2022 Doesn’t Have to Be Like 1980 for Gold

A recession is coming – but will it really be positive for gold? After all, the yellow metal plunged in 1980, despite an economic downturn.

Recession and Stagflation

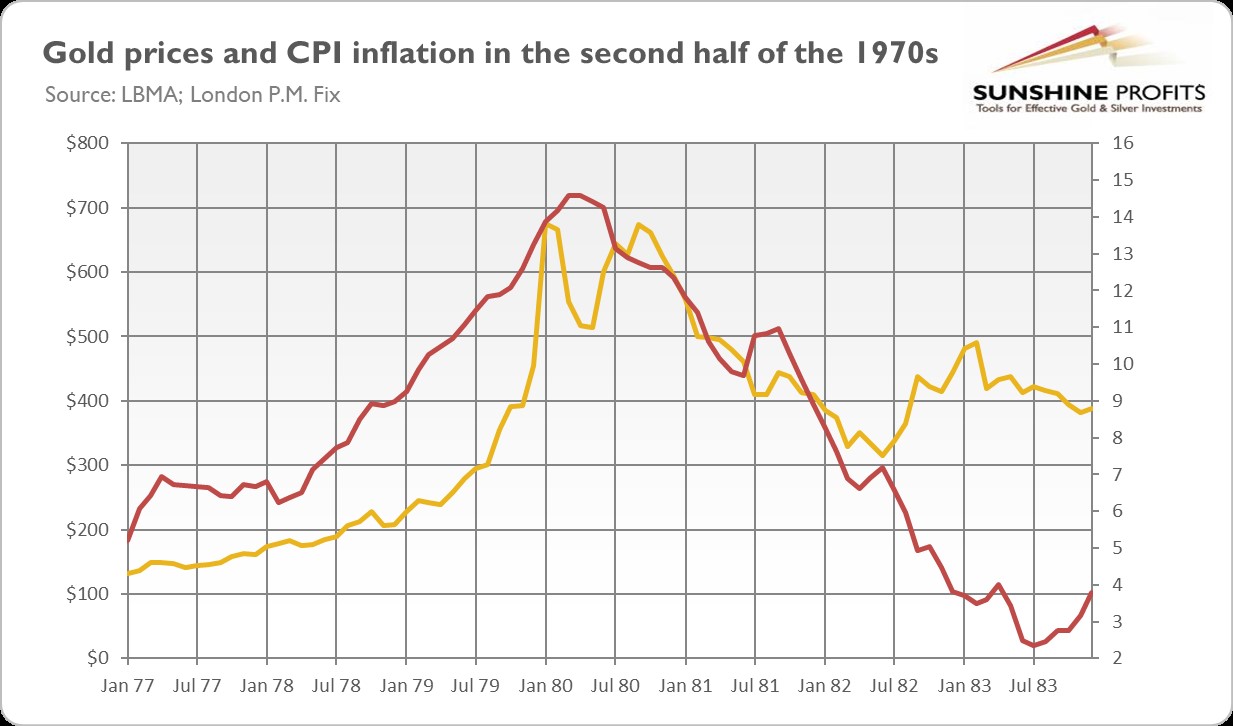

Everyone says that the upcoming recession and stagflation will be good for gold. However, will they really? Some doubts also arose in my mind, so let’s investigate them. I, of course, don’t dispute that gold soared in the 1970s. This is a fact which is illustrated nicely by the chart below.

But was it really caused by stagflation, or was it just a time coincidence? What I mean here is that the 1970s were a special time, the end of Breton Woods. In 1971, Nixon ended the gold window, and the price of gold was allowed to fluctuate freely. Under the gold standard, the US dollar was defined as 13.71 grains of gold, which implied that it was convertible to gold at the fixed rate of $35 per ounce. However, such a fixed exchange rate (technically, it wasn’t an exchange rate as the dollar was defined in terms of gold) was introduced in 1934, and since then the dollar had been losing its purchasing power. Hence, the rally in gold prices after the convertibility was ended was completely natural and could have had a limited relationship with the rampant inflation. The peg was artificially high for years, so the dollar was overvalued while gold was undervalued.

Another issue is that in the 1970s, the world moved into a new world of completely fiat, floating currencies, so there was a lot of concern and a safe-haven demand for gold. In short, the 1970s were a very special time in which several bullish factors occurred, boosting gold prices. But some of these drivers won’t be present in the 2020s, as the fiat monetary system is well established today, while in the 1970s it was in its infancy. You can’t break the gold standard twice.

That’s true, but there were bull markets in gold also in the 2000s and in 2019-2020, even though some factors characteristic of the 1970s were absent. Moreover, it’s very difficult to separate the end of the gold standard from stagflation, as the concerns about the new monetary system would be lower if rampant inflation were absent. It’s obvious that Nixon’s shock contributed to the overall economic situation, but trends in gold prices were driven ultimately by macroeconomic forces – and these forces can reemerge.

