The Everything Bubble is Bursting ... Well, Bursting Everything!

It started today with more bad job news, of the kind you cannot wring out of the federal government anymore. That sent stocks down hard and harder all day. Reported layoffs were the highest since the middle of the Great Recession when things were close to their worst.

Job truth dislodged at last

U.S. employers announced 108,435 layoffs for the month, up 118% from the same period a year ago and 205% from December 2025. The total marked the highest for any January since 2009, while the economy was in the final months of its steepest downturn since the Great Depression.

So, yeah, that’s bad! The “stealth recession,” as I’ve been calling our plight for more than a year now, is finally skirting the government’s deceptions and showing up in such undeniable ways that the statistics are even kicking the euphoric stock market in the groin, causing it to double over and cry.

Equally as bad as the news about layoffs was the corresponding plunge in new hires:

At the same time, companies announced just 5,306 new hires, also the lowest January since 2009, which is when Challenger began tracking such data.

The timing is also bad in terms of what it means:

It means most of these plans were set at the end of 2025, signaling employers are less-than-optimistic about the outlook for 2026.

As I’ve been saying for months, you will not see this recession via the absent or outright-lying government data, which is why I turn to the data put out by businesses like outplacement firm Challenger, Gray & Christmas. What I have been saying you could fully expect, others are now calling the new reality in economic data:

To be sure, if employers are stepping up plans to furlough workers, it hasn’t been showing up much in official government data.

To be sure. I’ve I explained why it wouldn’t, and now the mainstream press is reporting that it is not. For Trump, you could hardly schedule a better time for a government shutdown to slow down the reports of the economy’s demise.

Planned hiring dropped 13% from January 2025 and was off 49% from December.

The Bureau of Lying Statistics did apparently manage to eek out one report:

Filings with the Labor Department in January under Worker Adjustment and Retraining Notification regulations indicate more than 100 companies have given notice of significant layoffs….

That could get the new bureau boss added to list of firings … if recent history is any indicator.

The decrease in available positions put the ratio of available jobs to unemployed workers at 0.87 to 1, down from more than 2 to 1 at its peak in mid-2022.

Sounds exactly like what you’d expect during a recession.

The stock crash is here

I warned in a Deeper Dive back in the first week of January that …

… both stock and bond investors are relying on increasingly unreliable data, which was never too good in the first place (especially with respect to inflation) but also jobs that have been long overstated and then revised downward when few are looking….

The bottom line is that nothing has gotten better with respect to the economy or to government transparency or honesty over the past year….

I will be surprised all the same if the stock market doesn’t all crumble into dust this year…. The flatlining of the past few months and the broadly falling economy along with the continuance of tariffs makes the stock market more likely to fall hard than we were at the start of 2025….

However, the market is not going to get to see how bad the economy is because inflation is so poorly reported now, and the administration so set on hiding the facts about jobs….

Still, I think the reality of the economy, such as I keep reporting anecdotally from consumer and business surveys, is going to keep bashing investors’ heads in until they get the point. I’m reluctant to make a market prediction on this most relentlessly euphoric of all markets because last year’s proved only barely accurate enough to call it a score; but … I have to say, everything is poised even more precariously than it was at the start of 2025.

So, while I did not come right out and predict a stock crash, it is certainly not surprising that the long overextended euphoria of the stock market has turned into sudden job dysphoria in the stock market, and the market’s fear gauge (the CBOE volatility index) now looks like it’s starting to climb the big hill on the roller coaster.

