Gold Gains a Little; Dollar Drools Spittle; Powell Non-Committal

With reference to the above title’s adjective “non-committal”, let’s open with another of our infamous pop quizzes! Ready?

In Federal Reserve Chairman Jerome Powell’s address yesterday (Friday) from ever-stunningly magnificent Jackson Hole, how many times did he say either the word “reduce” or “cut”?

By FinMedia reports, multitudinous times. Hat-tip NBC News in quoting one independent strategist:

- “Today’s speech could not be more clear that Powell is ready to cut rates on September 17th…”

But if you said “Not once!” — that neither “reduce” nor “cut” was mentioned — you are correct!

Thus, the highlight of the “Nuthin’ but Fed!” week was The Chairman (to invoke an apt double negative) not saying the Open Market Committee would not cut rates. Still, to his credit, he acknowledged the Fed’s current monetary stance as “modestly restrictive” such that the Eccles Building bunch shall “carefully” proceed to assess if conditions “may warrant” a shift in policy.

But in which direction? Clearly from the opposite end of the spectrum, the prior week’s report of wholesale inflation via July’s Producer Price Index may well warrant a rate hike, given that month’s annualized +10.8% pace. (Such fact was deftly skirted in the address, but sorry Jay baby, somebody has to do the math).

Regardless, more observed in the offing (double entendre) come the “Fed-favoured” Personal Consumption Expenditures’ readings for July (due next Friday, 29 August) followed by August’s PPI (10 September) and (yikes?) Consumer Price Index (11 September). Then we’ve the FOMC’s Policy Statement (17 September), centered in the month which for the S&P 500 historically is at its worst: through the 24 Septembers century-to-date, that month’s cumulative S&P change is -32.3%.

Either way, equities enthusiasts interpreted The Chairman’s remarks as 100% confirmation the Fed will cut its FundsRate on 17 September: ’tis already a done deal, which in turn elicited the S&P 500 returning up to within two points (at 6479) of its all-time high (6481) in sporting the year’s 12th-best net daily gain (+1.5%). The mighty Index settled its week at 6467, putting the “live” price/earnings ratio at an affordable 45.5x and ever so attractive yield at 1.215%; (yes, for you WestPalmBeachers down there, ’tis italicized cynicism).

So with the perception, (or perhaps better stated, “hope”) of cheaper StateSide money on the way, the Dollar drooled spittle. The currency’s concoction called “Dixie” suffered on Friday its 13th-worst single-day high-to-low percentage drop (-1.3%) through the 166 trading sessions year-to-date, (just in case you’re scoring at home). For when the U.S pays less, elsewhere may be best: by sovereign rates, within “Dixie”, Canada (4.95%) tops the U.S. (4.50%); or beyond that, for example, there’s Iceland’s Króna (7.50%) if one can absorb a currency-risk profile that is more chilling.

‘Course here at deMeadville, we prefer an alternative currency: Gold … albeit hardly is it robust at present. For bang on time following last week’s piece “Gold Sensing Seasonal Sluggishness”, price just recorded (both by points and percentage) its narrowest trading week of the 34 year-to-date, toward settling at 3417. From low-to-high, Gold’s up week spanned “only” +70 points (+2.1%), netting a change of just half that. Here ’tis as Gold gains a little:

Indeed, Gold’s weekly parabolic trend remains comfortably Long with -241 points of “wiggle room” down to the ensuing week’s “flip-to-Short” level of 3176. And any further foaming-at-the-mouth by the Dollar’s decline generally works favourably for Gold. However, we duly point out that price’s daily parabolic trend is now Short as of last Tuesday.

Yet, have a look at this next measure for assessing the ebb and flow of Gold: direct from the both the website’s Market Rhythms and Gold pages, we bring you price’s 12-hour MACD (moving average convergence divergence). With our usual disclaimer that nothing in hindsight works in perpetuity, this Market Rhythm of late has been top-rate. The 10 most recent crossings (from 30 May-to-date) of the 12-hour MACD have produced — again in hindsight — minimum price follow-throughs of 20+ points either Long or Short, (even as “Shorting Gold is a bad idea”).

But we’ve this cautionary note thereto: as suggested, the perfection of hindsight calculates exiting at 20 points of gain, for instead if having purely swung from one signal to the next — in turn suffering “give back” — ‘twould have been a consistently losing proposition. Therefore (yet again): cash management, as ever, is King. Still, let’s graphically look at Gold’s 12-hour bars across the past five months: when the MACD is positive, price is in green, else in red if the MACD is negative, such as to portray a reasonable sense of near-term direction. At the foot of the graphic is the track of the MACD itself.

