Another Gold Price Spec Short Squeeze Pending

It may not be enough to reverse the momentum or flip the downtrend, but another Spec short squeeze is coming. Of that, you can be certain.

And how do we know this? Because the COMEX is a rigged casino! The market-making Banks have monopolistic control of the proceedings, and this grants them almost unlimited power to rig results in their favor. To the point, Speculators (primarily managed money, hedge funds and trading funds) are often led into extreme positions only to be routinely wrong-footed and fleeced by The Banks.

In the past, the ruling paradigm was that The Specs were NET LONG and The Banks were NET SHORT. From time to time, these positions would reach extremes, and the resulting price flush would lead to Spec liquidation and Bank short-covering... resulting in massive losses for The Specs and huge profits for The Banks.

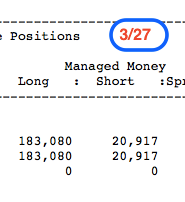

One most recent example occurred back in March of this year. At the time, sentiment was extremely positive for COMEX gold. Price had rallied in Q1 and was sitting near $1370 when a Commitment of Traders survey was taken on March 27. What did that report reveal?

• The Large Speculators were NET LONG 203,354 contracts

• The Commercials were NET SHORT 226,360 contracts

Specifically, the "Managed Money" category of the Large Speculators were NET LONG 162,163 contracts. See below:

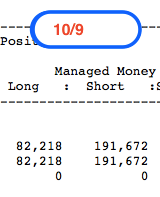

By now, you know what happened next. COMEX gold began to fall in April, breaking below its 50-day moving average on April 26. The Large Speculators gradually liquidated their longs and added shorts, with their position peaking on October 9, when they reached a whopping 109,454 contracts NET SHORT, as you can see below.

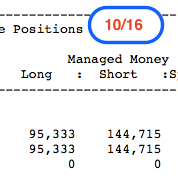

What happened next was utterly predictable. Price blasted higher on Thursday, October 11. It surged back up through the 50-day and posted the largest one-day move since Brexit in June of 2016. Why did this occur? When price moved up through 50-day, the pre-programmed computers of the "Managed Money" category began to buy back and cover their accumulated short positions. They did this en masse, and the result was a classic short-squeeze price spike. The next week's CoT survey proved this to be the case by revealing that the Managed Money NET short position had been more than cut in half.

On October 31, we wrote about what we should expect to happen next. You can read it here: https://www.sprottmoney.com/Blog/the-same-old-come... Below is the important point of the article.

And now you are seeing this all play out in real time. Last Friday, price was indeed rigged lower, down and through the 50-day moving average again. Beginning that day and including the two days that followed, price fell $24. Over those same three days, total COMEX gold open interest rose by 39,615 contracts, or nearly 8%, to 539,520. This is the highest total COMEX gold open interest since March 27. (Be sure to scroll back up and check the date of the first CoT report reference in this post.)

So, what is happening? The very same hedge funds that created the record Managed Money NET short position on October 9–and were subsequently squeezed to the tune of $40–are now flooding right back into the short side of COMEX gold due to its position below the 50-day moving average again. And so what do you think is going to happen next?

This isn't freaking complicated! Though price may not immediately zoom back up and through the 50-day (note below how it took a while back in late September and early October), you can be almost certain that another Spec-squeezing move is coming. Perhaps this next squeeze will be timed around the December 18 contract rolls, as this current front month moves into its "delivery" phase in two weeks? That would seem to be the most logical assumption.

As with each of the past four years, we expect a year-end rally in COMEX gold that extends into January. Whether or not this next Spec short squeeze sets off that rally will be a function of timing. We'll wait to see how it plays out. In the meantime, what's important is that you know it's coming and can take action to plan and prepare before it occurs.

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.You may copy, link to or quote from the above for your use only, provided that proper attribution to the author and source is given and you do not modify the content. Click Here to read our Article Syndication Policy.