout investment at this time.

It took it a while to “get with the plot” but platinum has finally decided to gatecrash the party with a very big runup from last May, a development that we anticipated. Interestingly, platinum has sliced through the resistance levels shown on its chart below almost as if they weren’t there, even breaking above its 2008 highs. This kind of action portends further big gains ahead as part of the expected broad metals sector advance, even if it should pause to consolidate for a while.

Lastly, while palladium’s chart does not look as impressive as the other metals shown here, it is still worth noting that it has doubled in price since last April. While it will have some resistance to contend with approaching its highs, it should go on to break above them in due course, buoyed by the broad metals sector advance.

********