Are Gold And Silver Prices About To Tumble?

The Member Update I put out yesterday regarding the US Dollar is imperative if gold and silver are going to drop to new lows as projected. The dollar must hold the 93.00-92.50 level and break above the resistance level at 100, from this 1-year consolidation.

The Member Update I put out yesterday regarding the US Dollar is imperative if gold and silver are going to drop to new lows as projected. The dollar must hold the 93.00-92.50 level and break above the resistance level at 100, from this 1-year consolidation.

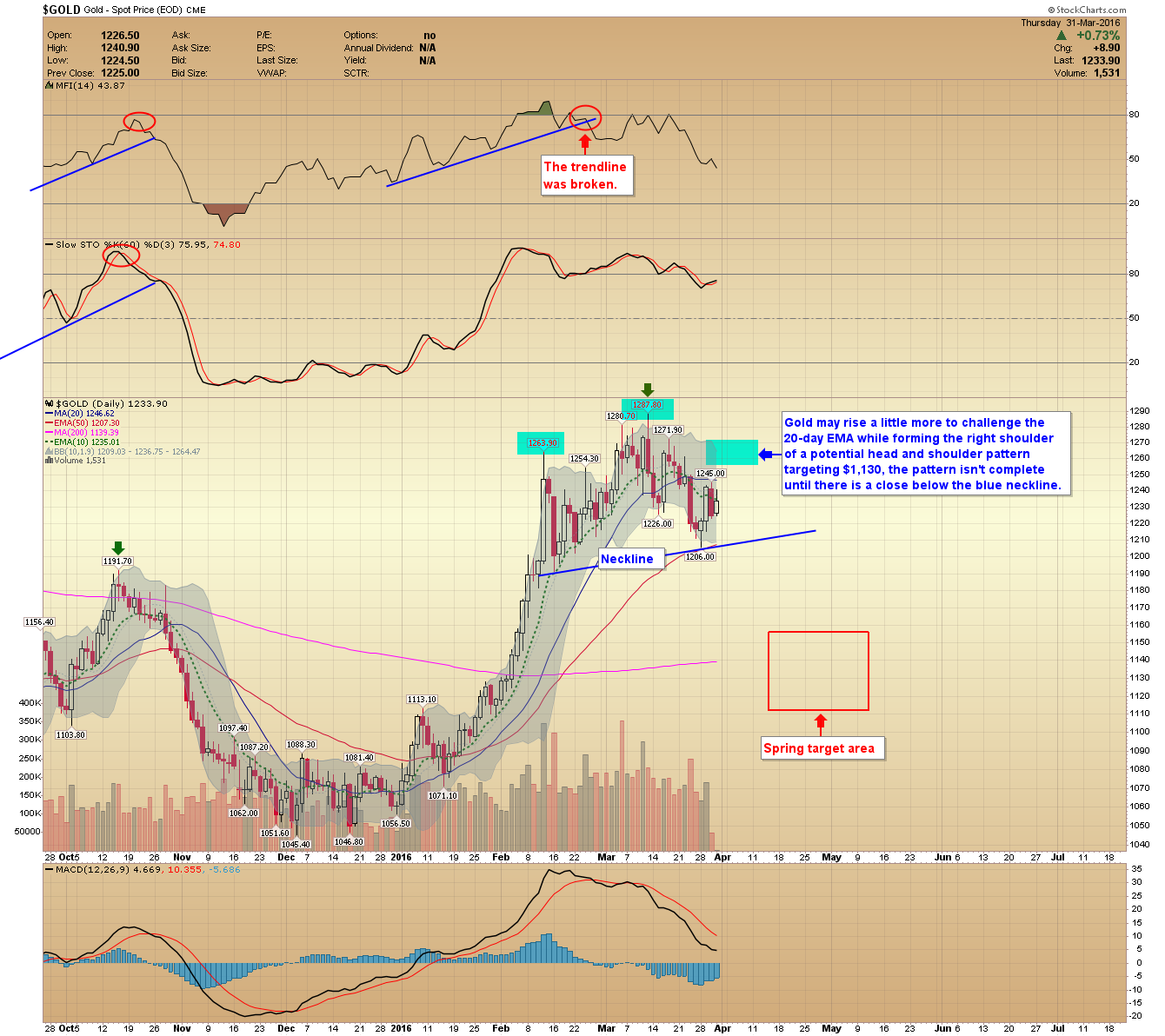

Our analysis is on track, the miners, and gold look to be forming head and shoulder topping patterns that should send prices tumbling once their respective trendlines are broken.

US Dollar

Prices are close to entering the green safety zone where 5-bottoms have formed over the last year. There is a positive divergence building in the MACD (below) suggesting this move lower is near exhaustion. The Dollar should bottom in the green zone about the same time gold makes the potential right shoulder of a head and shoulder topping pattern.

Gold Prices

Gold may rise a little more to challenge the 20-day EMA while forming the right shoulder of this potential head and shoulder pattern targeting $1,130; the pattern won’t complete until there is a close below the blue neckline.

Silver Prices

Silver prices may be forming another bear flag, and I expect them to rollover with gold, we should see an intermediate bottom in late April or early to mid-May.

GDX

I would prefer prices remain below $20.87 (left shoulder) while forming the right shoulder. Prices could accelerate lower quickly once the dashed line in broken.

GDXJ

Similar to GDX but this right shoulder can’t go any higher than it already has, or the pattern will lose its cohesion.

Have a great weekend and if something changes tomorrow, I’ll post a member update at www.GoldPredict.com