"Stimulating" The Economy Ain't What It Used To Be!

“Economic stimulation” is now a way of life for our “policy makers.” They have no other choice today but work hard all day and all night long. As Richard Russell has said for decades; “the Federal Reserve must inflate or die.” He was and still is 100% correct. But “economic stimulation” hasn’t always been a 24 hour a day, 365 days a year job as it is now.

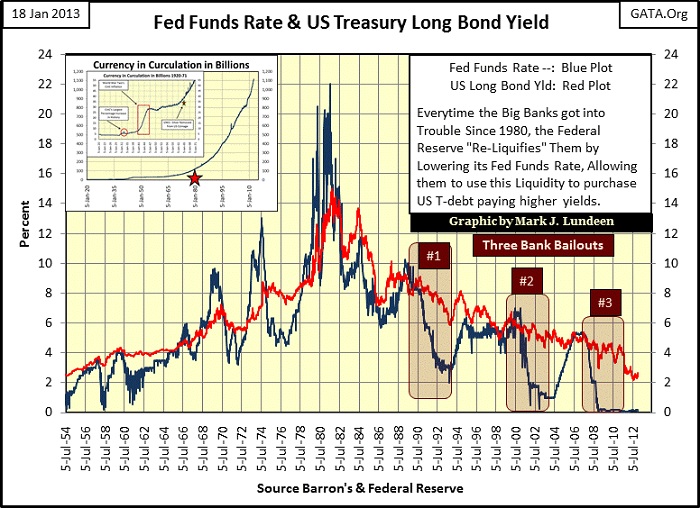

Previously to the Greenspan Fed (1987-2006), “policy makers” could and did tighten the money supply by “inverting the yield curve” with no fear of destroying the global economy. This was done by raising short-term rates above longer- term T- Bond yields. Banks borrow short-term money to create loans at higher rates in terms of years. By raising the Fed Funds rate (blue plot below) above the yield of US Treasury long bond (red plot), the Fed made “money tight” and banking less profitable, or even unprofitable.

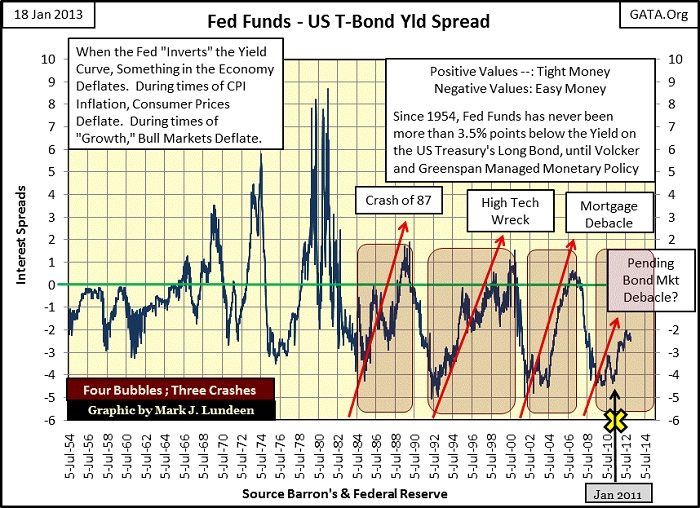

The plot of the spread of these two rates (below) better illustrates monetary tightening and loosening of the credit / business cycle. Positive values are times of tight money (recession), negative values are times of lose money and easy credit.

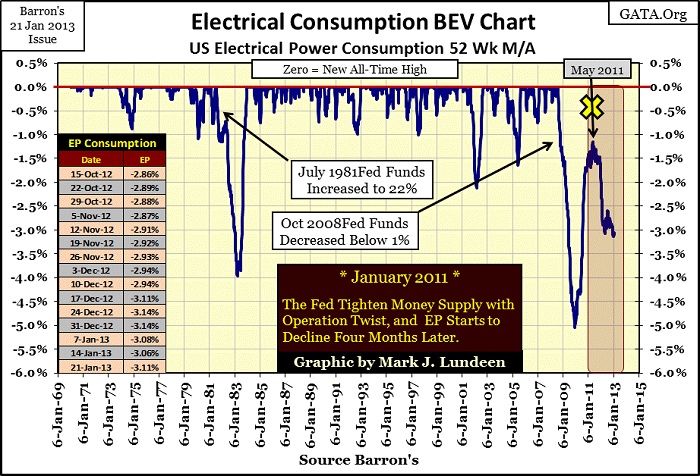

Note the Yellow X on Jan 2011 below. We’ll return to this later as it’s important.