Last but not least, it seems to me that although gold’s initial rally in 1972-1973 had more in common with the abandonment of the gold standard than with CPI inflation and other macroeconomic variables, after that period, trends in gold prices were more related to inflation and other fundamental factors (see the chart below). Hence, it would be hard to argue that the whole 1970s bull market was caused by the collapse of the gold standard.

My second concern is probably more disturbing. Although the 1970s were a great time for gold, its price peaked in tandem with inflation in early 1980 (see the chart below), entering a bear market for two decades. Hence, my worry is that when inflation peaks, gold may plunge, as it did in 1980-1981 due to the lower inflation expectations and high interest rates, which raised the opportunity costs of investing in gold. After all, during disinflation, inflation expectations decline while real interest rates increase, which should negatively affect gold prices.

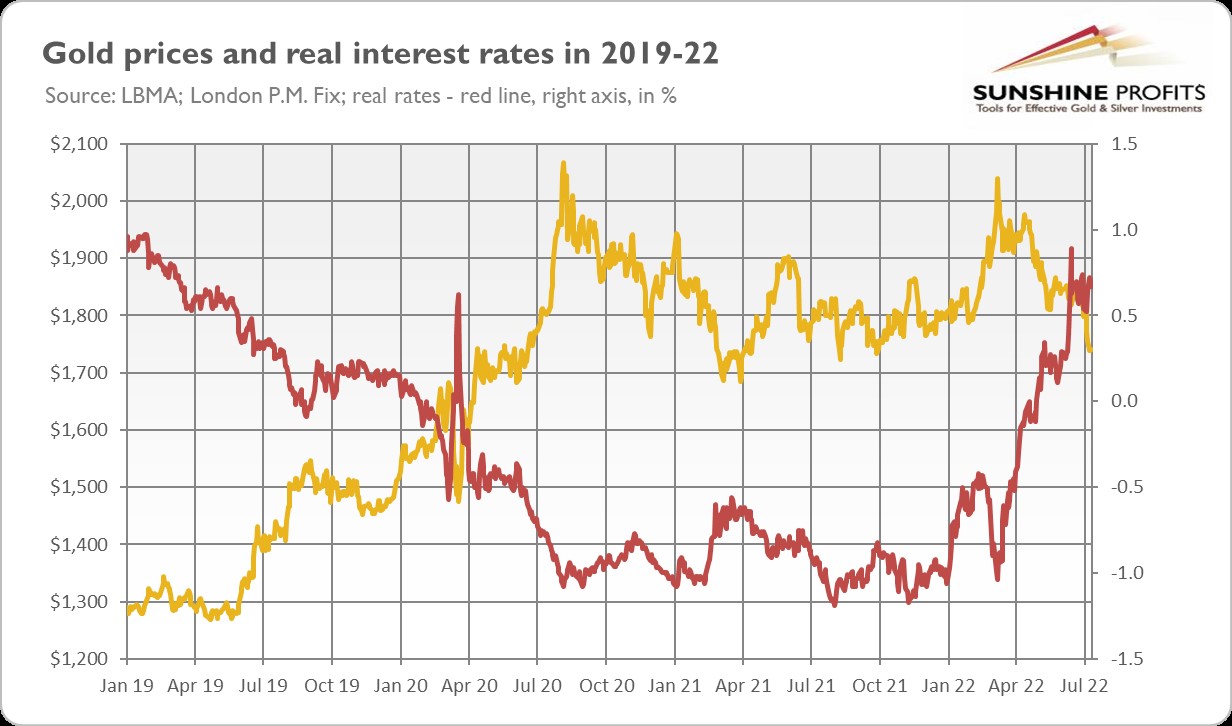

However, history doesn’t repeat itself (though it often rhymes). As the chart below shows, gold hasn’t actually surged with the current inflation. The rally occurred in the first half of 2020 amid the coronavirus recession when both actual inflation and inflation expectations initially plunged. Hence, the peak in inflation doesn’t have to be detrimental to gold. After all, what didn’t rise can’t fall.

What’s more, real interest rates have already surged (see the chart below), so the room for further movement is limited. Of course, they can always go up, but the risk of a spike similar to that seen in 1980-1981 is much lower, especially given the recessionary worries and their dampening impact on rates.

A Repeat of 1980?

Additionally, please remember that years of ultra-low interest rates created a lot of economic bubbles (some analysts say about “everything bubble”), so the upcoming economic crisis could be really severe, especially given the pace of the Fed’s tightening cycle (compared to 2015-2018). In other words, the level of debt and financial imbalances is larger than in the 1970s, so the Fed may turn to a dovish stance (or at least soften its hawkish stance) even if inflation remains high.

So far, Powell can flex his muscles, but only because the unemployment rate is staying low and interest rate hikes haven’t yet hit the financial sector. However, when the unemployment rate starts to go up and financial markets begin to falter, the US central bank will be under strong pressure to stimulate the economy once again. I seriously doubt whether there would be a willingness to accept a really huge economic cost to combat inflation. Hence, luckily for gold, the upcoming recession doesn’t have to be like that of 1980, but it can be rather similar to that of 2007-2009 or 2020.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

********