$1,500 Gold Price By Year End?

Strengths

- The best performing metal this week was platinum, up 2.24 percent on hedge funds cutting short positions and flipped the futures composite to a net long. Gold traders and analysts in the weekly Bloomberg survey are split between a bullish and a neutral outlook on the yellow metal ahead of the Fed’s meeting next week. Gold gained on Thursday after the European Central Bank (ECB) signaled low interest rates are ahead. Just like last week, Turkey saw its gold reserves rise. According to the central bank, holdings rose $58 million from the prior week.

- Silver went on a tear last week and investors sure noticed. Bloomberg reports that investors have flooded into ETFs backed by silver, with holdings surging to the highest on record. The iShares Silver Trust saw $146.5 million in inflows on Monday, the most since 2013. Then on Tuesday, assets rose 818.8 tons, which is the largest daily increase on record.

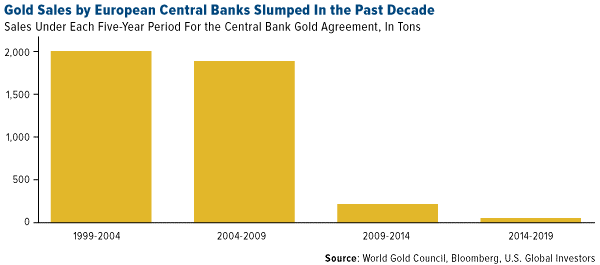

- European central banks have been slowing gold reserve selling for years. This week the ECB and its peers decided to allow an agreement on coordinating gold sales to expire, saying that it has become obsolete, reports Bloomberg. The pact is scheduled to end on September 26 and member institutions said they don’t currently have plans to sell “significant amounts” of the yellow metal.

Weaknesses

- The worst performing metal this week was gold, down 0.46 percent, partly on some stronger economic data and how that might affect the interest rate decision at the FOMC meeting next week. Gold is heading for its first weekly drop in three weeks as investors weigh on solid U.S. economic data, reports Bloomberg. According to Commerce Department figures, orders placed with U.S. factories for business equipment posted the biggest gain in more than a year. Holdings in gold-backed ETFs fell for a third day on Thursday.

- On Tuesday President Trump rejected aggressive moves to weaken the dollar that would boost trade during a meeting. Trump’s economic advisor Larry Kudlow told CNBC that the administration had “ruled out” a currency intervention. A weaker dollar has historically been positive for gold and just weeks ago there was talk of weaker dollar policy. From the news reporting, it is not clear that President Trump even attended the meeting; he has been a vocal proponent of lowering the value of the dollar.

- Newmont Goldcorp, the recently-crowned world’s largest gold miner, reported lower than expected second quarter adjusted profits and saw its shares fall 3.4 percent pre-market on Thursday. The company said costs rose amid shutdowns at two newly acquired mines.

Opportunities

- Chirage Mehta, senior fund manager at Alternative Investments, Quantum AMC, wrote a piece outlining reasons why gold should be an essential part of a portfolio. Those four reasons are: rising economic nationalism, the detiorating quality of reserve assets, central banks buying gold and non-dollar trade agreements. Mehta writes that gold is a strategic asset because it has low correlation to other asset classes, is liquid and has a history of improving portfolio risk-adjusted returns.

- Citigroup also praised gold this week. The group says it is bullish on bullion due to the possibility of the Fed cutting rates next week. “We think late second quarter may have represented a structural regime shift for the yellow metal” and that “gold should benefit in this environment” of easing monetary policy. The report says that a sustainable push above $1,500 an ounce this year and a $1,600 target in late 2020 seems plausible.

- JPMorgan research shows that no reserve currency lasts forever and many are questioning how long the U.S. dollar’s reign will last. Reserve currencies tend to be a reflection of markets that have the best prospects. JP Morgan sees the younger demographics and proliferating technological know-how of the Asian economic zone as having the best prospects with 50 percent of global GDP and two-thirds of global economic growth being the strongest contender. With $30 trillion in middle-class consumption growth forecast between 2015 to 2030, only $1 trillion is expected to come from Western economies. The bank sees the dollar deprecating over the medium term due to these structural reasons as well as cyclical impediments, which is why they recommend diversifying into developed markets and in Asia, as well as precious metals.

Threats

- UBS strategist Joni Teves wrote this week that gold investors should be cautious going into the FOMC meeting next week. Teves said “there is a risk that recent gold positions could come under pressure in the near term if the Fed is perceived to be more hawkish than the market is currently expecting.”

- Newcrest Mining and Harmony Gold Mining have hit a snag in the development of a key $5.4 billion mine in Papua New Guinea, reports Bloomberg. The permitting of the companies’ gold-copper project has been delayed for an unknown duration. This could be largely due to the fact that the nation’s newly elected prime minister is a critic of resource deals signed with multi-national corporations.

Despite a big rally in gold in the last few weeks, mining companies likely won’t see that reflected in earnings for the second quarter. Gold is up 11 percent this year, but those benefits won’t show up until third quarter earnings, due to pricing lags, according to Bloomberg.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of