During times of tight money (yield curve inverted to positive values), banks must raise cash by calling in business loans to reduce their leverage, thus increasing their solvency. That is the banks’ solvency; not the business whose loan the bank called in. These intentional contractions in bank- credit forced some business to shut their doors resulting in an increase in general unemployment. Historically, incumbent presidents have been run out of office for what past Fed Chairmen have done. Jimmy Carter (1980) and George Bush the elder (1992) come to mind. As you can imagine, tight money isn’t popular with anyone. But if an economy is to be based on paper money, whose interest rates are dictated by a central bank, the central bank must deliberately create occasional recessions in the economy to check the growth in credit and currency by its banking system. It’s this or it will be responsible for the dangerous inflationary bubbles in the financial and real estate markets that will follow.

The US banking system hasn’t seen a proper tightening in the money supply since the Volcker Fed (1978-1987). I blamed the 1992 re-election failure of George Bush the elder on tight money. But in the charts above, look at how small the tightening was in 1989-91 that caused him to lose the 1992 election (bank bailout #1 in my first chart). When compared to the yield inversions seen in the 1960s to 1980, it was a rather mild tightening; as has been true for each monetary tightening since 1980.

In 1985, Chairman Volcker decided to raise his Fed Funds rate for a scheduled tightening. Look at the charts above. It’s obvious that the Federal Reserve takes years to “wring the excesses out of the economy” when they begin increasing their Fed Funds rate from below long-term yields, to some point above long-term T-bond yields. Anyone managing a bank should understand what the Federal Reserve intends to do in the next few years, why they’re doing it, and begin to limit credit to enterprises with weak balance sheets. I’m assuming Volcker in 1985 saw that too many banks were making too many loans to companies whose share prices were rising just a bit too fast. Remember, in 1985 the Dow Jones was in its third year of a historic bull market that was beginning to attract the attention of the public.

Alan Greenspan became Fed Chairman in August 1987, just weeks before the October 1987 Crash, which I’ll skip except for noting that the Japanese stock and real estate bull markets, unlike other global markets, totally ignored the October 1987 crash in New York. Wall Street saw this too. Japan was an amazing “growth story” in the late 1980s. Books were written on samurai management and samurai investing that became popular best sellers because everyone knew that the Japanese economy and investments had nowhere to go but up!

So why did the banks need a bailout in 1989? Because what everyone knew in 1987 was wrong! At its top, the Japanese real-estate market had grotesquely inflated to where the Japanese Emperors’ Palace and its surrounding grounds had a larger market valuation than the entire state of California. Was this true? I find this hard to believe, but it was an accepted fact to the media who reported it. Does it even matter; with financial news like that, who couldn’t see that Japan was a bubble ready to go bust? The Big Wall Street Banks who couldn’t say no to speculators in Japanese stocks and real estate during the late 1980s! Alan Ableson of Barron’s passed on a joke during this time to his readers:

Why does New Jersey have all the toxic waste dumps, while New York has all the investment bankers? New Jersey had the first choice.

Returning to bailout #1 in the charts above; see where Greenspan just barely raised his Fed Funds rate above the US long bond yield when the Japanese real estate bubble went bust in 1989. To save Wall Street, Greenspan lowered his Fed Funds rate to 3% during a time when US Treasury Bond yields were 5% higher. This was the loosest monetary policy seen since 1954 (charts above), maybe in the one hundred year history of the Federal Reserve. In doing so; Easy Al – the Bankers’ Pal, allowed Wall Street to borrow unlimited billions of dollars from the Fed at hundreds of basis points below the US Treasury Bond yields to “re-liquefy” their busted balance sheets in the US Treasury market. Obviously Congress had no problem lending its AAA-credit, via its Treasury Bonds the banks were purchasing with the Fed’s monetary inflation, to save Bankers from themselves. Disaster in Tokyo and New York provided Washington with an excellent opportunity to sell more Treasury Bonds, as has been the case with every financial calamity since.