“But hardly is it perfection, mmb, as you say there’s a lot of ‘give back’ in every case…”

For which we’ve obligingly noted, Squire, per the aforementioned cash management quip. Market Rhythms can be profitable along the trail, but eventually fail as the trend turns tail.

And talking of turning tail, the Economic Barometer is appearing a bit pale. To be sure, Spring’s decline reversed into Summer’s climb. But since the Baro’s recent peak (31 July), reports have not been as sweet … which ought eventuate into a FedFunds rate cut, barring inflation’s eliciting a stagflative gut-punch.

Thus far in August, the Econ Baro has taken in 37 metrics, of which only 14 (38%) have improved period-over-period. So hardly was it a surprise that Thursday’s lagging indicators for July per the Conference Board’s report of “Leading Indicators” came in at -0.1%. ‘Tis the sixth month in the past seven such measure has been negative … “so someone please fax the Fed and tell them to cut right now!” Anyhooo, here’s the Baro as the “Dog Days of August” continue:

Meanwhile, to Gold’s two-panel display we next go featuring the daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. The Dollar’s end-of-week demise gave Gold some rise, albeit by the track of the baby blue dots depicting regression trend consistency, seasonal sluggishness continues. The good news is per Gold’s Profile, present price appears well volume-supported:

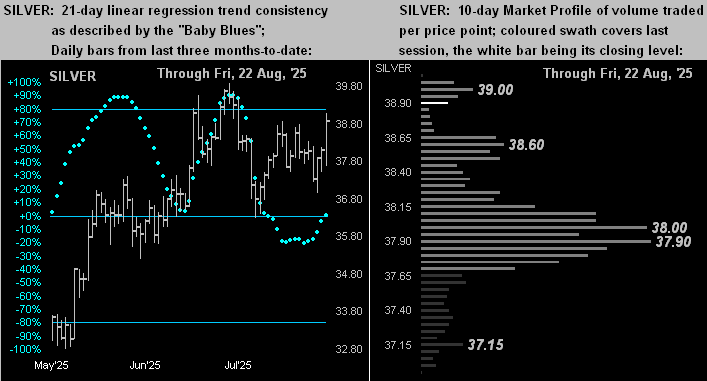

With the similar graphic display for Silver, whilst her price track (below left) remains much like that of the yellow metal, Friday’s “Powell Boost” moved the white metal well up into her Profile (below right). That in turn brought the Gold/Silver ratio down to now 87.9x, its lowest daily reading so far this month. ‘Course, with the ratio’s century-to-date average at 69.3x, Sister Silver is still a steal relative to Gold. And as we mused two missives ago, 40.00 Silver is not that far to go from here at 38.80:

To wrap, ’tis the Stack.

The Gold Stack (continuous contract pricing):

Gold’s Value per Dollar Debasement, (from our opening “Scoreboard”): 3864

Gold’s All-Time Intra-Day High: 3534 (08 August 2025)

2025’s High: 3534 (08 August 2025)

Gold’s All-Time Closing High: 3483 (07 August 2025)

Trading Resistance: by the Profile, none of note

Gold Currently: 3417, (expected daily trading range [“EDTR”]: 44 points)

Trading Support: by the Profile 3417 / 3405 / 3394 / 3383 / 3369

10-Session “volume-weighted” average price magnet: 3394

10-Session directional range: down to to 3354 (from 3465) = -111 points or -3.2%

The Weekly Parabolic Price to flip Short: 3176

The 300-Day Moving Average: 2883 and rising

2025’s Low: 2625 (06 January)

The 2000’s Triple-Top: 2089 (07 Aug ’20); 2079 (08 Mar’22); 2085 (04 May ’23)

The Gateway to 2000: 1900+

The Final Frontier: 1800-1900

The Northern Front: 1800-1750

On Maneuvers: 1750-1579

The Floor: 1579-1466

Le Sous-sol: Sub-1466

The Support Shelf: 1454-1434

Base Camp: 1377

The 1360s Double-Top: 1369 in Apr ’18 preceded by 1362 in Sep ’17

Neverland: The Whiny 1290s

The Box: 1280-1240

Next we’ve Summer’s final snoozer week for August … but for the Econ Baro robust? Or a just a bust? 12 incoming metrics are scheduled including as aforementioned on Friday “The Big One”: July’s PCE. What shall it be? One can wait and see…

Or garner more Gold if you please!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********