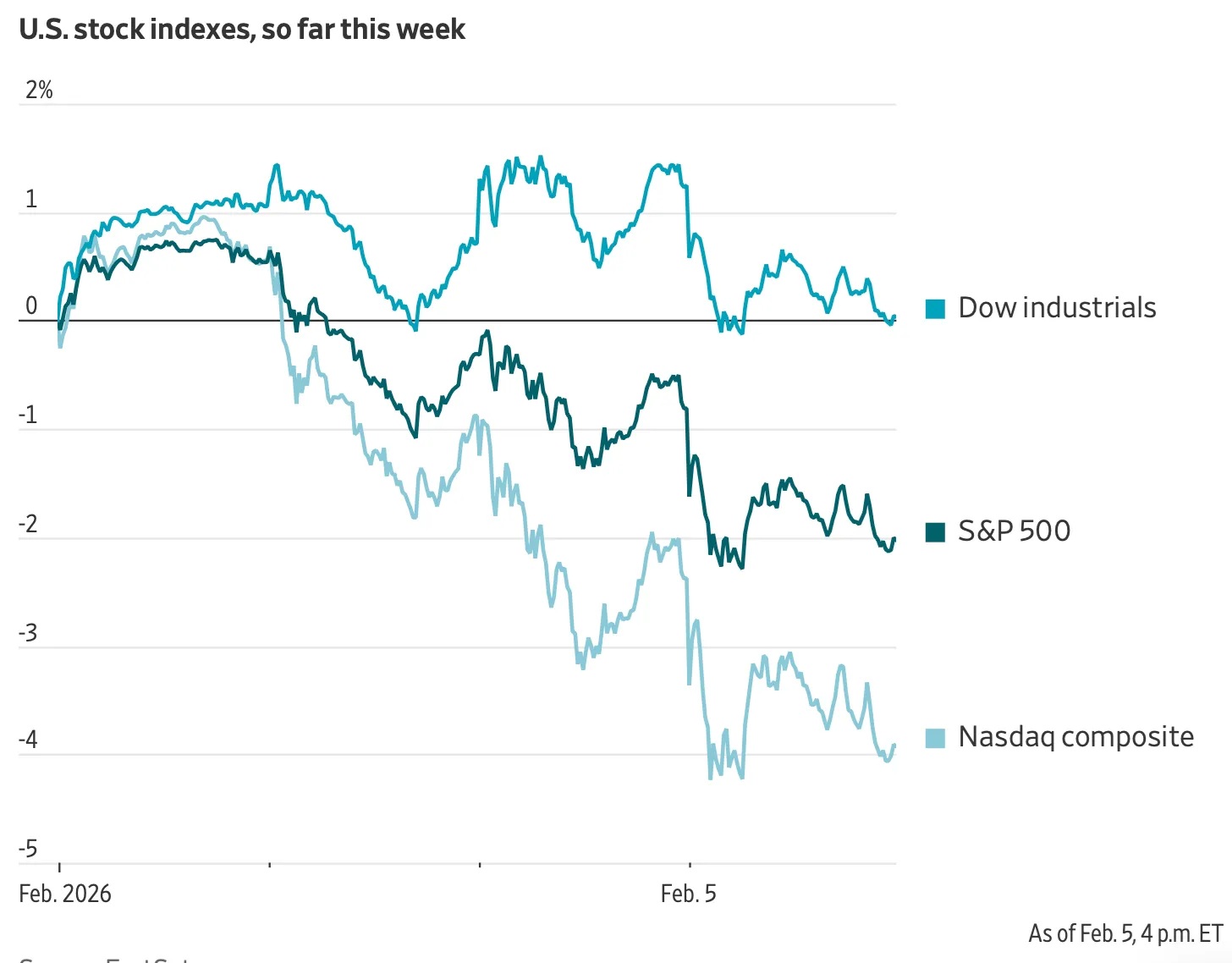

Naturally, the fear is materializing in the sectors of the market where you should expect, contrary to the experts, to see it most—the high-tech/AI echelons that we were told could not fall. Those drops in value now looks like this compared to other sectors:

Clearly, the tech-heavy NASDAQ is falling the hardest, just as it did during the dot-com bust. That’s after AI-related companies beat expectations, and that is exactly how I said the next market crash would go. Good thing those companies are reporting they are doing great, or imagine how the fantasy evaluations would be turning into bedrock revaluations if they had some serious bad news to report. Market action is now seen as the worst turmoil in the tech sector since the stock market storm that hit when Trump announced his tariffs last spring.

Remember how Google gyrated yesterday with a big flush and a huge rebound that turned it positive in a more than $800-billion reversal. Well, Amazon didn’t get to participate in that kind of action after its report. It fell and then fell a lot worse

Among big tech stocks, Amazon dropped 4.4% before its afternoon earnings report, which disappointed investors and sent the company’s stock down another 8%.

In other words, down 12%.

Alphabet was the latest of the “Magnificent Seven” companies to report earnings results. The company projected a sharp increase in artificial intelligence spending that spooked some investors, calling for 2026 capital expenditures of up to $185 billion.

That kind of investment news has ceased to be exhilarating in the way that it once was back hen investors salivated over prospects of the huge returns that would come from such Capex.

Microsoft lost another 5% at the bottom of the cliff it fell off of yesterday. That now puts it down a deeply bearish 27% since those heady days when brokers were telling their clients AI couldn’t lose like high-tech did in the dot-com days:

Enjoy the waterfalls, I guess.

And, no, I’m not going to readily let go of that, since it was such a widespread and utterly foolhardy kind of “failsafe” claim on the level of claiming the Titanic could never sink. It was a boast that you couldn’t beat out the heads of people who think they know a lot more than they do.

That kind of hubris is exactly the pride that goes before a great fall, and a great fall this has turned out to be, and we are likely far from seeing the end of it. With a fall like that, who needs winter? But winter is still coming for AI. Nuclear winter. Will, it rebuild? Sure. Some companies will. Some always do. Let’s hope this crash only takes half as long as it did to rebuild after the dot-com bust. That way things could be back to even sometime early in the next decade.

Is this really the Everything Bubble bust?

Well, take a look at how things have gone over the past year. Here is where have fallen to since the start of the Trump 2.0:

Dollar down.

Stocks down—high-tech by far the worst.

Employment down.

Trade down.

Housing prices down (thank goodness for many) with Trump trying to prop them back up.

Precious metals way up, then way down.

International relations, never worse.

Republican popularity down. Dem’s not much better.

Trust in government, way down.

Inflation up. (See latest inflation headline below.)

War up. (See continuing war headlines below.)

Civil unrest way up.

Epstein, a long delayed mess, but starting to reveal bits of what they’ve been hiding. Withheld files down; redactions up.

Cryptocurrencies down, $Trump about the worst, beat in its decline only by his wife’s coin.

And, so clearly, the year of chaos did arrive, even if a tiny bit later than I anticipated. Ain’t chaos grand! But “disorderly” is exactly how you would expect the collapse of everything to look. And this is just the start.

********