But the early 1990s was a missed opportunity to teach Wall Street some humility and caution. Had Alan Greenspan continued to increase his Fed Funds rate to complete the tightening cycle began by Volcker in 1985, and refused to accept rapidly deflating Japanese assets as collateral for these loans, many famous names on Wall Street would have gone down, simply because they deserved to die. Yes, the US and the world would have had a few bad years. So what? The high-tech revolution would have happened anyway, but not the high-tech bubble that made Bill Gates the richest man in the world for a few years, but devastated many retail investors’ high-tech portfolios. Had Greenspan did his job in the early 1990s, Wall Street’s reputation with the public would have smelt like week-old sushi. Congress in 1999 would never have allowed such a banking system to create an unregulated, and members’ only “derivatives market” to manage the global economy’s “risks.” So, the 2001-08 housing / derivative bubble wouldn’t have happened.

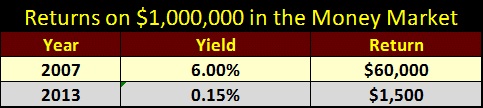

There was a human cost to the 1989 bailout, but obviously not to Wall Street. Barron’s at the time saw how lowering the Fed Funds rate to 3% would drive savers out of their bank’s savings accounts, forcing conservative savers (retired people) into the stock market. They didn’t believe this was such a good idea. Barron’s was correct. But in the early 1990s they couldn’t have predicted that with each subsequent Federal Reserve funded bank bailout;

- Bailout #1 Japanese Bubble

- Bailout #2 High Tech Stock Bubble

- Bailout #3 US Housing Bubble

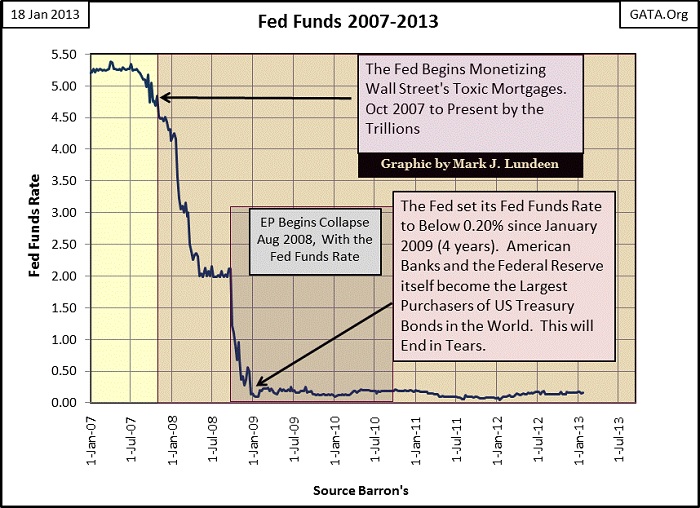

would provide the rocket fuel for Wall Street’s next bubble. Currently the Federal Reserve is bailing-out Wall Street from their mortgage and derivative fiascos. The Fed Funds rate has now been below 0.20% for over four years, causing the world’s bond markets, our current bubble, to become grotesquely bloated. We are not yet finished with the cycle of booms and busts that Alan Greenspan began in 1989.

Go back to the second chart above plotting the Fed Fund – US T Bond Yld Spread. Can you see how Doctor Bernanke is actually tightening the credit market by stealth with his “Operation Twist?” Do you see how the spread has moved up from -4.5 to -2 since January 2011? Doctor Bernanke may have described his “Twist Program” as a new mechanism to “promote growth”, but he has actually tighten the money supply by lowering long-term rates – genius! Well, I guess that’s why he’s the Chairman of the Federal Reserve, and I’m just a guy in the peanut gallery who enjoys throwing spitballs at him.

So, Doc B is now tightening the money supply? How can I claim lower long-term rates will slow “economic growth” when * Everyone * knows lower long-term rates will foster “growth?” And with his Fed Funds rate almost at zero percent, what else could he do but lower long-term bond yields to kick-start the economy?

