Bear Market Alert: The US Treasury Yield Curve AGAIN Menaces Inversion

An inverted yield curve means that short-term interest rates are higher than longer-term ones. The inverted yield curve is what happens when investors are bidding for longer-term bonds -- thus driving down their yields -- because they are pessimistic about the short-term prospects for the economy.

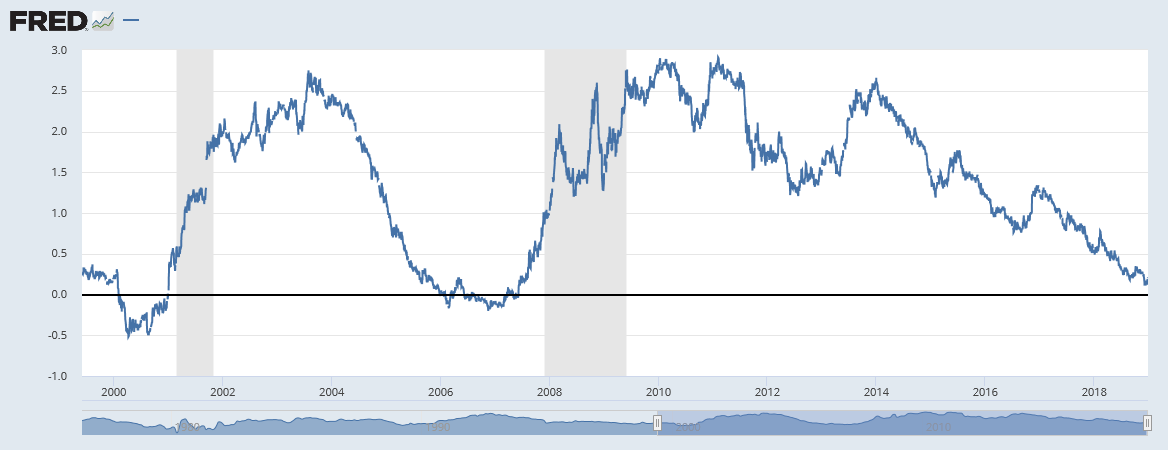

(Source: https://fred.stlouisfed.org/series/T10Y2Y#0 )

The yield curve is making headlines as a possible predictor of recession. The New York Times called it the “new fear gauge.”

The gap between the US Treasury 10-year yield and the two-year yield is at its lowest in 11 years, which the Wall Street Journal called a “red flag.” The above chart shows lowest yield gap was precisely 11 years ago in 2007, which heralded a recession (vertical shaded bar)…AND A STOCK MARKET CRASH causing the S&P500 Index to plummet -50%. It is imperative to also notice the same Yield Inversion occurred in 2001, which precipitated a recession (vertical shaded bar)…and caused S&P500 stocks to crash -50%.

Fast Forward To Yearend 2018

Per the FRED chart above we see yet again the gap between the US Treasury 10-year yield and the two-year yield is rapidly approaching zero. Ergo, the menacing Yield Curve Inversion is crystalizing…which will eventually birth another recession and much lower stock prices.

Inverted Yield Curve And Why It Predicts A Recession…Probably Soon

https://www.thebalance.com/inverted-yield-curve-3305856

Related Article: Stock Bears Are On The Rampage…WORLDWIDE!