Are Gold Stocks Too Overbought?

Gold Stocks could be at a tricky juncture.

They have already made significant gains, yet history, coupled with the current bullish conditions, suggests more gains coming and probably significant gains.

However, corrections of 15%-20% during these rebounds are normal and sometimes frequent (like in 2008-2009).

One doesn't want to risk having to chase strength, but one doesn't want to risk buying ahead of an imminent sector correction.

Let's take a look at several charts that can help us figure out where we are.

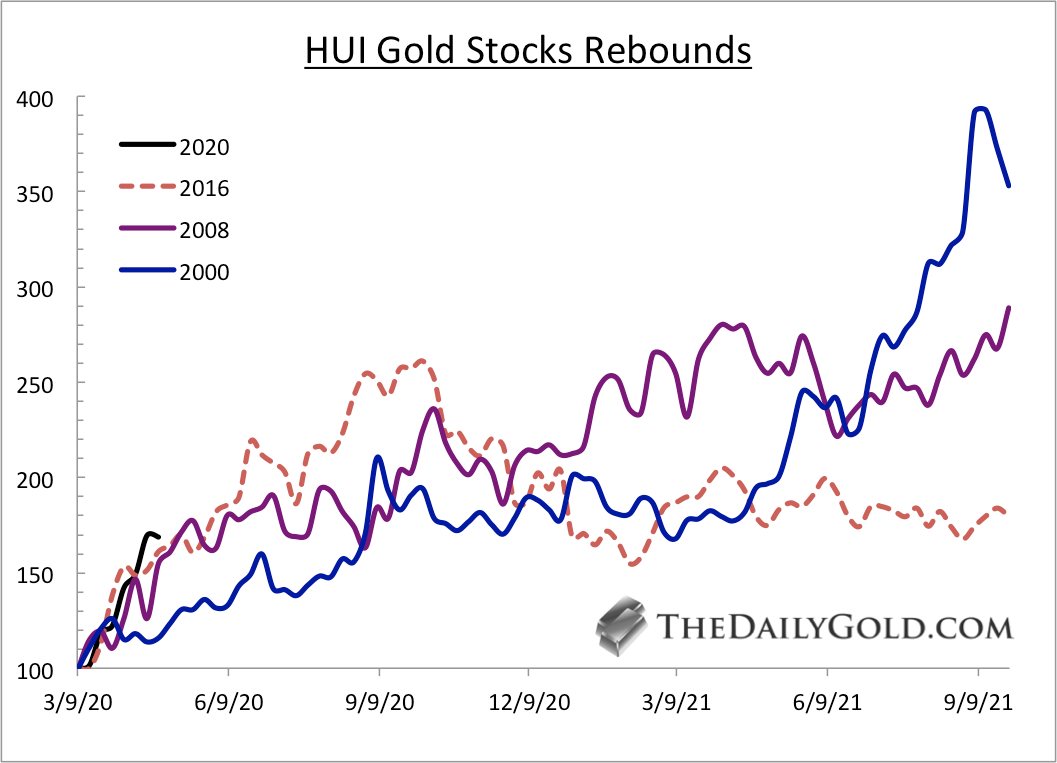

First, let's take a general look at where we are compared to past rebounds from significant market lows.

We plot weekly data and the rebounds from 2000, 2008, 2016, and 2020 in the chart below.

As you can see, history shows that the current HUI is a bit above the trend but has plenty of upside potential over the next four to five months. Based on the current time frame, history suggests a real correction to begin in late June.