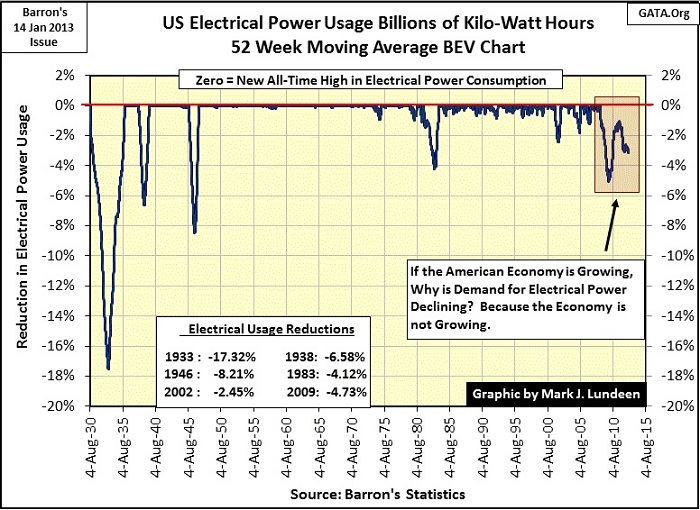

This is incorrect! What Doctor Bernanke is actually doing is kick-starting the economy to death. The next chart plots eighty-three years of American electrical power demand (EP). In the red box we see something very unusual. Within it, EP began its first decline in August 2008; just weeks before the Credit Crisis exploded in the news two months later in October.

However, this decline in EP’s began one year * After * the Federal Reserve began lowering its Fed Funds Rate in September 2007, as seen in the chart below. Lowering the Fed Funds rate (loosening the money supply to stimulate “Growth”) isn’t supposed to result in declining economic activity a year later; but that is what happened.

I expect the top in the housing market passed, and actually began turned down in October 2007. Doctor Bernanke knew a derivatives disaster was quickly approaching should housing prices decline. So Doc B lowered his Fed Funds rate in an attempt to keep the housing bubble inflated, but failed. A year later, EP turned down as the housing bust finally took hold on the US Economy.

Now notice when “Operation Twist” was placed in operation: the big yellow X on my second chart I told you we would return to. Do you see the Big Yellow “X” at January 2011? It lines up with the Big Yellow X on the chart below placed at May 2011. Four months after “Operation Twist” was implemented, EP began its second collapse in our current bear market. This isn’t a coincidence.

I expect to see further declines in EP in the future, as “Operation Twist” has decimated interest income in and out of the banking system. “Operation Twist” and the new taxes Washington is levying on the economy, are sucking income and purchasing power from the private sector. Lower demand for goods and services (and EP) in the economy are inevitable. Look at it this way; lowering Fed Funds below 0.20% for the past four years is an act of cruelty to the elderly who need a safe source of income that was once available in money market, but is no more.

And halving US Treasury Bond yields via “Operation Twist” has also halved the income Wall Street banks, and institutional fiduciaries receive from their Treasury bills, notes and bonds portfolios when they roll over Washington’s maturing debts. As time goes by, more and more T-debt will mature and income will become progressively scarce for pension funds and insurance companies. We also hear of stories of Wall Street downsizing their operations. Operation Twist has to be a big part of that too.

“Finance: The Application of Money to Practical Ends”

- Barron’s banner credo from its 1920’s issues

Barron’s first issue was published in 1921, long before August 1971. Since Washington severed the dollar’s last link to gold, finance has become a perverse art whose main purpose is to manage manufactured “risks” at the expense of the banking system’s clients via derivatives. This was exactly the criminal objective of the LIBOR scandal. The banks sold their clients derivatives that would have protected them from rising interest rates. Then the Central Banks conspired to manipulated interest rates lower so these derivatives would never come into the money – as intended. But the banks kept the commissions for hundreds of trillions of dollars in worthless derivatives sold to the world’s pension funds and insurance companies. Eric Holder, the US Attorney General has yet to stop this infamous fraud.

Maybe this is why Doctor Bernanke is “twisting” long term rates lower to tighten the money supply. Had he raised the Fed Funds rate to accomplish the same degree of tightness, HUNDREDS OF TRILLIONS OF DERIVATIVES WOULD HAVE COME INTO THE MONEY!!!

