Are We Approaching Peak Gold Production?

Strengths

- The best performing precious metal for the week was palladium with a 2.72 percent gain and a quarterly gain of 20.24 percent, its best three month gain since 2010. Global car sales have experienced an improved outlook.

- This week we also had Kirkland Lake Gold make a friendly takeout offer for Newmarket Gold. The transaction almost appeared as a merger of equals as the premium offered had closed somewhat before the deal was announced. The combined companies will produce about 500,000 ounces of gold per year; the operations are in politically safe Canada and Australia with reasonably long mine lives.

- The Delaware Depository, in collaboration with CUSIP Global Services, announced last week its creation of the first-ever CUSIP identifiers for physical precious metals, reports the CPM Group. The CUSIP number previously kept physical metals apart from mainstream investment channels, but now they will be under the same system in which financial assets are bought, sold and managed by individual and institutional investors, along with brokers and sell-side analysts.

Weaknesses

- The worst performing precious metal for the week was platinum, falling 2.66 percent, with silver nearly down as much too. Reuters reported that investors are shying away from the platinum as concerns over supply chain inventories persist. In 2014 there was a five-month strike that left one million ounces of production on hold yet there was little impact on platinum prices. In addition, electric vehicles in the future could further erode the need for the metal.

- European banks have inundated the ECB with their largest request for dollar funding in four years. This week Bloomberg reported that 12 banks sought $6.248 billion in liquidity. What seemed obvious was this was driven by the continued troubles at Deutsche Bank but according to one source there were no German bidders in the mix. This could mean that the banks in Europe were simply taking precautionary measures in case there will be a crisis.

- China imported 251 tons of silver in August, according to data from customs authorities and commented on by Germany’s Commerzbank last week. Lawrie Williams writes that although this import number was 16 percent up from last month’s, it was down 29 percent from August 2015 data. On the gold end, China cut bullion imports from Hong Kong in August to the lowest level since January, reports Bloomberg, amid rising property prices and an improving economy.

Opportunities

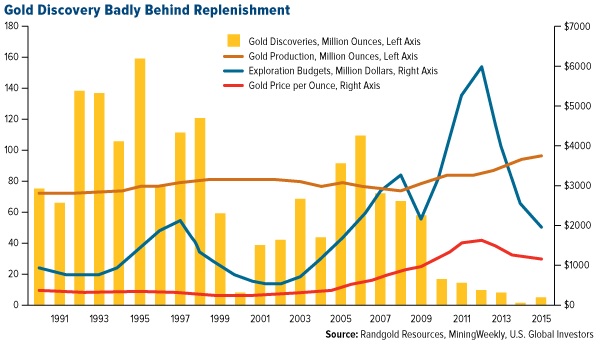

- According to the CEO of Randgold Resources Mark Bristow, peak gold production could be reached in the next three years, reports Bloomberg, as miners fail to replace their reserves. The chart below is a good example of how a lack of new discoveries, paired with miners digging out high-grade material for a short-term gain, can quickly diminish the lifespan of a mine.

- Goldman Sachs believes inflation pressures are starting to build. According to data from Bank of America, investors anticipate consumer prices to rise 1.3 percent annually, the highest level in 14 months, reports Bloomberg. “All of the signals are suggesting that we are now pretty close to full employment,” chief economist at Goldman Sachs Jan Hatzius said. “We’re starting to exert some upward pressure on inflation.” Brown Brothers Harriman sees this pressure stemming from two elements: rents and medical services.

- BMO is making revisions to its precious metals forecast, reports Kitco News, and is now saying that safe-haven demand will continue to drive gold and silver prices higher next year (and support the precious metals market in the next three years). The bank revised its outlook for the yellow metal in 2018 and 2019 to around $1,350 an ounce and $1,250 an ounce, up 8 percent and 4 percent respectively from the prior forecast.

Threats

- Shares of B2Gold and OceanaGold fell sharply this week, following notification of environmental breaches for the companies’ mines operating in the Philippines. OceanaGold’s Didipio mine is the only mine affected by the environmental audit rolled out by the Philippines’ Department of Environment and Natural Resources. For B2Gold, the Masbate mine is the only mine affected by the audit; however, it is also the primary driver of outperformance in 2016.

- According to Citigroup Inc., gold may be in for a bumpy ride in the final quarter. With presidential candidate Donald Trump now at a 40 percent chance of winning the election, reports Bloomberg, Citi says volatility in bullion could be on the horizon, in combination with investors preparing for higher U.S. interest rates. A Trump win may indeed be chaotic, but would slashing U.S. corporate tax rates be worse for the market or just the medicine its needs? Contrarily, a democratic win might mean more of the same policy choices which have been keeping gold well bid.

- Deutsche Bank’s counterparties seem to have mounting concerns about doing business with Europe’s largest investment bank, according to an article on ZeroHedge. Bloomberg data show a number of funds that clear derivatives trades with Deutsche Bank AG have withdrawn some excess cash and positions held at the lender. The bank is one of the most interconnected on the planet. Any type of unwinding of Deutsche Bank’s assets would have major repercussions to the global banking system. Perhaps that’s why news stories at the close of the week speculated that the U.S. Justice Department would assess a much smaller fine against the bank for past misdeeds. Ironically, Wells Fargo and other U.S. banks have been in the news for creating accounts for the purpose of collecting higher fees from their customer base, lowering the threshold of trust.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of