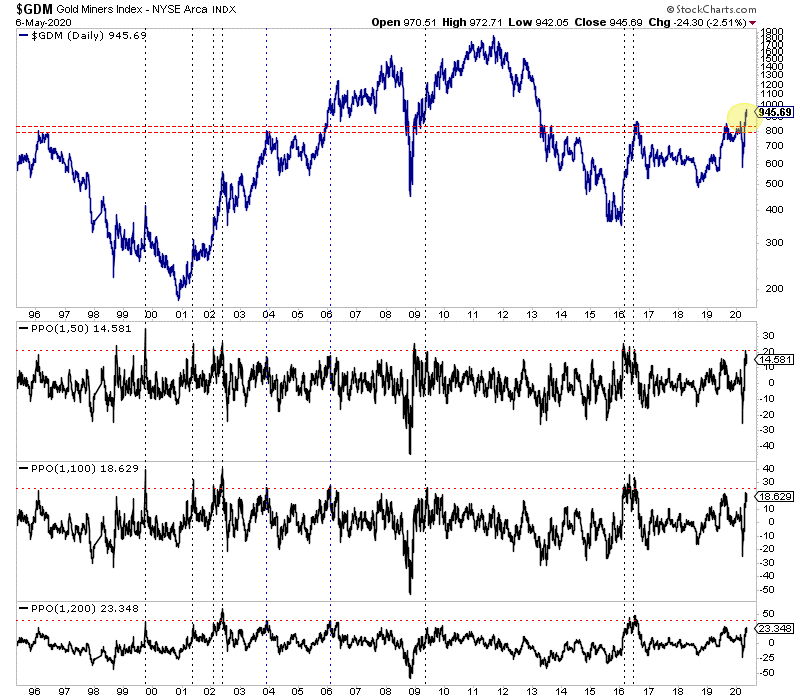

Elsewhere, oscillators based on the moving averages would argue the same. The market is a bit extended but has yet to hit an overbought level based on its distance from its 100-day and 200-day exponential moving averages.

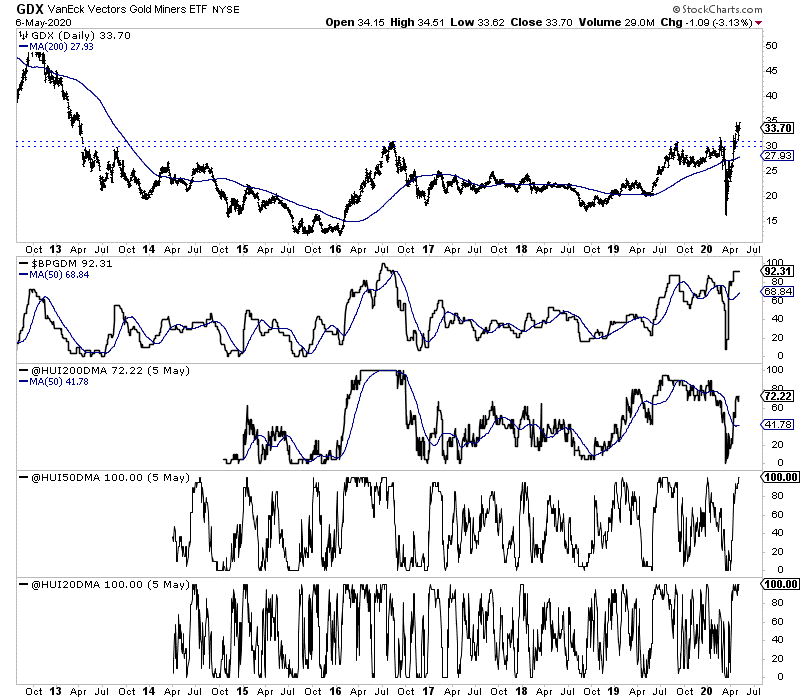

Finally, consider various breadth indicators.

The bullish percent index is near an extreme at 92%, but the percentage of HUI stocks above the 200-day moving average (72%) is not. The percentage of HUI stocks above the 20-day and 50-day moving averages (100%) does reflect a short-term overbought extreme.

A correction is certainly possible, and corrections during these types of sharp rebounds can be swift. The short-term breadth indicators could argue so.

But gold mining stocks just broke out to a new 7-year high and selling pressure remains muted and even as gold is $100/oz off its high.

I hope that GDX, which closed Wednesday at $33.70, does a quick retest of support at $30-$31, which would allow for a stronger leg higher. Should GDX trend higher from here, then keep an eye on the confluence of resistance around $37.

In the meantime, take advantage of the weakness in quality individual stocks. Two of my top junior holdings have corrected 20% after ripping higher.

We continue to focus on identifying and accumulating these types of companies that have significant upside potential over the next 12 months. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

Contributing to kitco.com

*********