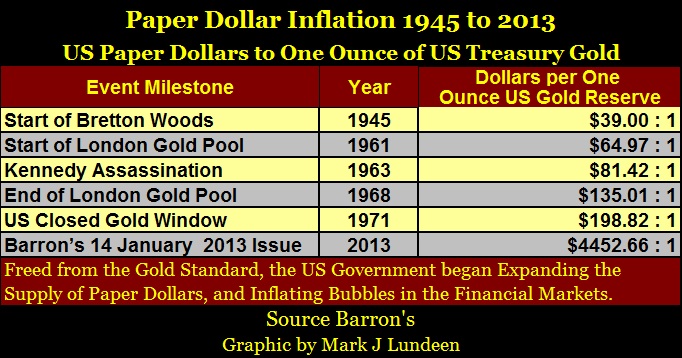

I told you he was a genius. But I’m sick of “risks” and the derivatives that “hedge” them. These risks now being hedge didn’t exist when the dollar was fixed to gold:

- Currency Risks

- Interest Rate Risks

- Market Volatility Risks

- Inflationary Risks

The following table illustrates how far we are from the days when the US dollar itself was an economic asset.

Long gone are the days when the $20 used to purchase a man’s suit made a pleasant “clink” on the tailor’s counter! Have no doubt about it; since the US dollar was removed from the discipline of the gold standard, the US Government and the Federal Reserve System it created, has had its way with the world’s reserve currency and the global dollar economy. This has impacted everyone.

In fact, you can place your baby’s photo here

“High Finance” today is a historic-criminal scandal that has comingled not only other people’s money (MF Global and others), but also the very worst of what government and banking has to offer the world. If the truth be told; Washington and Wall Street have become a lawless-gang of thieves. Well-dressed and educated to be sure; but thieves nonetheless. Congress rewrites the US Legal Code to make everything legal, Wall Street does the hard work of shearing the sheep, and the media focuses the public’s attention on “Reality TV” or “news coverage” of the most recent Hollywood or sport scandals.

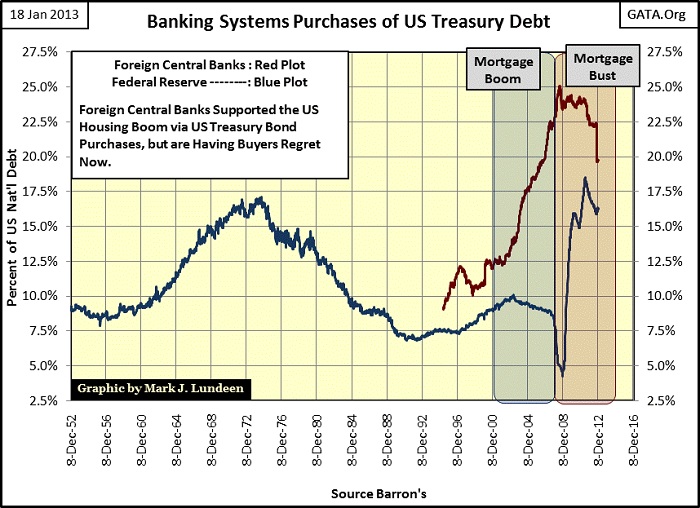

The next chart should give everyone pause for thought. Since the start of the credit crisis, foreign central banks have refused to own more than 25% of the total float of the US Treasury market. Though the Red Plot’s trend below was declining from Dec 2008 to November 2012, these central banks actually continued buying more Treasury bonds, just not as fast as the Congress was increasing the national debt.

Then in Barron’s 12 November 2012 issue, the Fed Reported these central banks actually reduced their “reserves” by $420 billion dollars, or a full 2.5% of the total US National Debt in a single week. Wow! Is this a sign to things to come? You’re darn right it is! Before this is all over, and it may be years from now, the US Government will default on all of their debts to all creditors who aren’t one of the Big Banks on Wall Street. The world’s central banks know this, and want to exit the US Treasury market, slowly, but while they still can. Don’t be stupid and believe they won’t default! Hey? Has anyone seen Germany’s gold yet?

Mark J. Lundeen